Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"The demand for Blackwell is insane." - $NVDA CEO Jensen Huang on CNBC just now

JPMorgan said today that Nvidia expects several billion of Blackwell revenue in Q4 Source: Stocktwits

Bullish sentiment is through the roof:

US equity futures positioning by investors excluding market-makers just hit a net long of ~$290 billion, the most on record. Since the beginning of the year, net long positioning has more than DOUBLED. This is also twice as high as during the previous peaks seen in early 2018 and 2020. Meanwhile, US households' stock allocation as a percentage of financial assets hit a new record of 41.8% in Q2 2024. Investors are all-in on stocks. Source: The Kobeissi Letter

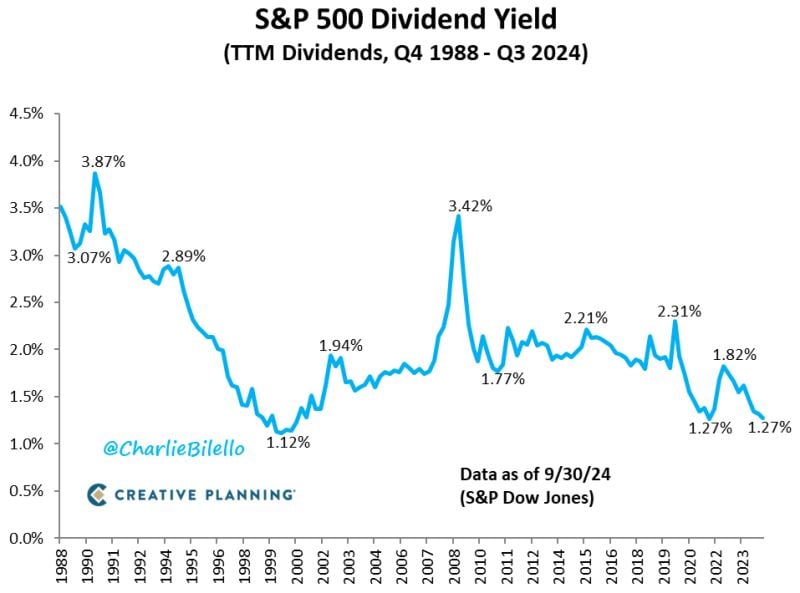

The S&P 500's Dividend Yield has moved down to 1.27%, tied with Q4 2021 for the lowest yield since 2000.

Source: Charlie Bilello

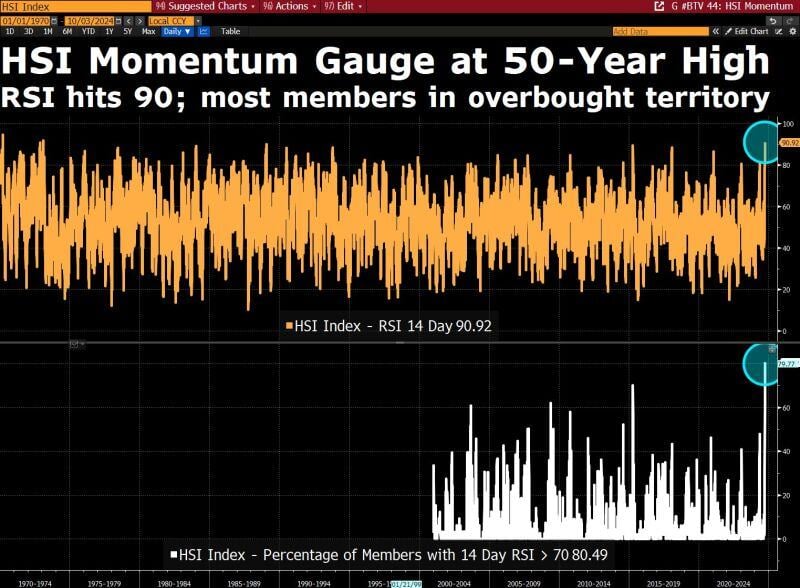

Here's a crazy stat on this Chinese equity rally.

A momentum gauge of the Hang Seng Index just hit the highest level in 50 years. The % of members signalling overbought conditions is at a record. Source: Bloomberg, David Ingles

Michael Burry has had a sensational 2024 so far.

His fund is up 39%. Over the last 8 years he has also managed to provide returns of 345% compared to 110% for the S&P 500...! He only holds 10 companies. Source: @MMMTwealth

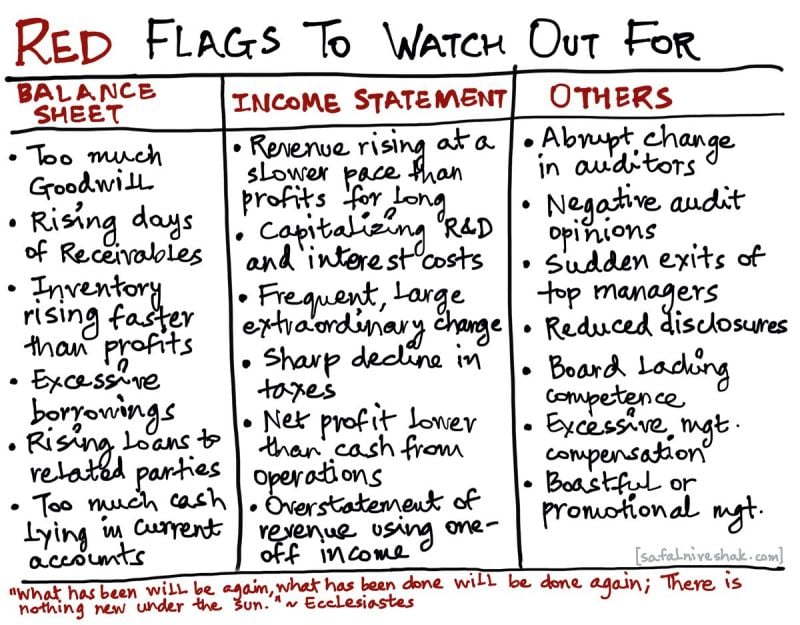

Financial statement red flags.

Nice summary by @safalniveshak thru Brian Feroldi

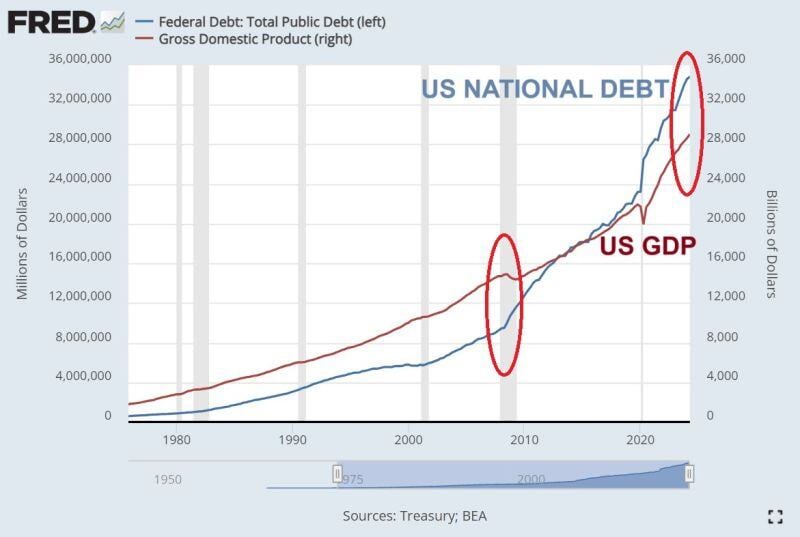

😱 The shocking chart of the day: US PUBLIC DEBT GROWTH HAS BEEN MASSIVE 😱

In 2008, the US federal debt was $9.4 trillion while the US GDP was $14.7T with the debt-to-GDP ratio at 64%. Now, the public debt is $35.7 TRILLION (Total US debt added another $345 billion between Sept 27 and October 1st...) and the US GDP is $29.0 TRILLION with the debt-to-GDP ratio at 122%... What is the pain thresold for the bond market ??? Source: Global Markets Investor, FRED

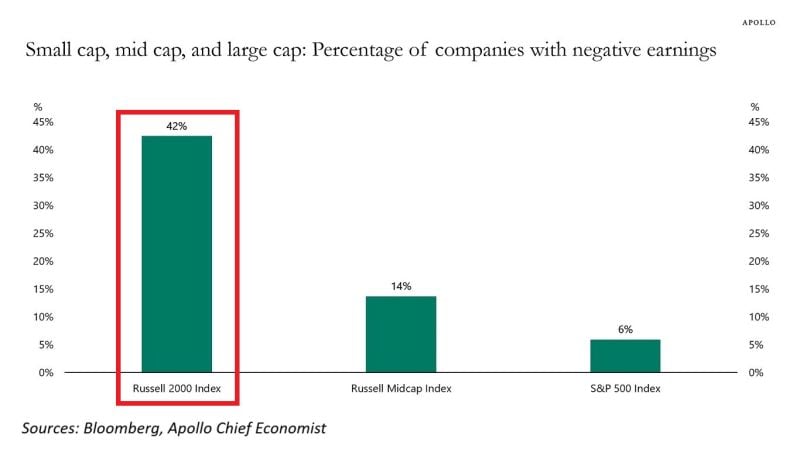

🚨42% OF US SMALL-CAP COMPANIES ARE UNPROFITABLE🚨

This is in line with the 2009 Great Financial Crisis levels. Notably, the share was higher only in 2020 and 2021. Russell 2000 firms also have $832 billion of debt. More rate cuts may help these zombie companies to stay alive. Source: Apollo, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks