Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

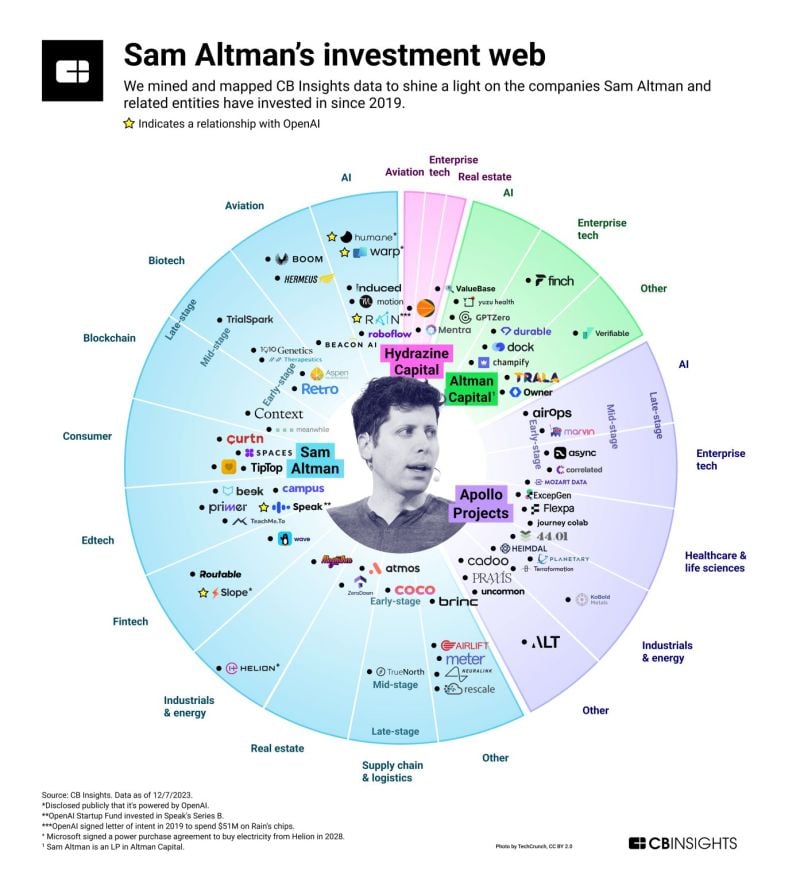

OpenAI CEO Sam Altman is not only one of the most powerful people in the world right now.

He's also one of the best angel investors and entrepreneurs. Source: CB Insights thru Linas Beliūnas

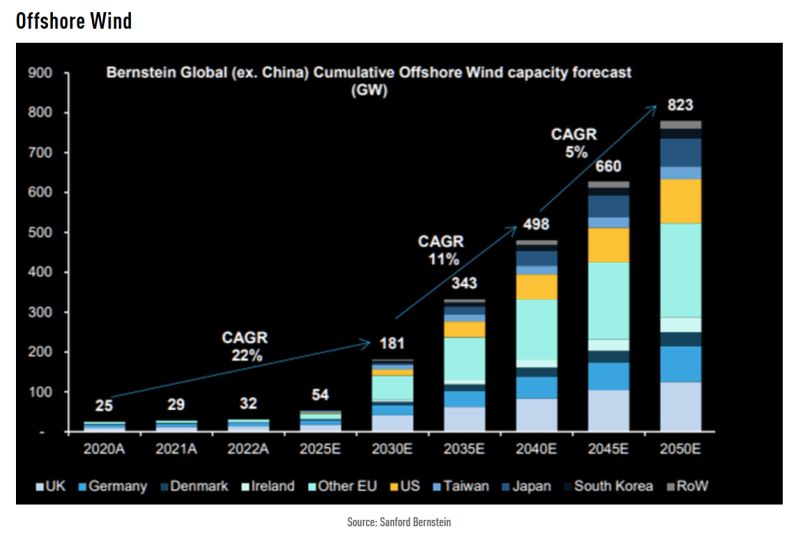

While renewables energy have been a bug disappointment for investors over the last few years, long-term forecasts for offshore wind capacity remain quite attractive.

Growth still remains strong at 22% CAGR until 2030, 11% CAGR between 2030 and 2040 and 5% CAGR between 2040 and 2050. In the next 12 months, more than 80GW of auctions will be started or concluded globally. Source: Bernstein, TME

According to Darwin's Origin of Species, the species that survives is the one that is able best to ADAPT and ADJUST to the changing environment in which it finds itself.

See below the twitter profile of Franklin Templeton, a 77 vyears old asset manager with $1.5T assets under management.

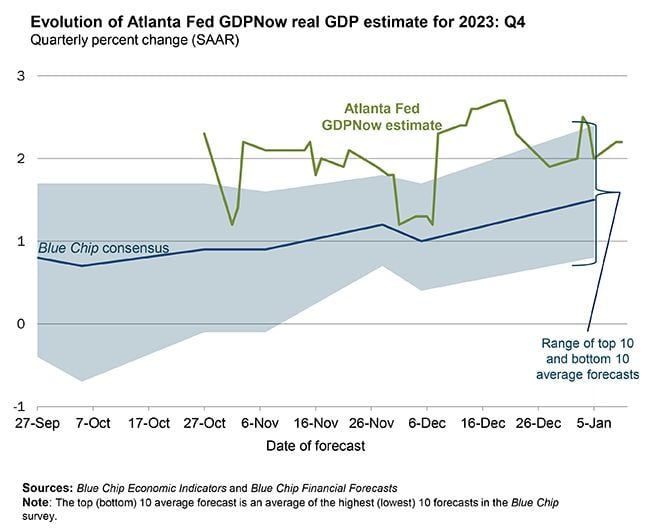

On January 10, the GDPNow model nowcast of us real GDP growth in Q4 2023 is 2.2%

Source: Atlanta Fed

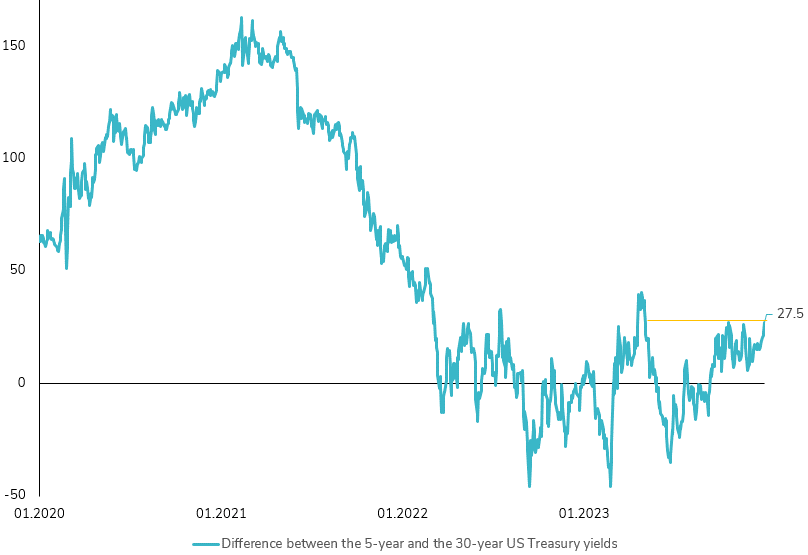

US Treasury Yield Curve Faces Crucial Test Today

Today, the US Treasury market faces a crucial test. Since its low in early December 2023, the spread between the 5-year and 30-year US Treasury yields has surged by 20bps, now touching the highs seen in June 2023. This significant shift sets the stage for today's key event: a $21 billion auction of 30-year US Treasury bonds. 🔍 Notably, the absence of 30-year bond maturities this month suggests that demand will likely stem from investors looking to lengthen their portfolio's duration. This development comes at a time when concerns were already mounting about the long end of the US Treasury yield curve, driven by factors such as negative US term premiums, a heavy supply forecast for Q1, and a resilient US economy that had witnessed a strong rally at the end of 2023. 🏦 This evening's auction is more than just a routine procedure; it's a litmus test for the supply-demand dynamics in the Treasury market. The results will be telling, offering vital insights into market sentiment and future directions, particularly regarding long-term government debt. Keep an eye out for our analysis on the outcome and implications of this pivotal financial event. #Finance #USTreasury #EconomicIndicators"

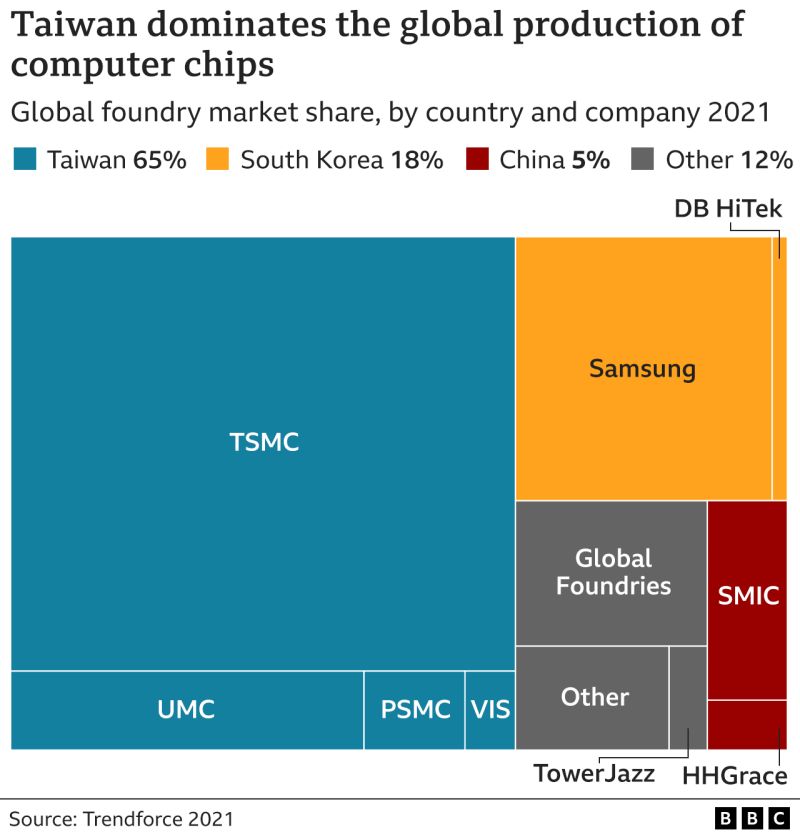

A few days ahead of Taiwan election... Taiwan: the island that matters - or why Taiwan is important to China, USA and the rest of the world...

Imagine the implications of any blocade or invasion on the semiconductor value chain and the magnificent7... Source: BBC

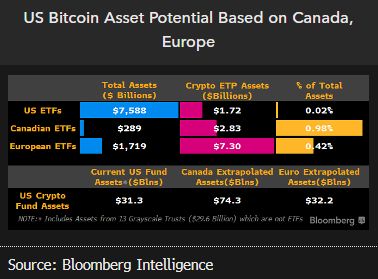

BlackRock may break the first-day flow record with a possible $2 billion asset injection on the first day of trading for its US spot Bitcoin ETF

according to BI's senior ETF analyst Eric Balchunas Seed funding could combine with grassroots interest to give it momentum in a race that includes up to 11 ETFs that we think could gather as much as $4 billion on the first day, and $50 billion of assets within two years.

Investing with intelligence

Our latest research, commentary and market outlooks