Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A new all-time-high for Nvidia $NVDA up +6.4% on the day

The chart looks rather bullish with an ascending triangle breakout as the weekly MACD begins to cross to the upside... The big news of the day was Nvidia planning to begin mass production of its AI chips designed for China that comply with U.S. export rules starting in Q2 - Reuters Source chart: Jake Wujastyk

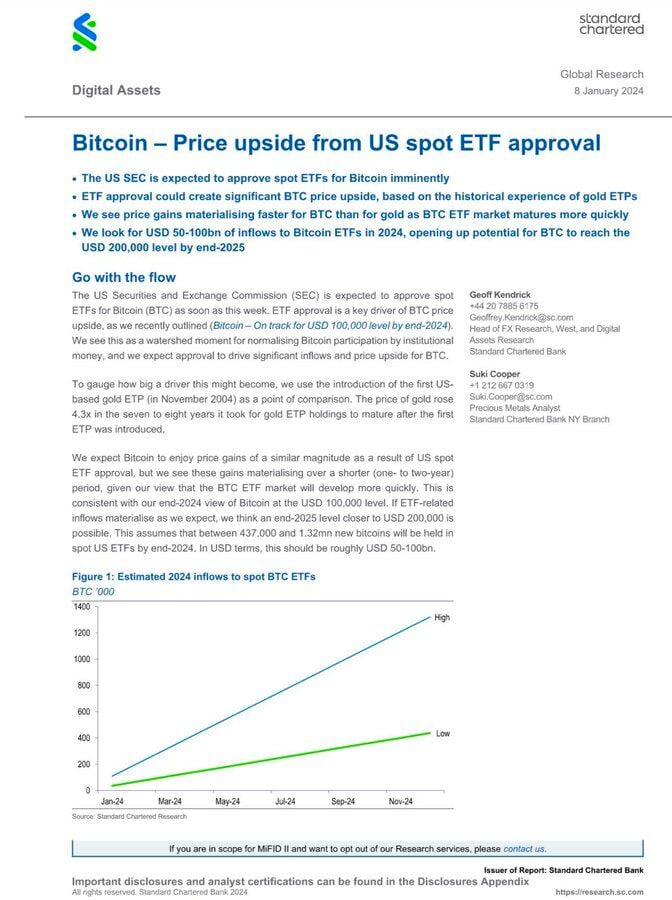

Grayscale Bitcoin Trust $GBTC traded close to half a billion on Monday

which is more than 99% of the 3000 current ETFs, and reminder that they are bringing a (volume) gun to a knife fight if they launch with everyone else. That said, the 1.5% fee will act as a repellent at a time when the big asset managers plan to launch spot BTC ETF at 0% or super low fees. Source: Eric Balchunas, Bloomberg

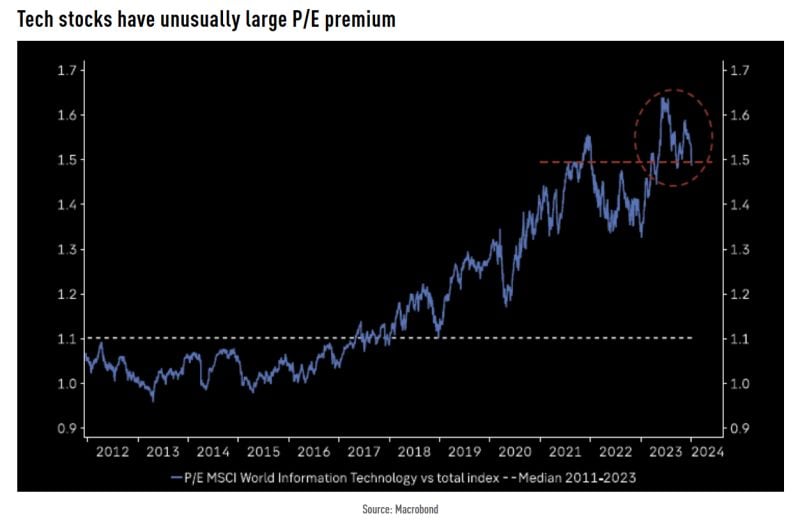

P/E MSCI World IT vs MSCI World

Tech stocks have unusually large P/E premium Source: Macrobond, TME

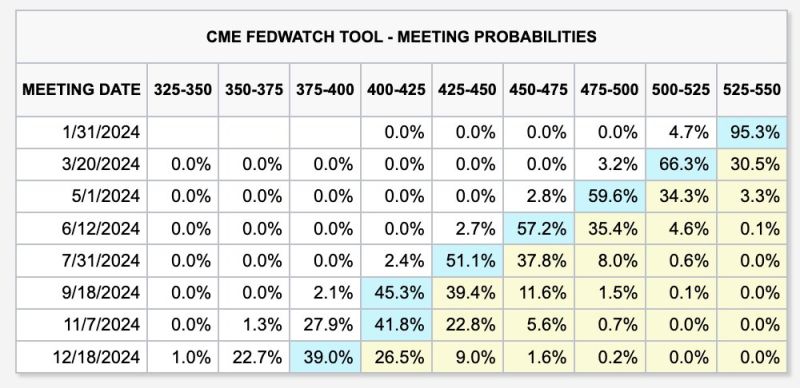

Fed member Bostic just said that he sees just 2 interest rate cuts in 2024 for a total of 50 basis points

As highlighted by the Kobeissi Letter -> This ONE THIRD the amount of rate cuts that futures are currently pricing-in. Bostic also said that he is "not comfortable declaring victory" against inflation at this point. Meanwhile, markets see a base case of 150 basis points in rate cuts in 2024. There is even a ~24% chance of 175 basis points in rate cuts. The Fed to market disconnect is widening. Source: The Kobeissi Letter

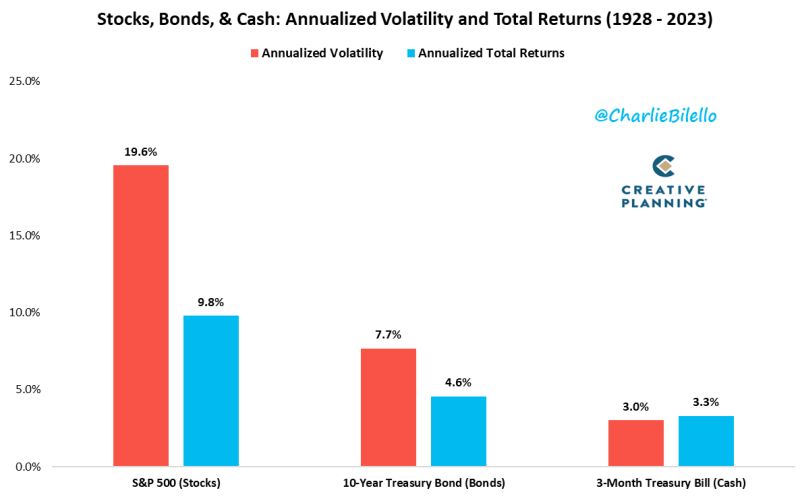

Why investors should embrace risk in one chart by Charlie Bilello:

Annualized Volatility since 1928... Stocks: 19.6% Bonds: 7.7% Cash: 3.0% Annualized Returns since 1928... Stocks: +9.8% Bonds: +4.6% Cash: +3.3%

Bank of America Corp. expects the Federal Reserve to announce plans to begin tapering the runoff of its Treasuries holdings in March, coinciding with its first 25 basis points interest-rate cut.

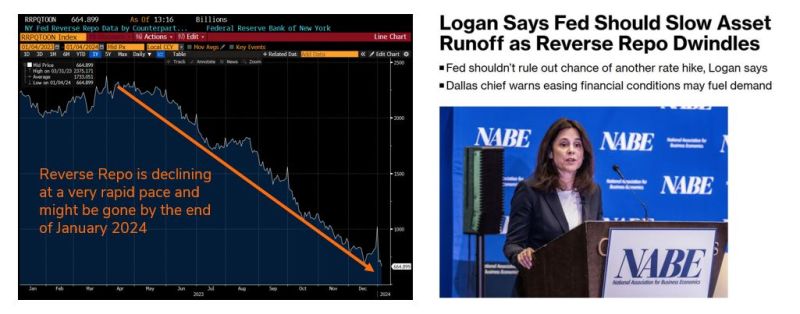

- The Reverse Repo ("RRP") is de facto QE-infinity $ printed during 2020-21 that was sitting dormant. It's now being used to buy up US Treasuries. Problem: it is declining at a very rapid pace and might be gone by the end of January 2024. - Something needs to be done to preserve QB / liquidity. - This is why the Fed is now thinking about slowing down the pace of QT. Over the week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles - 2024 is an election year and we expect net liquidity to be supportive for the economy, bond markets and risk assets

BREAKING bitcoin spot ETF: the fee war has begun

Bitcoin ETF applicants are filing last-minute amendments to lower their fees 👀 BlackRock's lowered to 0.30% 👀 ARK lowered lowered to 0.25% 👀 Wall Street is competing to offer cheap access to $BTC... Source: The Kobeissi Letter, Bitcoin Magazine

Investing with intelligence

Our latest research, commentary and market outlooks