Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"Don't just teach your children to read... Teach them to question what they read. Teach them to question everything."

-George Carlin

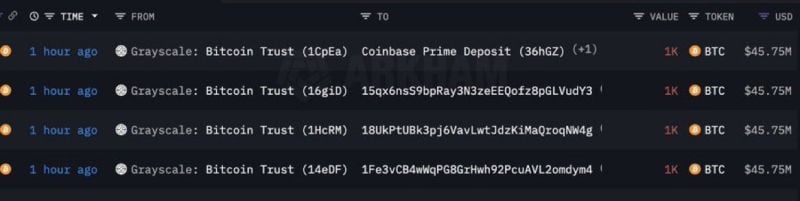

Bitcoin is down -12% from yesterday $49k high. So what's going on?

that some unexpected supply is coming to the market. Indeed, 4 Grayscale Bitcoin Trust wallets have just transferred over 4,000 BTC ($177,500,000+) to Coinbase Exchange. A lot of supply to absorb... Source: WhaleWire

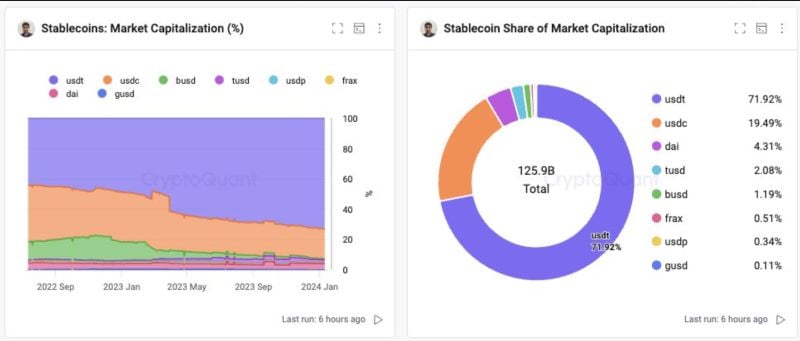

Tether $USDT's market cap dominance is 71% now.

Source: https://cryptoquant.com, Ki Young Ju

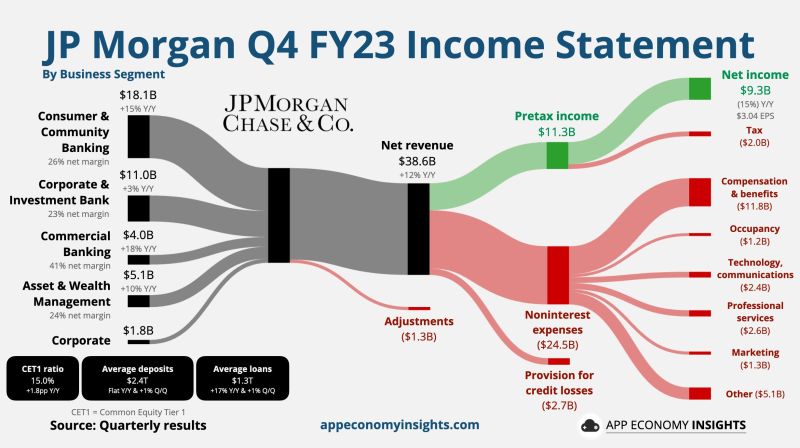

$JPM JP Morgan Chase Q4 FY23.

CEO Jamie Dimon: Deficit spending and supply chain adjustments “may lead inflation to be stickier and rates to be higher than markets expect." • Net revenue +12% Y/Y to $38.6B ($1.2B miss). • Net Income $9.3B. • Non-GAAP EPS: $3.97 ($0.37 beat). • CET1 ratio of 15.0%. • Expect FY24 NII of $90B (+1% Y/Y).

BREAKING: PPI data

- Core PPI comes in at 0% m/m vs 0.2% forecast - Core PPI comes in at 1.8% y/y vs 2% forecast - Headline PPI comes in at -0.1% m/m vs forecast of 0.1% - Headline PPI comes in at 1% y/y vs 1.3% forecast A colder than expected print across all readings! Source: Bloomberg, Markets & Mayhem

Oil prices jump back above $75 after the US and UK conduct strikes in Yemen.

We are also seeing gold prices up on the news as fears of a larger war resurface. The primary motive for these strikes was the recent Red Sea attacks by the Houthi group in Yemen. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks