Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitcoin on a roller coaster after SEC drama

Shortly after the market close on Tuesday, the SEC's X account posted an announcement that it had approved bitcoin ETFs to begin trading, something that has been widely anticipated by the crypto market. That post was made by an imposter and was deleted soon after. About 15 minutes after SEC's imposter post, SEC chair Gary Gensler said from his X account that no bitcoin ETFs had been approved. “The SEC’s @SECGov X/Twitter account has been compromised. The unauthorized tweet regarding bitcoin ETFs was not made by the SEC or its staff,” an SEC spokesperson told CNBC. The price of bitcoin briefly spiked after the initial post, but then quickly slid below $46,000. Source: Bloomberg, CNBC, HolgerZ

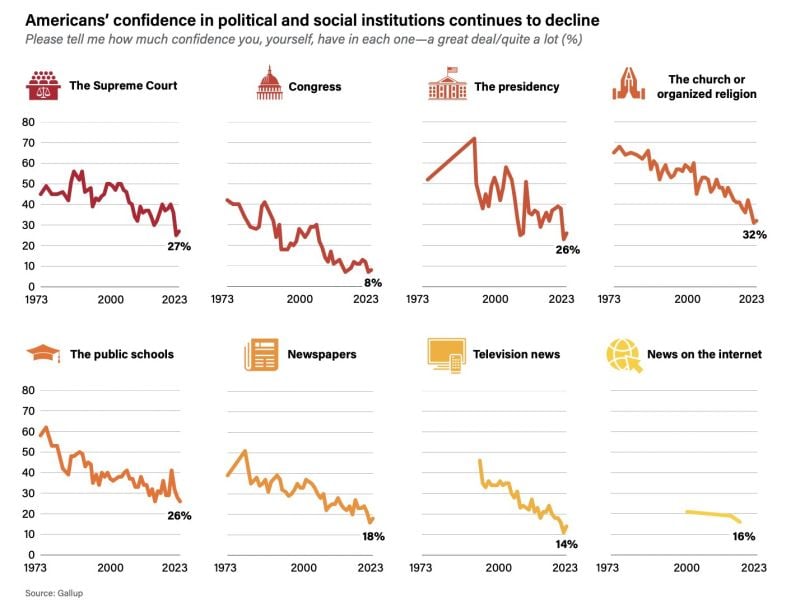

This chart from Eurasia Group's Top Risks 2024 Report shows how far Americans' trust in institutions has eroded

And the chart gives a feel for the upcoming election campaign, which is unlikely to be a trust-building measure. And should Trump win, he 'would take steps to consolidate exec power, weaken checks & balances, & undermine the rule of law,' the authors write. Source: HolgerZ

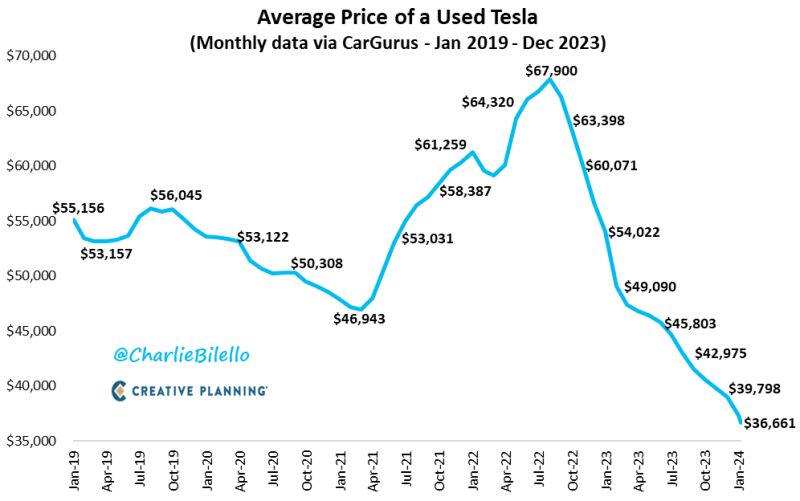

The average price of a used Tesla has declined 18 months in a row

moving from a record high of $67,900 in July 2022 to a record low of $36,661 today (-46%). $TSLA Source: Charlie Bilello

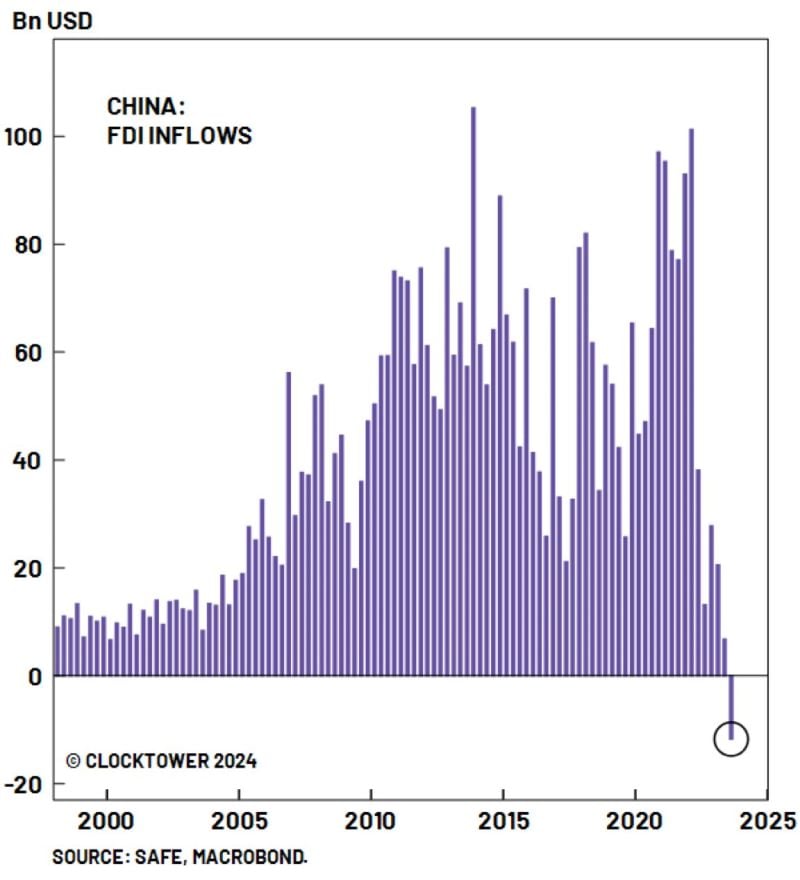

Money is flowing out of China for the first time in over 25 years

Source: AnilVohra1962, Safe, Macrobond, Clock Tower

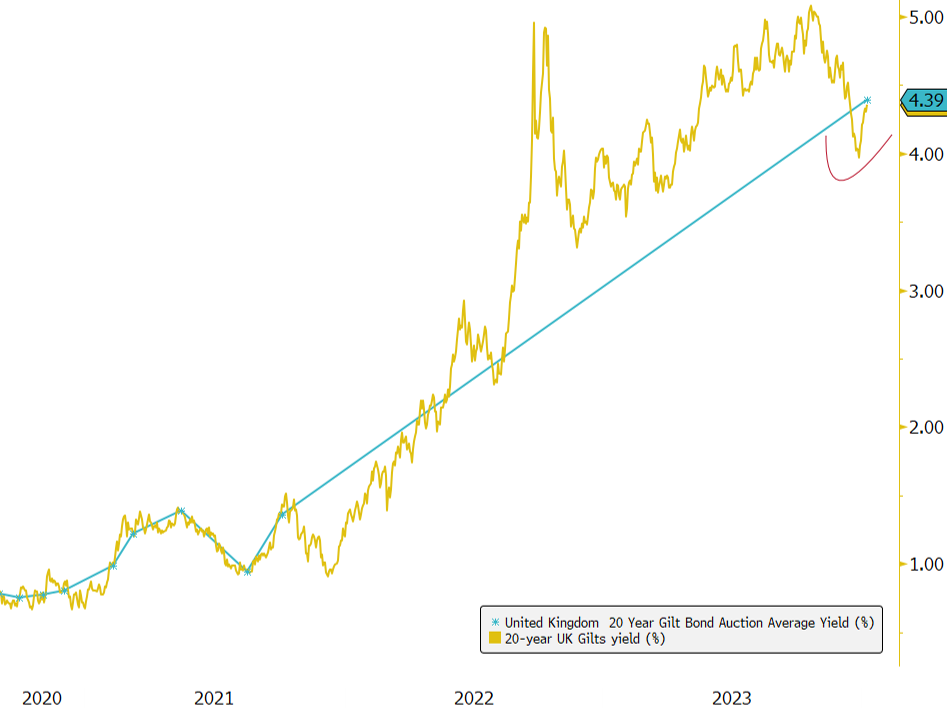

UK 20-Year Bond Auction: A Strong Start to 2024!

Today's successful auction of the UK 4.75% 2043 bonds, raising GBP 2.25 billion at a yield of 4.391%, represents a significant rise from the 1.36% yield in the previous auction in October 2021. 📈 Highlighting investor confidence, the auction achieved a strong bid-to-cover ratio of 3.6. Notably, the 20-year UK Gilt has climbed nearly 40bps from its late 2023 low. 🔍 With core inflation trends showing signs of stabilization, market participants are keenly awaiting signals from upcoming wage and inflation data. We are observing keen interest in how the yield curve will react, particularly with the anticipated new 30Y gilt syndication on the horizon. More steepening could be on the cards. 💷 Considering the estimated £76 billion gilt supply for Q1 2024, a key question emerges: Can today's robust auction mitigate the recent selloff, primarily driven by substantial global duration issuance and reassessment of aggressive rate cut expectations? Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks