- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

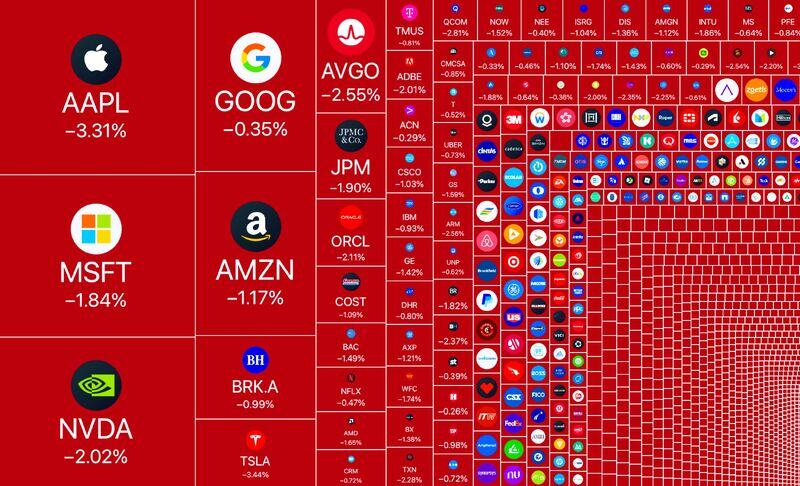

NEARLY 200 MISSILES WERE LAUNCHED INTO ISRAEL FROM IRAN, ISRAELI ARMY RADIO SAYS

ISRAELI OFFICIAL SAYS RESPONSE TOWARDS IRAN ‘WILL BE HARSH’: KANN Bomb alarm sirens across the entire country (map). Oil spikes +4% Gold +1% VIX skyrockets +20% S&P 500 down 0.9% Source: Global Markets Investor on X

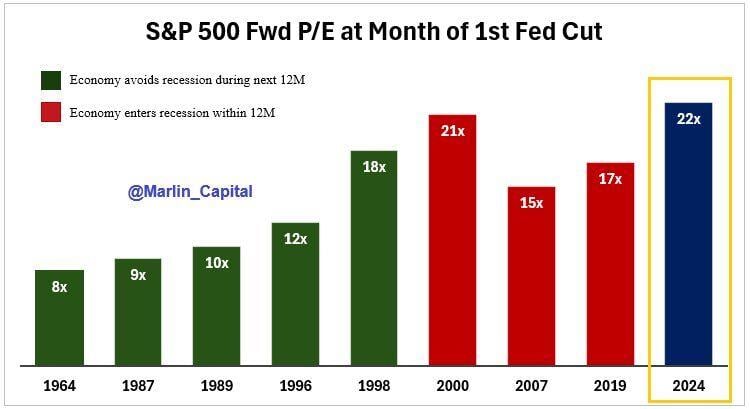

This time is different…

Historically, Fed rate cuts triggered market rallies led by valuation expansion. But this time, it seems that markets front-loaded the Fed by accumulating us stocks AHEAD of the Fed decision. Bottom-line: Current market valuation is now on the high side vs. other instances in history when the Fed cut rates. This should limit the amplitude of the current bull equity Source: David Marlin

BREAKING: Oil prices surge back above $70/barrel as investors begin pricing-in potential supply disruptions in the Middle East.

We now have a port strike, rising oil prices, aggressive Fed rate cuts and a china monetary + fiscal package. Could this combination trigger a second wave of inflation?

😱 The shocking chart of the day: a 128% INTRADAY increase for a HK-listed ETF !!!

The China equities rally look unstoppable... 😱 The Hang Seng Tech Index expanded its gains to 9%, while the Hang Seng Index surged by 6%. The FTSE China A50 Index futures rose by over 8%. As shown on the chart below, the HK-listed Science and Technology Innovation Board 50 ETF, surged dramatically, with an intraday increase of 128%. In the previous trading day, it closed with a rise of over 21%. Source: CN Wire

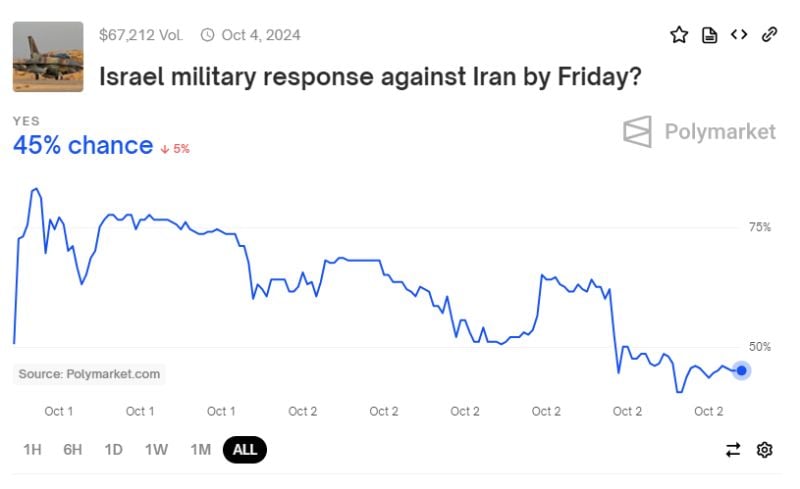

According to Polymarket, probability of having an Israel military response against Iran by Friday is <50% as of writin

Source: Polymarket, C.Barraud

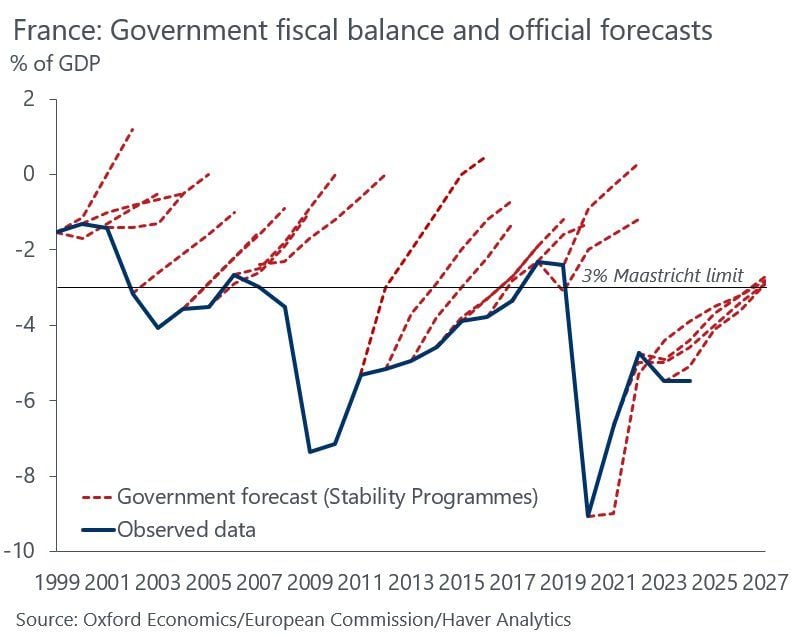

France has always missed its fiscal deficit forecasts

France has the highest tax burden in Europe, so cannot increase taxes without throttling growth. Spend is mostly pensions & local governments And with political paralysis there won’t be any structural reforms. Is a fiscal crisis looming? Source: Michel A.Arouet, Oxford Economics

HedgeFunds are buying Chinese Stocks at the fastest speed in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks