Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

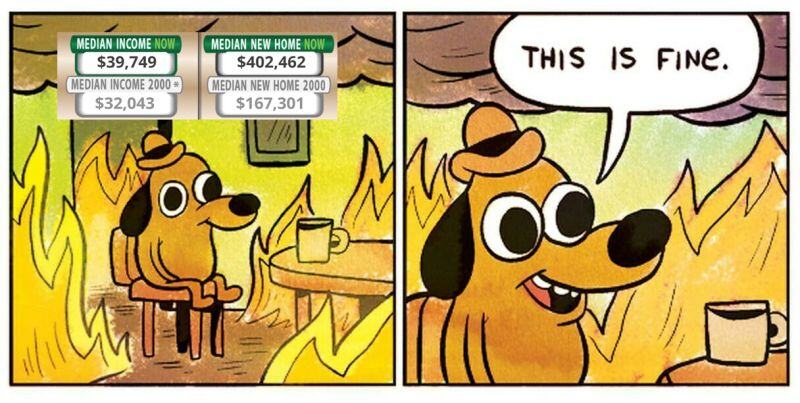

Between 2000 and 2024:

US Income +24% US House prices +140% Source: Trend Spider

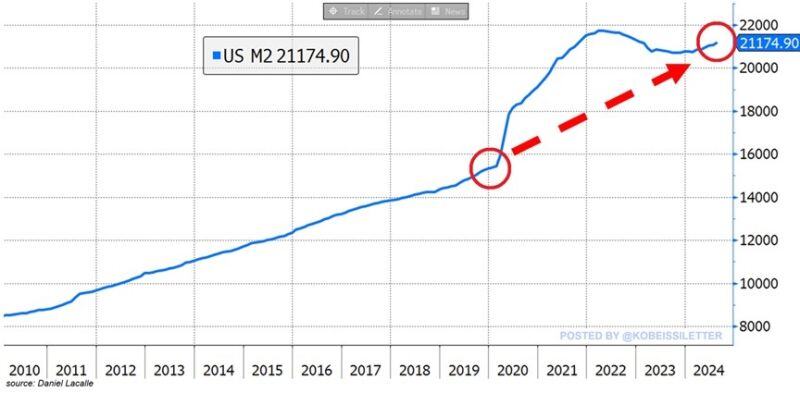

BREAKING: The US money supply hit $21.17 trillion in August, the highest level since January 2023.

This also marks a fifth consecutive monthly increase for the US money supply. Over the last 10 months, the amount of US Dollars in circulation has jumped by a MASSIVE $484 billion. In effect, the money supply is now just $548 billion below a new all-time high. After a brief decline, the quantity of money in the financial system is surging again raising concerns about another inflation wave. Source: The Kobeissi Letter

BREAKING: GOLD NOW MAKES UP A RECORD 31.5% OF RUSSIA'S TOTAL RESERVES.

Source: Make Gold great again on X

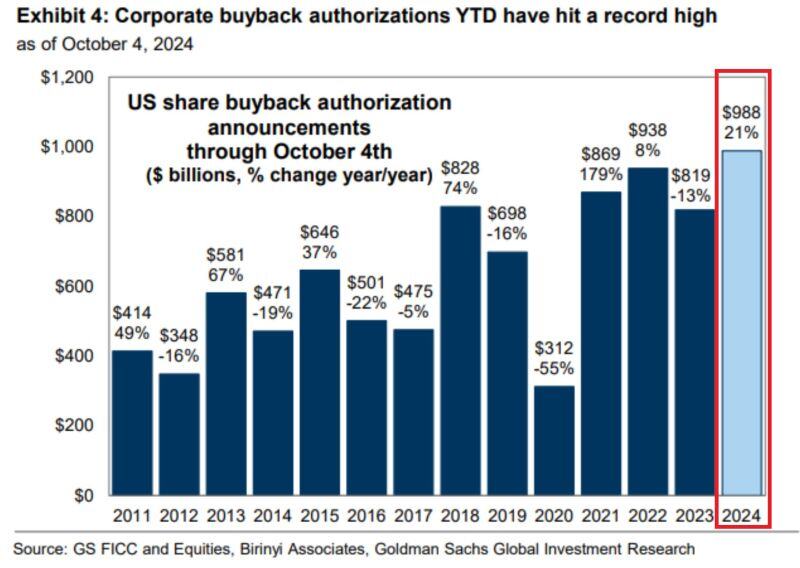

WONDERING WHY US STOCKS HAVE BEEN RALLIED SO HARD THIS YEAR

Part of the reasons is share buybacks which currently stand at all-time highs. As shown on the chart below, US share repurchase authorization announcements hit $988 billion, the most on record. This is 3 TIMES HIGHER THAN in 2020 and up 21% year-over-year. Source: Global Markets Investor, Goldman Sachs

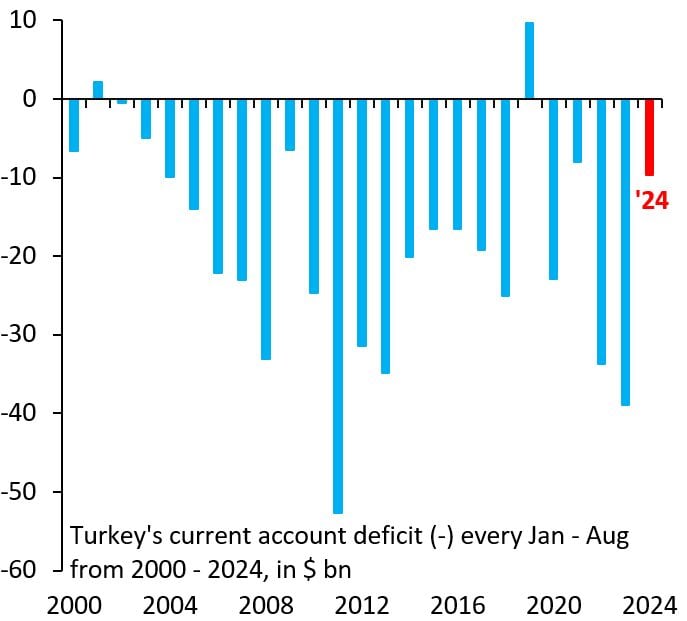

Turkey is running the narrowest current account deficit since 2021.

Kudos to Finance minister Mehmet Simsek and his economic team for this turnaround. This is an impressive adjustment! Source: Robin Brooks

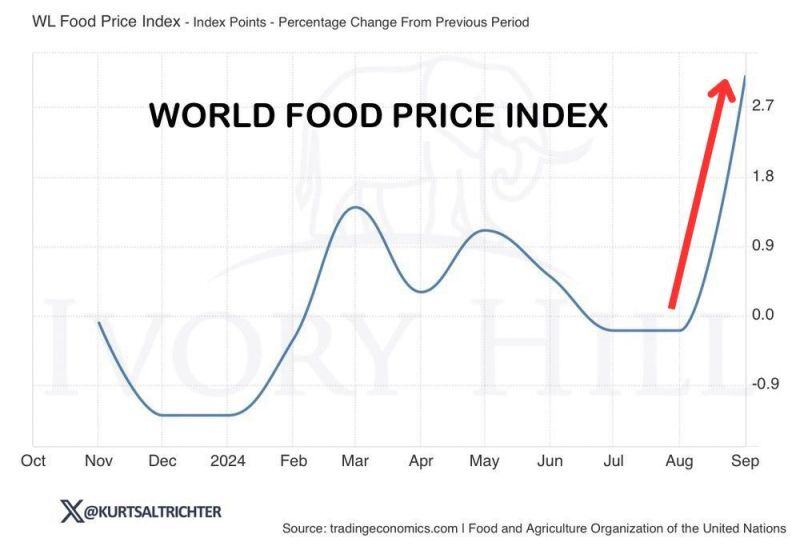

Food inflation is accelerating

Source: @Kurtsaltrichter on X, www.tradingeconomics.com

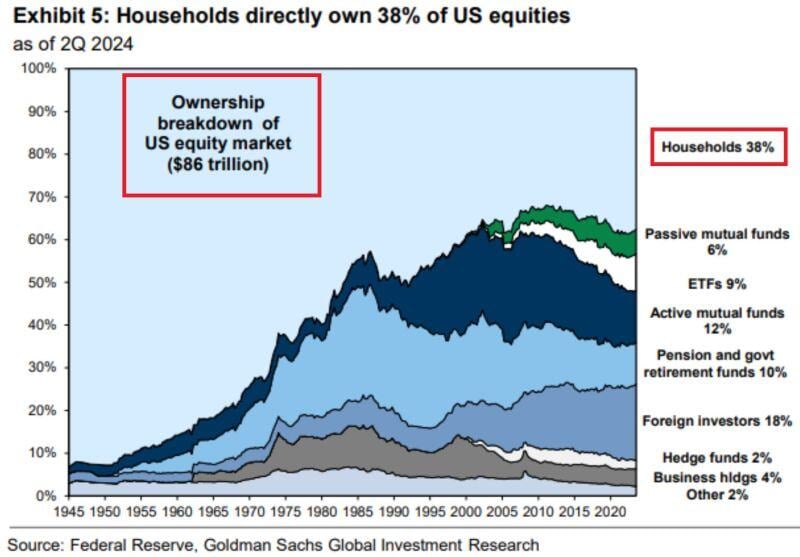

⁉️WHO OWNS THE MOST SHARE OF THE US STOCK MARKET⁉️

US households own 38% of the total equity market, the most among other participants. This equals to roughly $33 trillion. This is followed by foreign investors and active mutual funds with 18% and 12% shares respectively. Source: The Kobeissi Letter

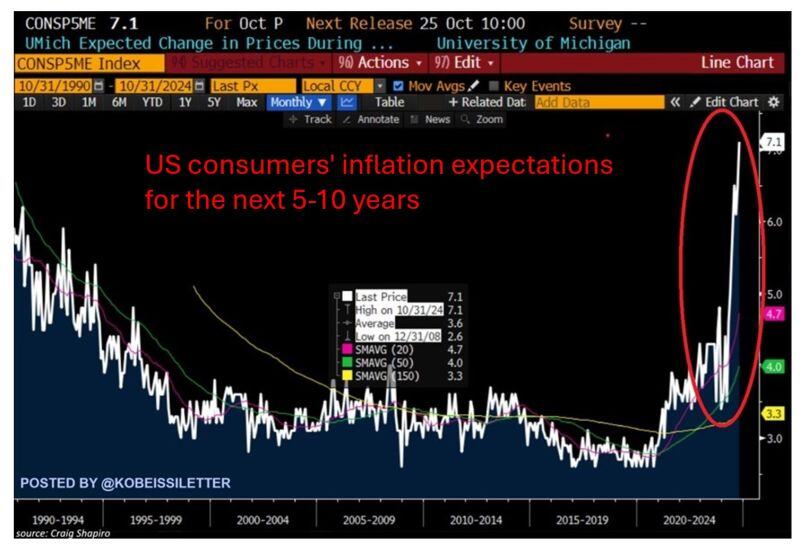

😱 The shocking chart of the day: US consumers' inflation expectations for the next 5-10 years skyrocketed to 7.1% in October, the highest in over 40 years.😱

This metric has DOUBLED in just several months, according to the University of Michigan Consumer Survey. To put this into perspective, median inflation expectations have been at ~3% for the last 3 years. Consumer sentiment has been severely damaged by rising prices of necessities, and expectations are getting worse. This comes as core CPI inflation has been above 3% for 41 months, the longest streak since the early 1990s. Inflation is still a major concern for Americans. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks