Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

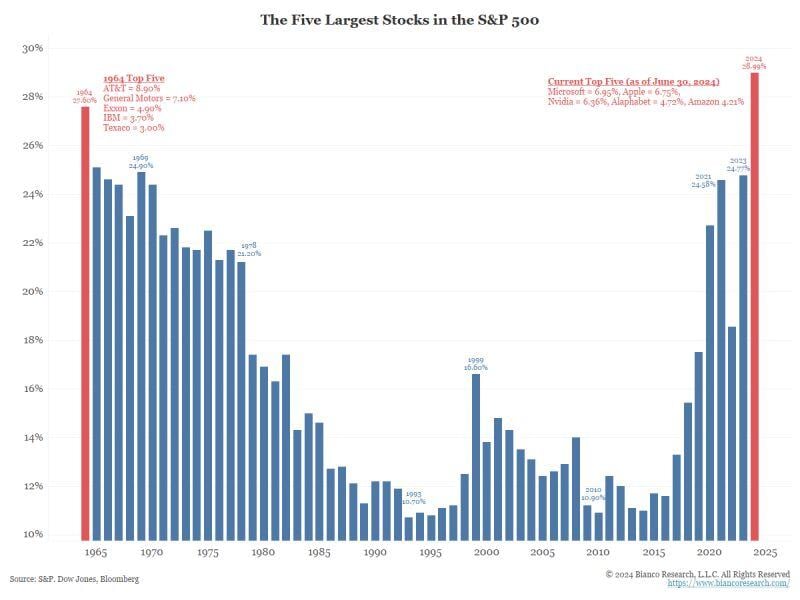

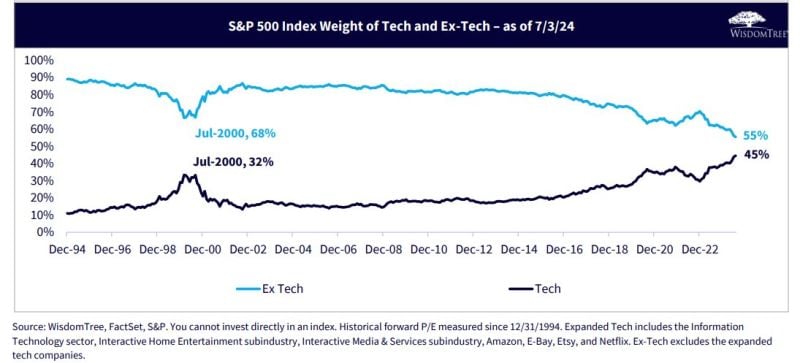

S&P500 concentration at the highest level in at least 60 years: 5 largest stocks within S&P 500 = 28.99%

As mentioned by Jim Bianco: The risk of the current S&P500 concentration is that one day the opposite happens: five stocks could kill the index funds while everything else outperforms... "Restated, one buys an index fund to get diversification. But with record concentration, they are not getting it". Source: Bianco Research

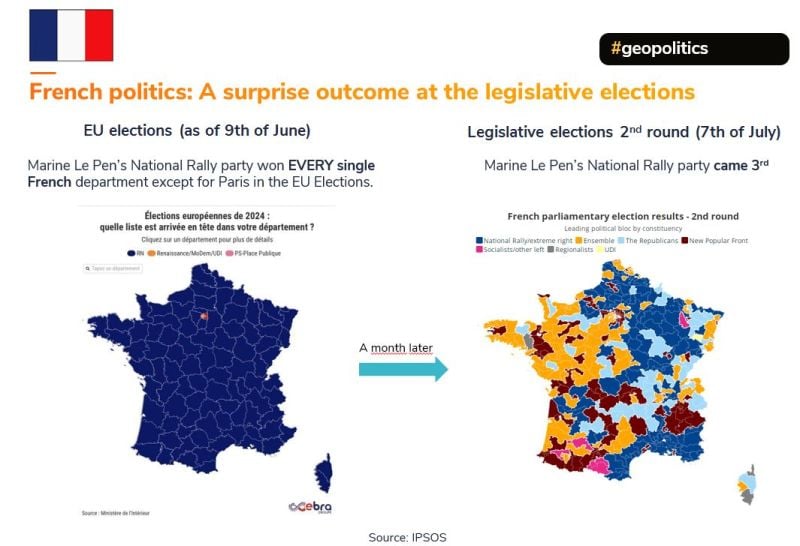

The far-right RN was defeated yesterday but the problem is far from over.

They got 37% of the popular vote. 37% !! The "winning left" got 26%... Note 2 things: 1) The specificities of the French lower house voting system: One party rises from 33% to 37% between the 2 rounds and move from rank #1 to rank #3. Another one (left / far left) declines from 28% to 25% a move from rank #2 to rank #1 2) If you take out far-right RN and far-left/left, the true "traditional / establishment" parties are less than 30% of votes... (despite unprecedented turnout) Source image: JohannesBorgen

A month in French politics...

4 weeks ago, Marine Le Pen’s National Rally party won EVERY single French department except for Paris in the EU Elections. Yesterday, Marine Le Pen’s National Rally party came 3rd... How to explain this? - The specificities of the lower house voting system (2 rounds) - The coordinated anti-RN strategy, under which the left and centre tactically withdrew their candidates from run-off ballots - Or just an ungovernable country?

The combined annual revenue of the 5 highest earnings 🇺🇸 companies is higher than the GDP of Brazil, Italy and Canada

Top 5 US companies based on Revenue (TTM) 🥇 Walmart $WMT: $657.3B 🥈 Amazon $AMZN: $590.7B 🥉 Berkshire Hathaway $BRK.B: $410.9B 4) Apple $AAPL: $381.6B 5) UnitedHealth $UNH: $379.5B Source: Evan

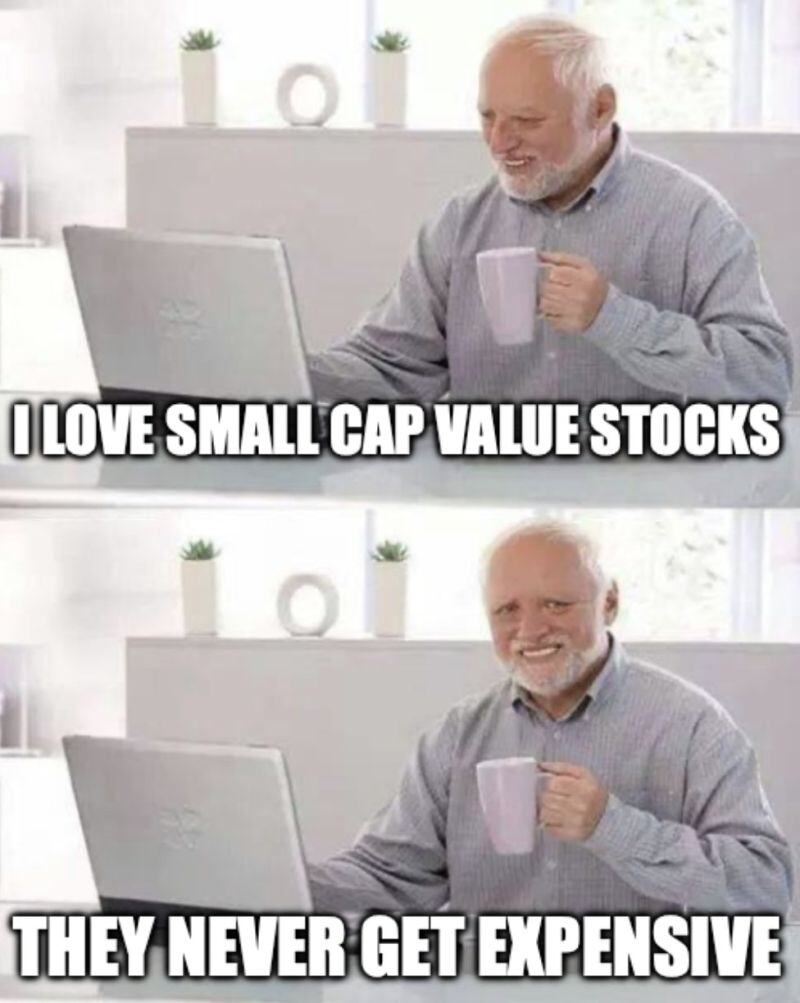

A remainder that US small caps have been lagging meaningfully during the current bull market

Source: MicrocapClub

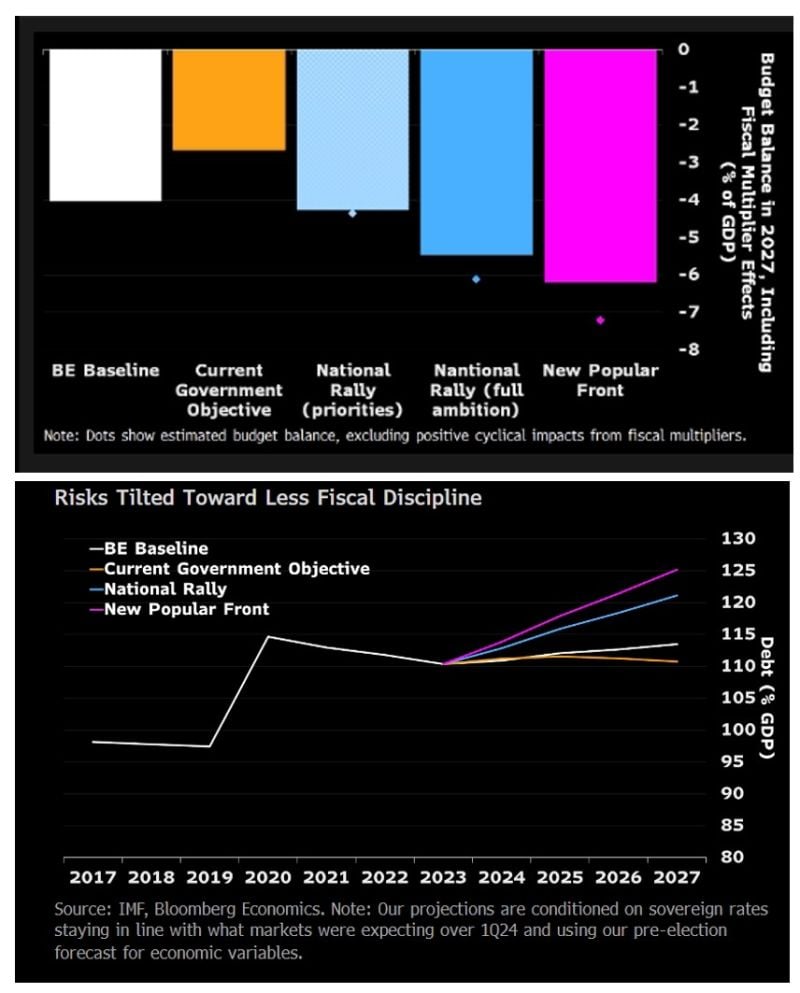

France was going to choose between debt, more debt and way more debt.

Way more debt it is. Fascinating. Deficit and debt projections via Bloomberg Source: Daniel Lacalle

Almost half of the S&P500 is now essentially tech...

Source: Wisdom Tree, Mike Zaccardi

AI Evolution has tested 119+ AI tools in the last 6 months.

But most of them are useless in my daily life. Here are 8 AI tools I use almost daily: Credit: Razib ul Karim, AI evolution

Investing with intelligence

Our latest research, commentary and market outlooks