Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

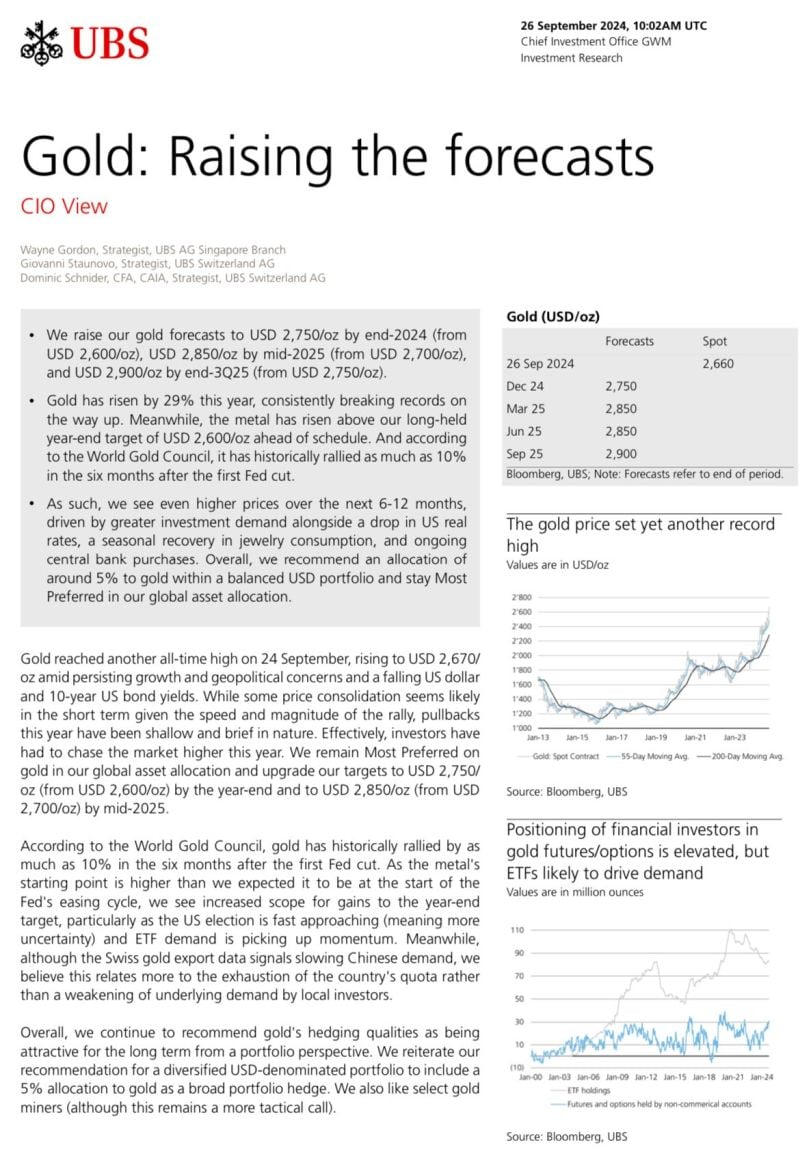

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

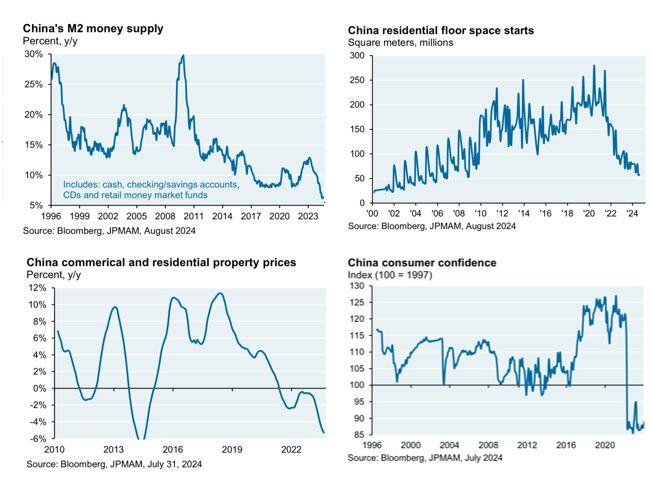

JPMORGAN, on China stimulus:

“.. I don’t think it’s an exaggeration to say that China is acting somewhat out of desperation given the severity of the declines shown in the charts below.” [Cembalest] This is very close to our thesis >>> We view this stimulus package as an emergency policy adjustment designed to halt the downward trend, NOT to engineer a higher level of economic growth going forward. The package addresses short-term risks, but medium- and long-term challenges remain: Unfavorable demographic dynamics Households’ sentiment has been hit hard in the past four years and will need time to recover durably, a necessary condition for higher domestic consumption Business and investors’ sentiment has equally been damaged by the succession of regulatory crackdowns and anti-bribery campaigns. The latest announcements are an encouraging sign for domestic and foreign equity investors, but only a small first step in rebuilding the confidence toward Chinese listed companies. Trade barriers have already increased for China’s exports to the US and Europe and this trend is unlikely to reverse, especially if Donald Trump is elected Source: Carl Quintanilla on X

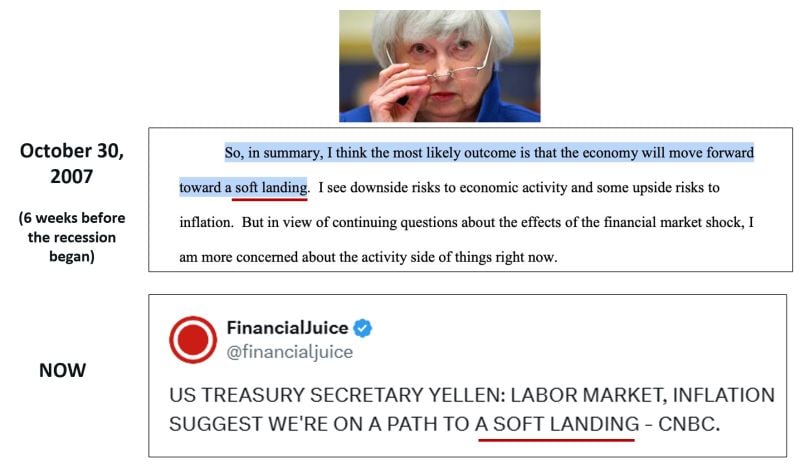

A soft landing of the US economy is our CORE scenario.

But we are well aware of the tail risk (hard landing and no landing). As a remainder, in 2007, Yellen talked about a soft landing 6 weeks before the recession began...

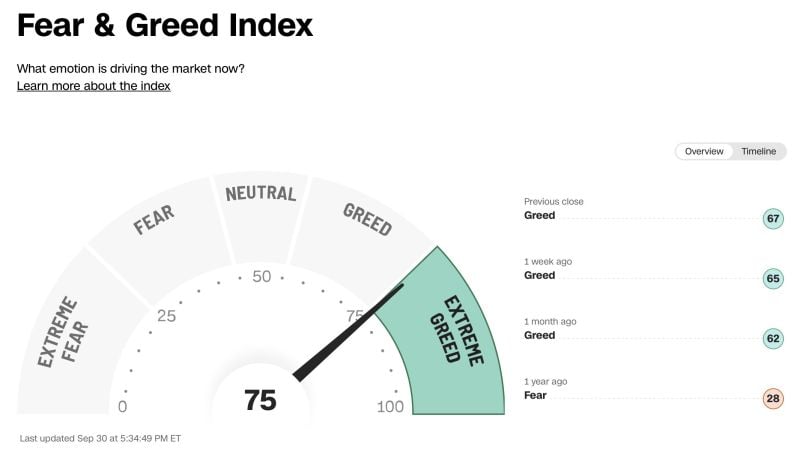

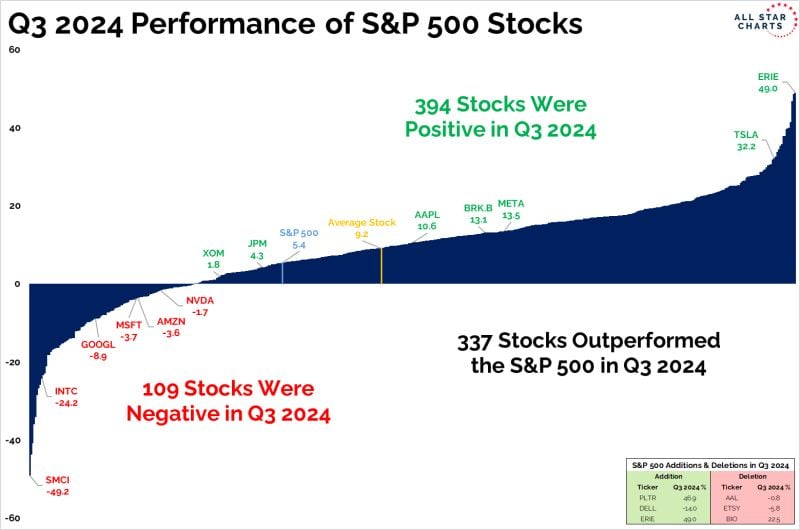

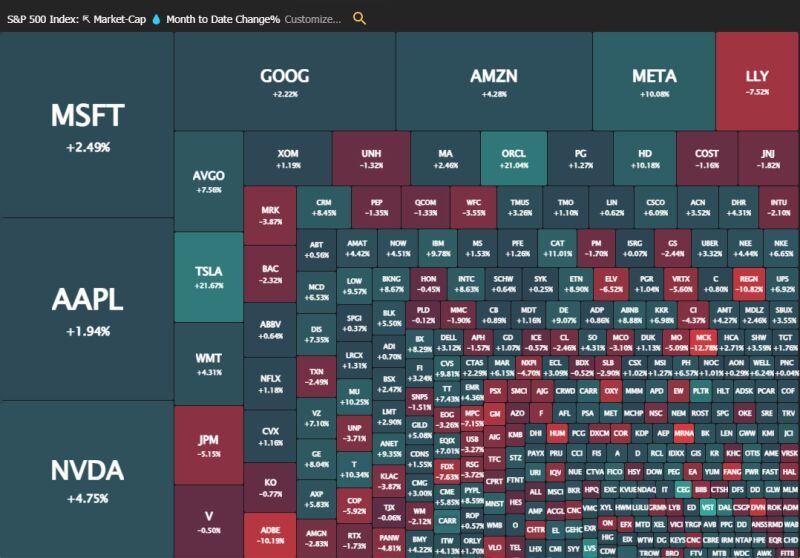

It's a bull market baby...

Some amazing statistics for the sp500 Q3 performance as highlighted by Grant Hawkridge on X 👉 S&P 500 closed Q3 at 5.4% 👉The average stock in Q3 was 9.2% 👉394 stocks were positive in Q3 👉109 stocks were negative in Q3 👉337 stocks outperformed the S&P 500 in Q3 These are the things you tend to see during bull markets...

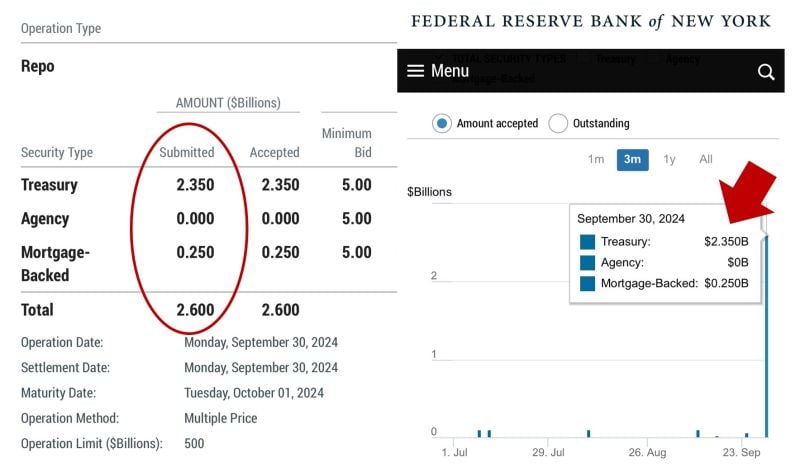

😱 The shocking chart of the day: THE FED REPO FACILITY FOR EMERGENCY LIQUIDITY HAS BEEN TAPPED FOR 2.6BN$! 😱

Is a big bank in troubles ??? Source: JustDario on X

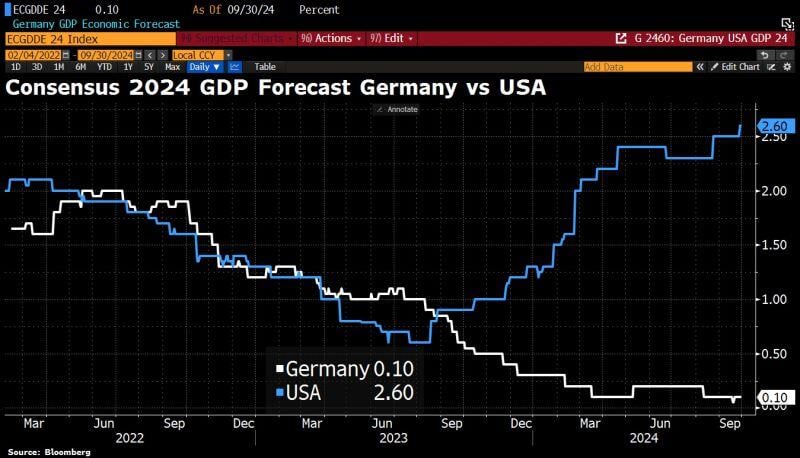

German government has abandoned hopes of achieving any economic growth in 2024.

Officials now expect stagnation at best, down from the previously projected 0.3%. This new forecast is even below consensus of +0.1%. As a result, Germany is falling further. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks