Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

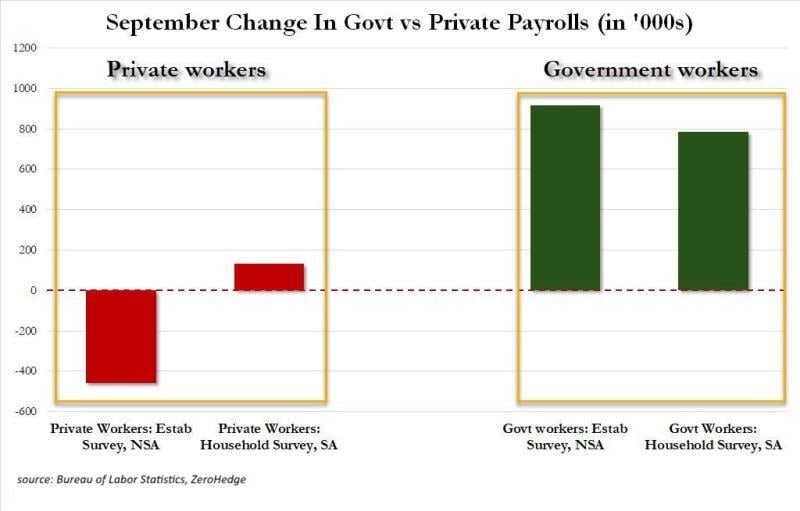

‼️IN REALITY US JOB MARKET SHED 458,000 PRIVATE JOBS IN SEPTEMBER‼️

Not seasonally adjusted private sector workers FELL by 458,000 in Sep. Government jobs SPIKED 918,000 This largely came as young people left summer jobs and returned to school while teachers went back to work. Source: Global Markets Investor

Russia may be poised to make a notable shift in its precious metals strategy, with silver potentially emerging as a key asset in the country’s expanding State Fund.

According to a report released by Interfax this week and cited by Bloomberg, Russia’s Draft Federal Budget outlines plans to significantly bolster its holdings in precious metals over the coming years. Notably, the budget includes plans to acquire gold, platinum, palladium, and, for the first time, silver. The inclusion of silver in the State Fund's acquisition strategy marks a departure from recent trends. While central banks around the globe, particularly Russia, have set records in gold purchases following international sanctions, silver has largely remained off their radar. This latest development suggests that silver’s role in Russia’s financial strategy may be evolving. Source: The Jerusalem Post

Commodities, measured by the Bloomberg Commodity Index, are on the verge of breaking out!

Source: Bloomberg, Karel Merck on X

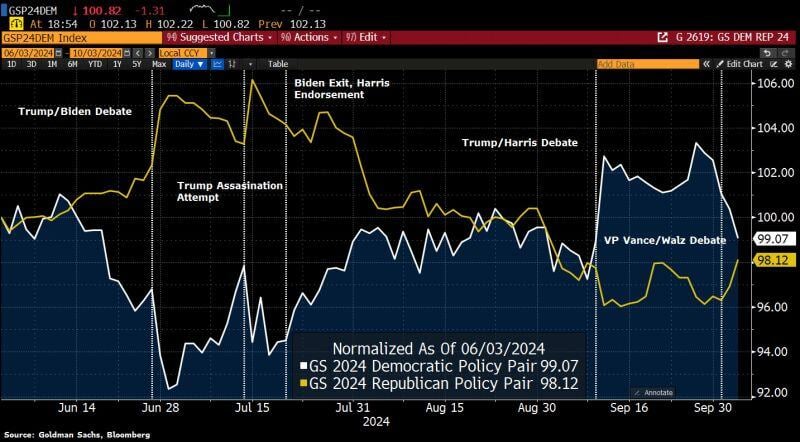

33 days away from election day, it looks like the markets see Republican Vance as the clear winner of the VP debate Vance/Walz.

The GS Republican policy pair depot has risen significantly, while the GS Democrat policy pair depot has fallen recently. Source: HolgerZ, Bloomberg

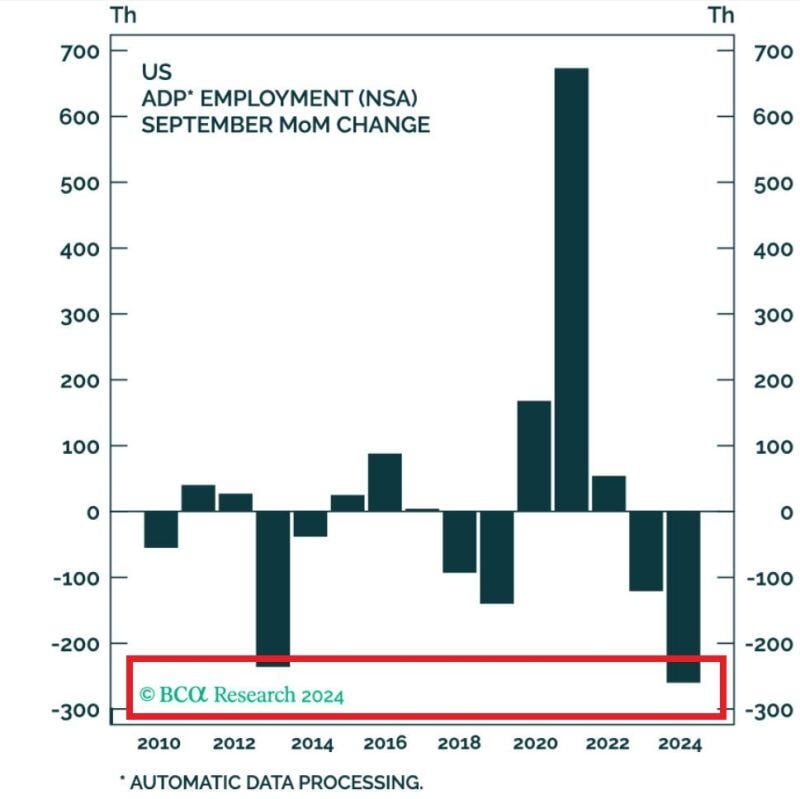

US job market is cooling down...

US Private businesses added 143,000 workers to their payrolls in September. Adjustment was almost 2x prior Septembers elevating the print,!!! On a non-seasonally adjusted basis payrolls FELL 260,000, the worst September in history. Source: Global Markets Investor

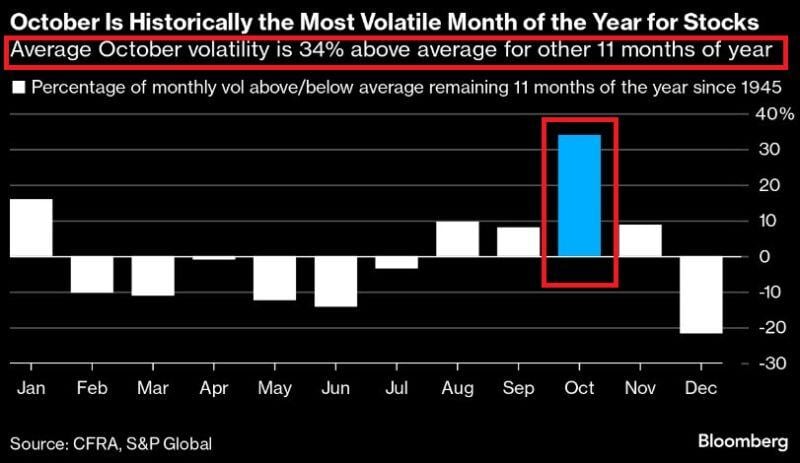

‼️MARKETS JUST ENTERED THE MOST VOLATILE PERIOD OF THE YEAR‼️

In October, equity markets volatility is ~34% above average for the other 11 months of the year. October is also the worst period for the S&P 500 during election years as uncertainty spikes... Sourcre: Bloomberg, Global Markets Investor

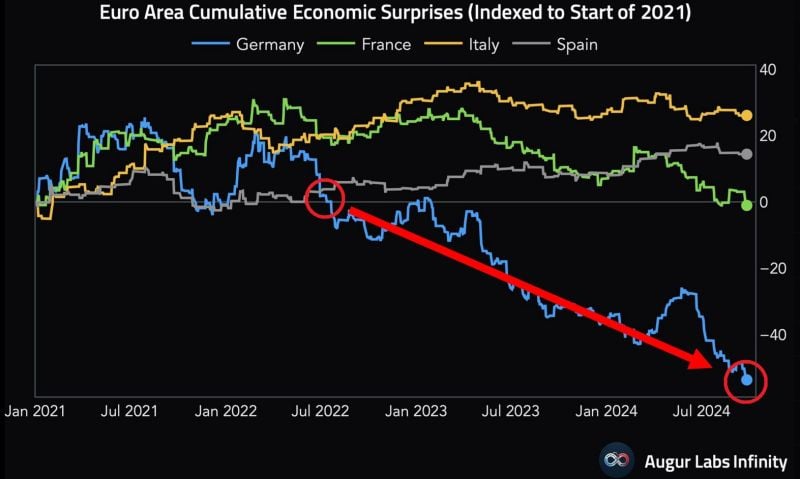

WHAT IS HAPPENING IN GERMANY ???

Most economic data in the world's third-largest economy has come below average economists' expectations over the last 2 years. Germany is also on track for 2nd straight year of SHRINKING GDP, for the 1st time since 2003. Chart: @AugurInfinity thru Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks