Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

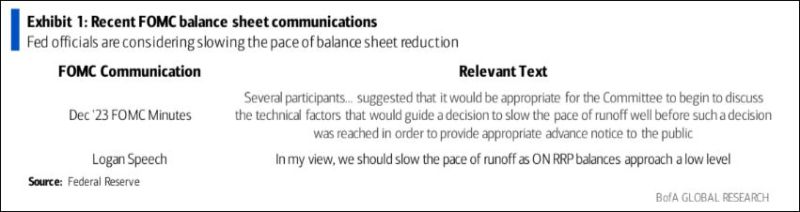

Franco-Nevada testing again major support zone

Franco-Nevada (FNV US) is testing for a second time since December major support zone 105-109 ! This level is key as stock is in a trading range 105 - 170 since 2020 ! . Will it rebound once again ? Source : Bloomberg

The Fed balance sheet expanded last week by $5.7BN - the most since March's SVB crisis...

Source: Bloomberg, www.zerohedge.com

Speculators have built their largest short U.S. Dollar position since 2020 and one of the largest in history

Source: barchart

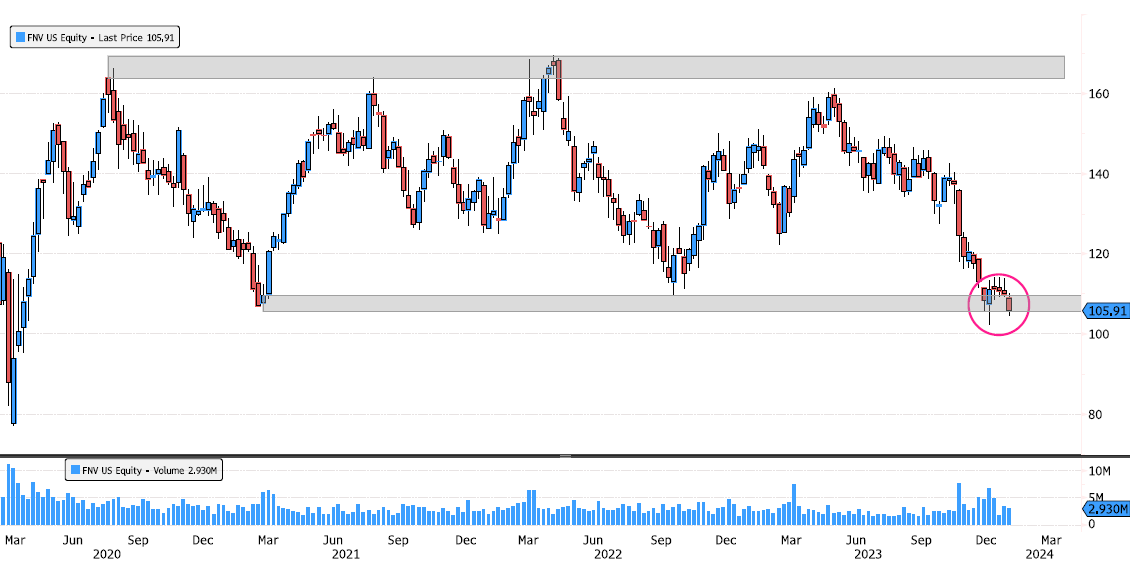

Wondering by us bank stocks are doing well?

Since the introduction of the Bank Term Funding Program (BTFP) in March, there is a nice arbitrage opportunity for banks - watch out on the chart below the gap between the rate on the Federal Reserve’s nascent funding facility and what the central bank pays institutions parking reserves. Since March / SVB crisis, the BTFP-Fed Arb continues to offer 'free-money' to banks - and usage of the BTFP has risen by $38BN since the arb started to exist. Source: Bloomberg. www.zerohedge.com

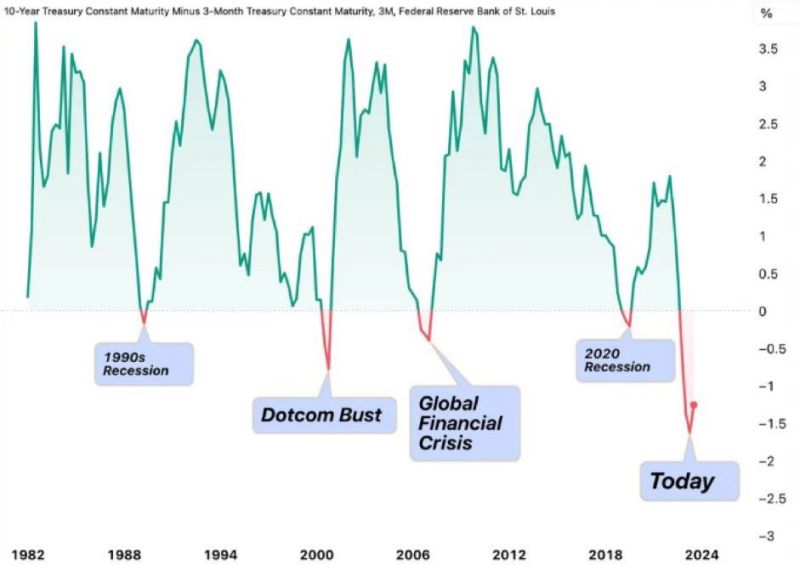

The last 4 times the 10Y Minus 3M Treasury Yield Curve inverted, it led to the 1990s recession, the Dotcom Bust, the Global Financial Crisis, and the 2020 Recession.

Will this time be different? 🤔 Source: Barchart

Uranium 16-Year High: Uranium going parabolic as it hits its highest price since November 2007

Source: barchart

Investing with intelligence

Our latest research, commentary and market outlooks