Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

RED CAC...

France’s CAC 40 index is back in the red for the year after President Emmanuel Macron backed a temporary tax on the country's largest companies. Source: Bloomberg, HolgerZ

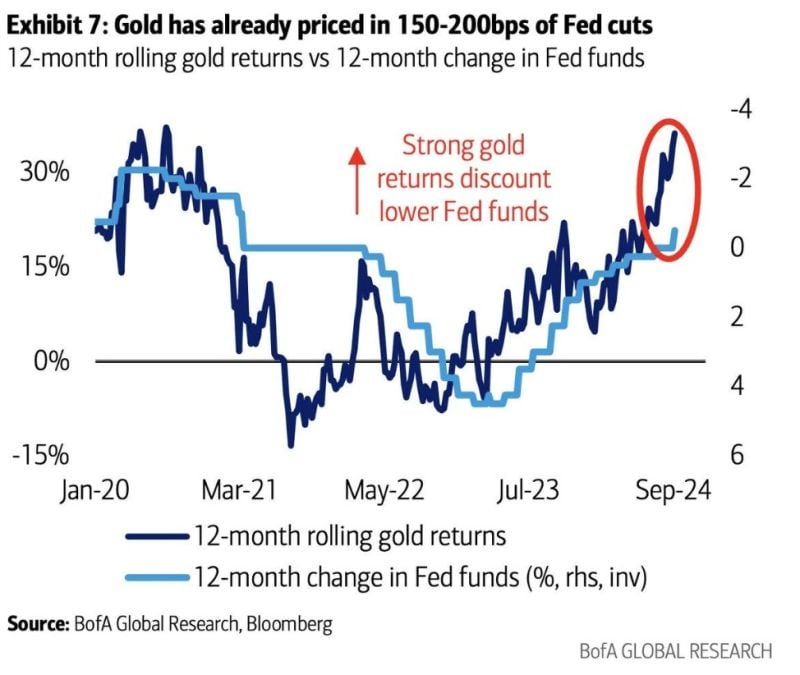

Gold continues to shine, trading at all time highs and up 34% since February.

To BAML, gold is frontrunning rate cuts. Or is it something else?

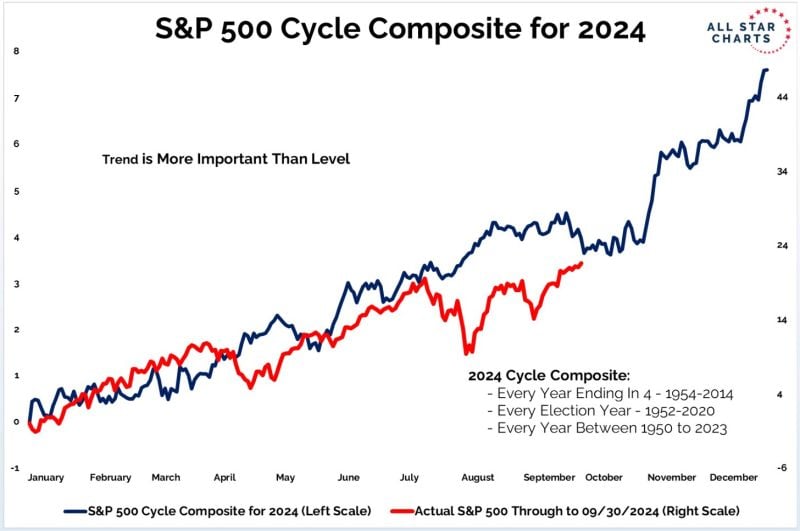

The cycle composite for S&P 500

The trend is more important than the level Source: J-C Parets

🚨 BANK OF AMERICA OUTAGE LEAVES CUSTOMERS UNABLE TO ACCESS ACCOUNTS, SPARKS PANIC🚨

Bank of America customers experienced a major outage on Wednesday, with many unable to access their accounts or seeing $0 balances. The issue, reported on Downdetector, began around 12:45 pm ET. While the bank's app stated accounts were "temporarily unavailable," users flooded social media with concerns. Bank of America has yet to clarify the cause or confirm if funds were at risk. Source: Downdetector thru Mario Nawfal

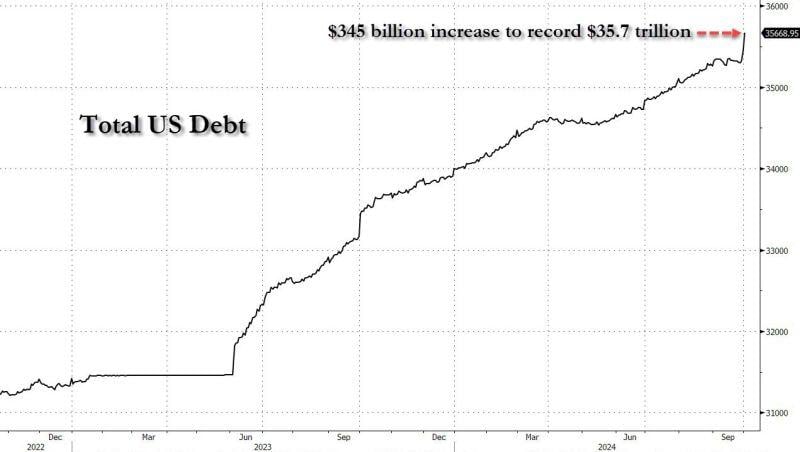

Total US debt explodes to $35.7 trillion on Oct 1, up $345 billion from Sept 27.

Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks