Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

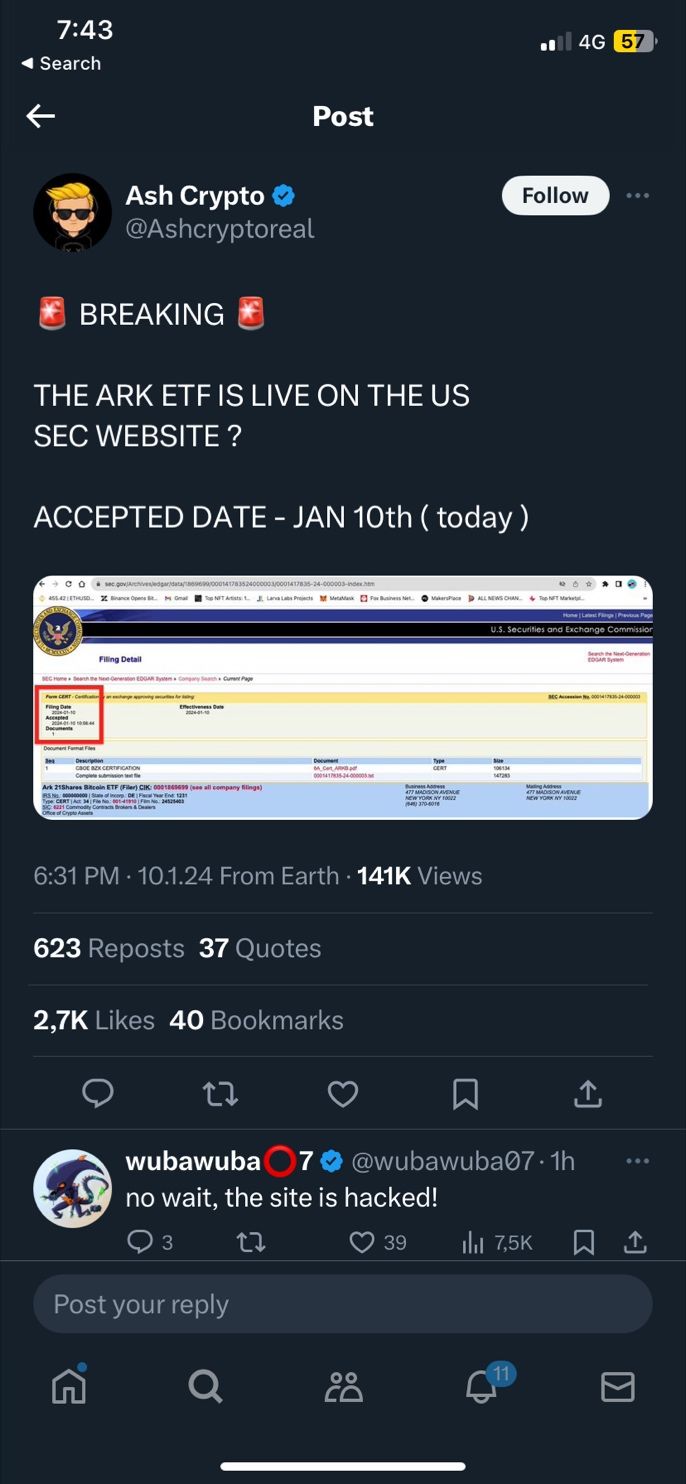

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

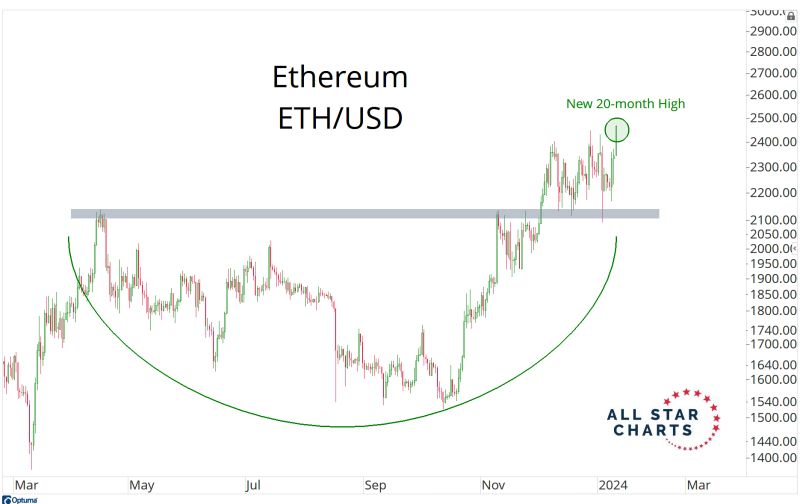

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

After Bill Gates became friends with Warren Buffett, he began to diversify his portfolio and sold Microsoft shares

Bill Gates' fortune today is 138 billion dollars, if he hadn't diversified it would be 1.33 trillion dollars. Source: alex_avoigt

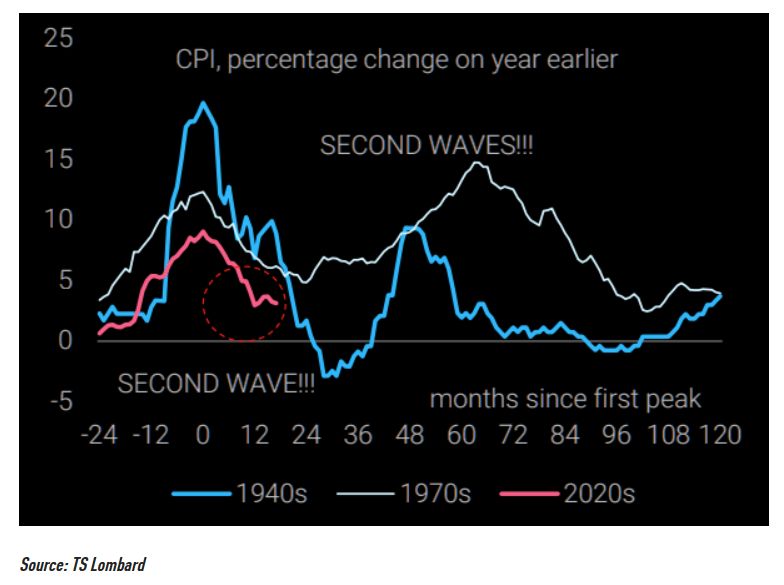

Beware the second wave...inflation moves in mysterious ways and sometimes you get that "unplanned" second wave.

Source: TS Lombard, TME

"The measure of intelligence is the ability to change" -Albert Einstein

Source: Yasin Arafeh

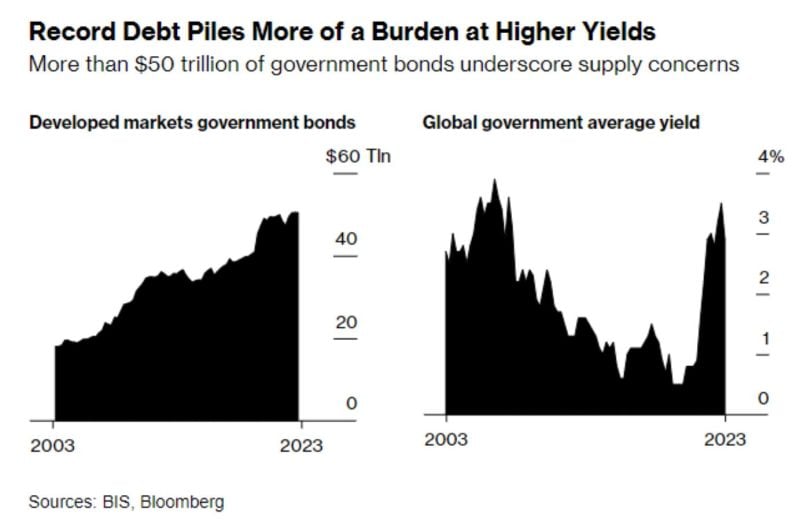

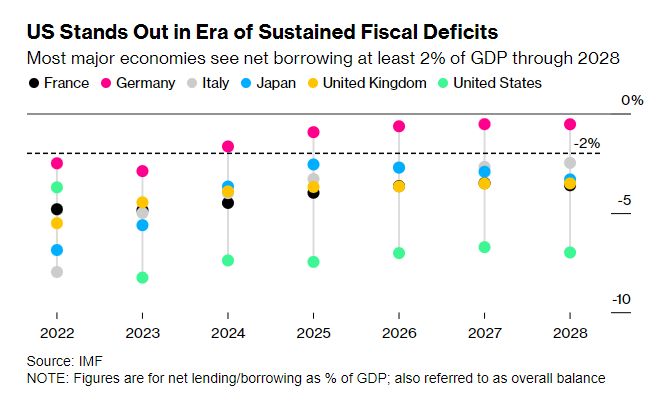

While G7 claims can offer short-term tactical opportunities, soaring G7 debt levels at the the of high yields mean that the long-term risk-reward remains unattractive.

Source chart: Bloomberg

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

Investing with intelligence

Our latest research, commentary and market outlooks