Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

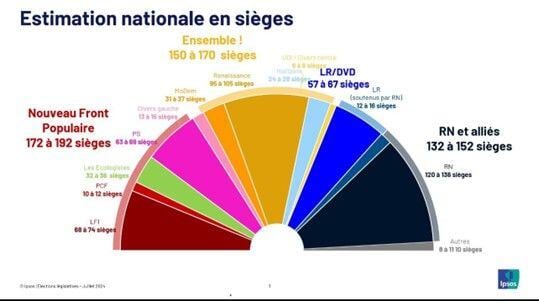

French politics: 📢 Absolute shock result for the legislative elections 📢

The left-wing New Popular Front (NFP) is set to come in FIRST, and Marine Le Pen’s far-right National Rally in THIRD in absolute shock result for the French legislative elections. Within NFP, radical left LFI leader J.L Melenchon wants the current Prime Minister to leave and rules out any coalition with the centrists (i.e he claims the Prime Minister seat for him or someone else from LFI) We note that within NFP (left-wing), the socialist party PS and the Greens have a strong score relative to radical left LFI. As such, it is unlikely that LFI will be able to claim the Prime Minister seat. Three scenarios: 1/ NFP government (with a Prime Minister coming from the less radical arm of NFP); 2/ A center-left coalition government (Macron’s Ensemble + less radical left + green).; 3/ If no political solution is found, a caretaker government could be appointed, OR instead a so-called technocratic government led by a non-political prime minister. All-in, the result is rather negative for markets (equities and bonds) as the radical left & left NFP party program is somewhat of a flash-back into the old French socialist program: - Retirement age at 60-year old - Increase of the minimum salary - Increase of taxes Such a political program would obviously be both inflationary and increase debt load and budget deficit. Still, it remains unlikely that left & radical left would be able to impose this program as their majority is a relative one. All in all, we do expect some sell-off of French equities and a rise of the OAT-Bund spread tomorrow. With regards to the new PM and the economic & social program to be applied, next few days will be critical (unless they postpone any decision after the Olympic Games...).

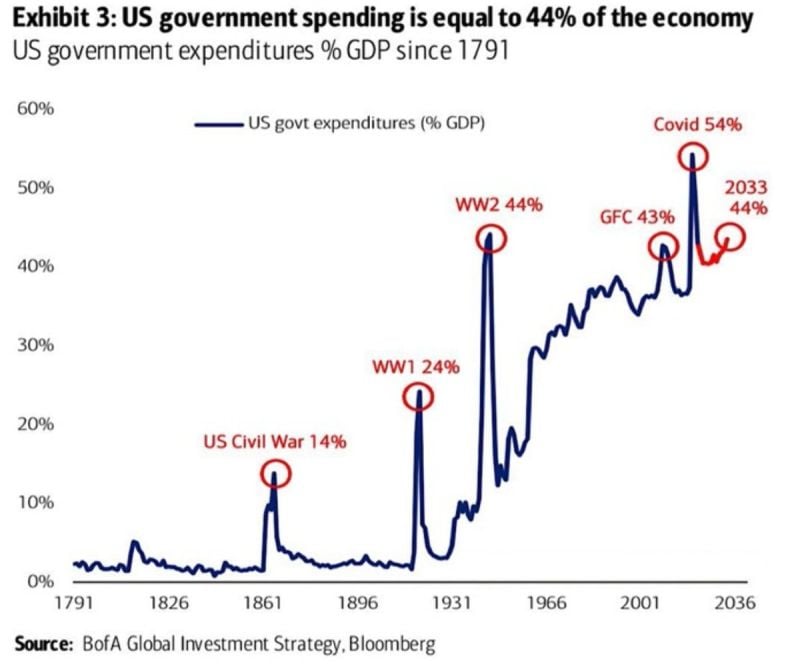

US GOVERNMENT SPENDS MONEY AS IF THERE IS A CRISIS:

US government spending as a % of GDP is now ~43%, in line with THE GREAT FINANCIAL CRISIS. This is just 1 % below World War II levels. Only the COVID crisis saw higher expenditures as a share of GDP of 54%... Source: BofA, Global Markets Investor

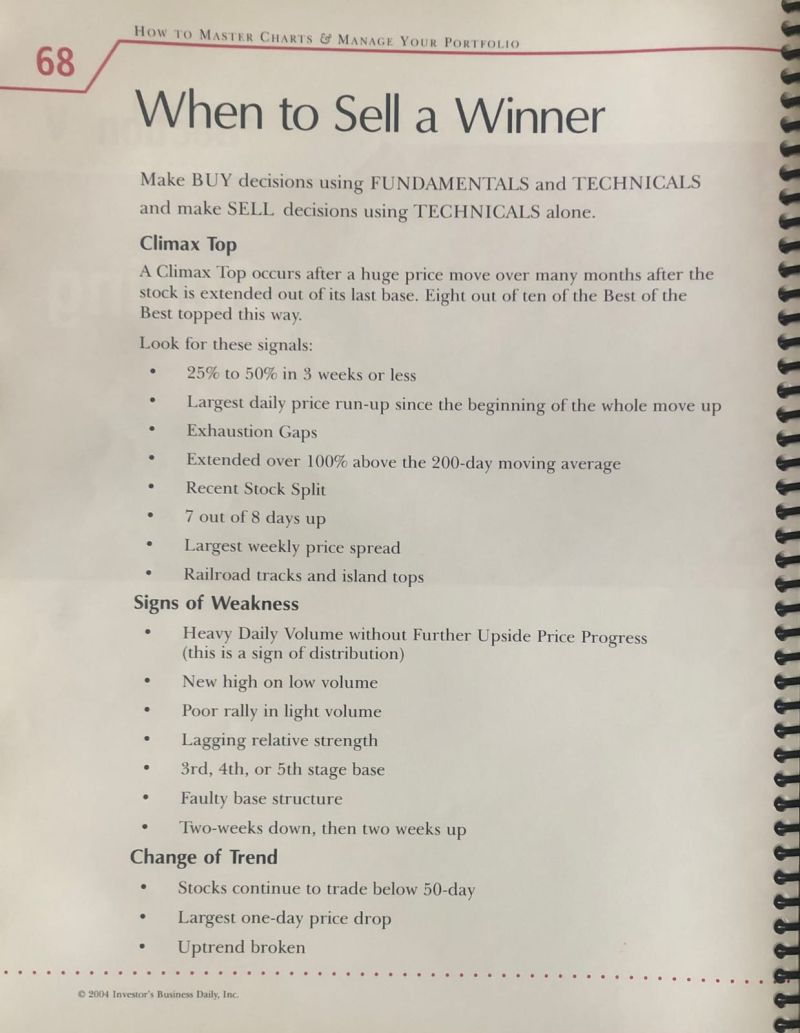

Probably one of most difficult question to answer for portfolio managers... WHEN TO SELL A WINNER?

Source: Marketr rebellion

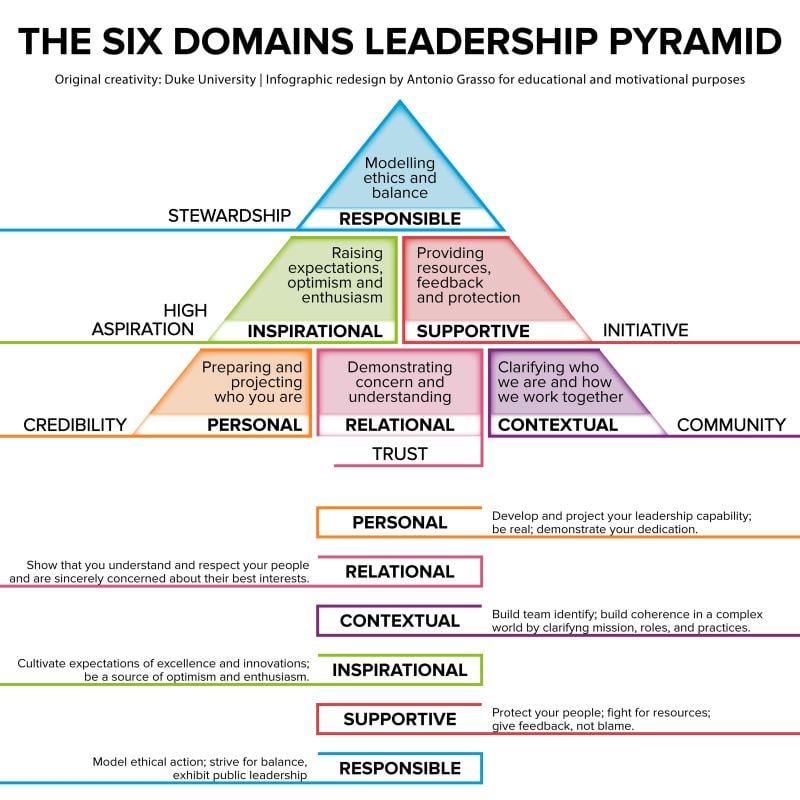

Duke University thru agrassoblog.org:

The 6 domains leadership pyramid or where to focus to become an effective leader

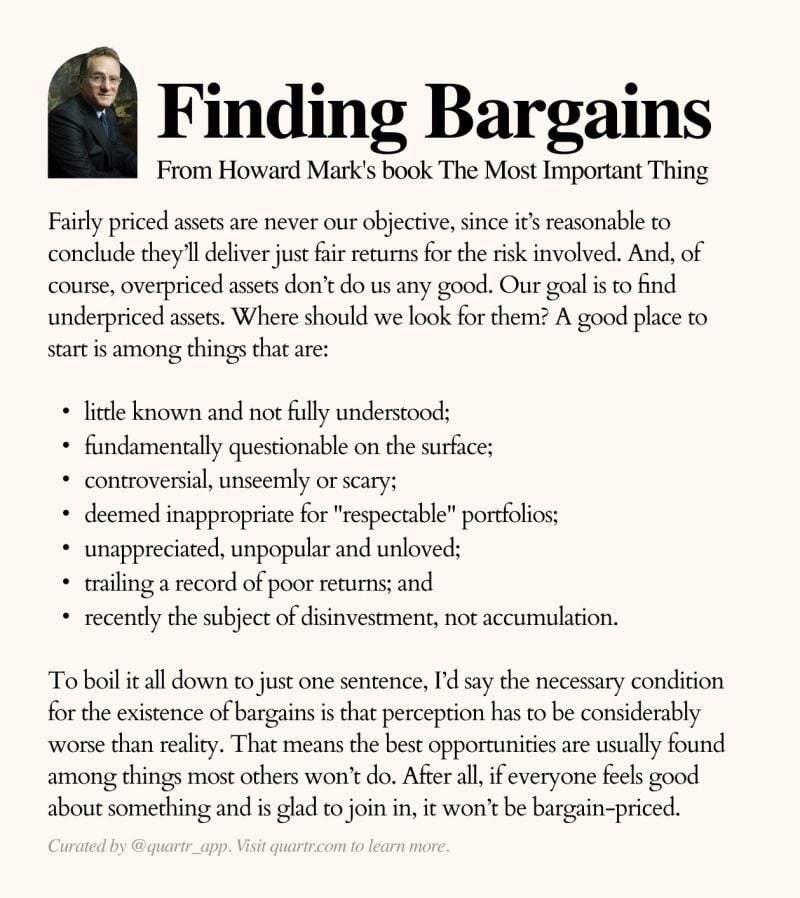

Investing with intelligence

Our latest research, commentary and market outlooks