Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

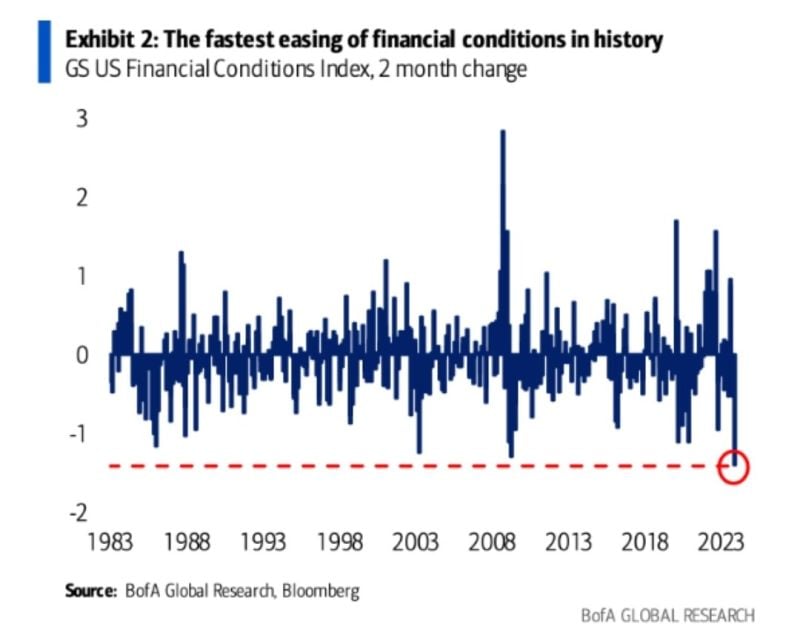

FASTEST easing of Financial Conditions in HISTORY

Source: WinSmart, BofA

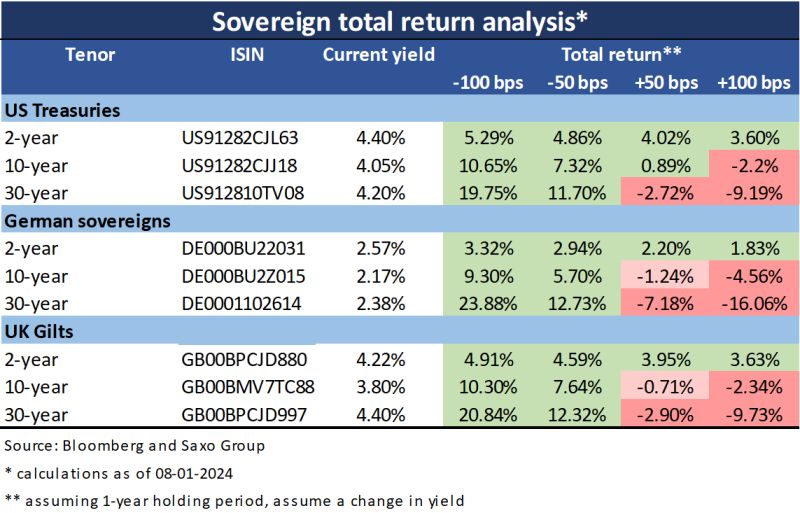

Total return bond analysis update

Source: Althea Spinozzi, Saxo, Bloomberg

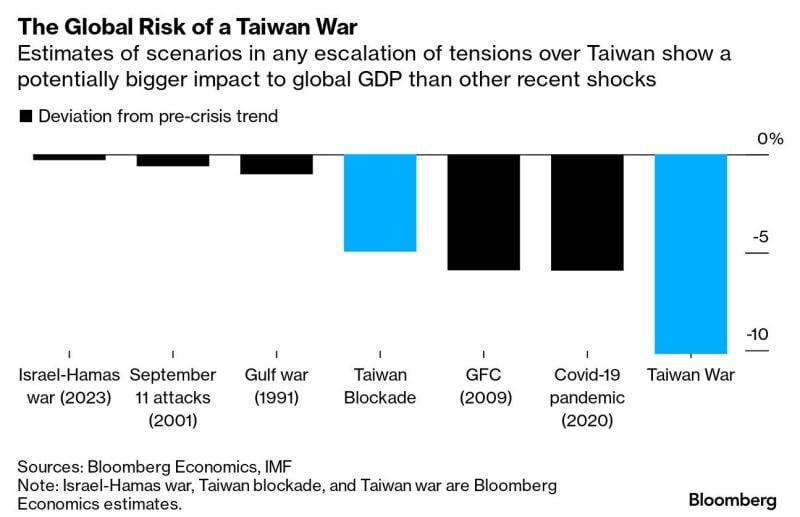

Is Taiwan risk the biggest risk for the economy and financial markets in 2024? See below a scary chart by Bloomberg

Source: Bloomberg

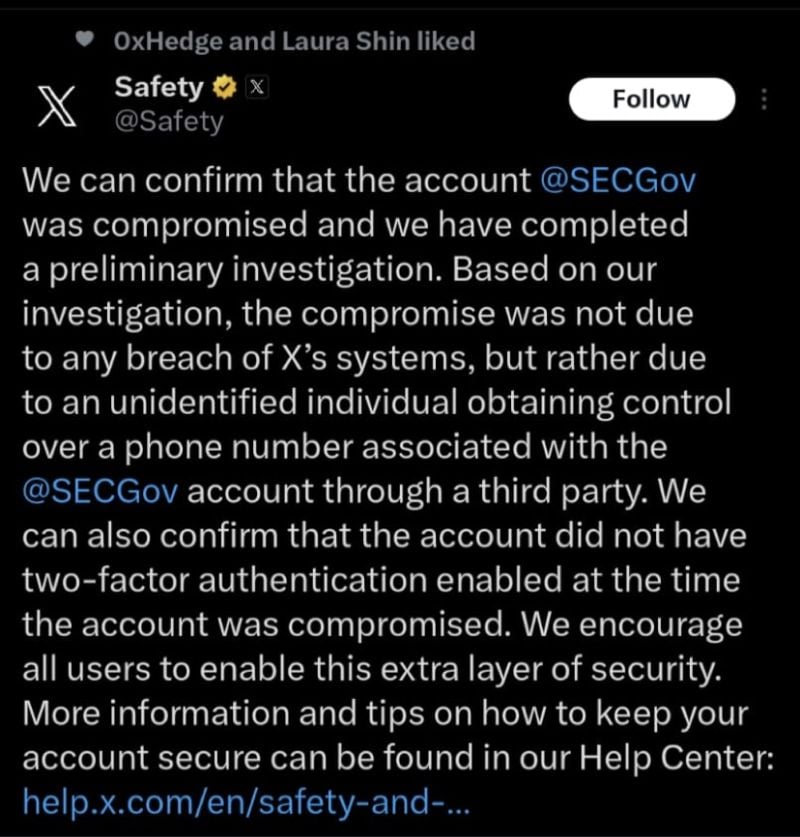

Interesting tweet by X Safety with regards to yesterday evening fake news around bitcoin spot etf approval by SEC

A bit worrying as well… let see what internal investigation will reveal

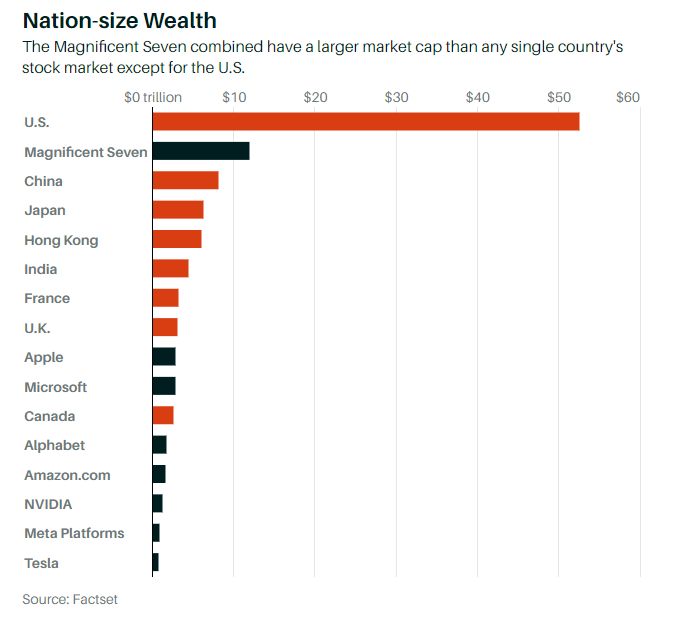

The Magnificent Seven have a larger market cap than any country's entire stock market except the US

Source: Barchart

BREAKING: Japan's Nikkei 225 stock index rises above 34,000 for the first time since March 1990. Breakout from a 30-year base!

- Breakout + test from 30-year base (blue circle) - Successful test of 2nd base (purple circle) - $NIKKEI now trading at 34-year high - Still below ATH recorded in 1989 - Yen is undervalued by ~40% on PPP-basis (source: ) Along with hitting a fresh 33-year high, Japan's stock market is now up 120% from its low in 2020. Both technology and health care stocks have been the main drivers. Recently, Warren Buffett began betting on a recovery of Japan's economy. Japan is back in a bull market.

Nvidia, $NVDA, has already added another $130 billion of market cap in 2024 and we're only 6 trading days in

Since its low in October 2022, $NVDA has officially added $1 TRILLION in market cap. As of today, the stock is officially up 400% from its 2022 lows. In 2 years, Nvidia has gone from barely being a top 30 company by market cap to being the 6th largest public company in the world. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks