Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

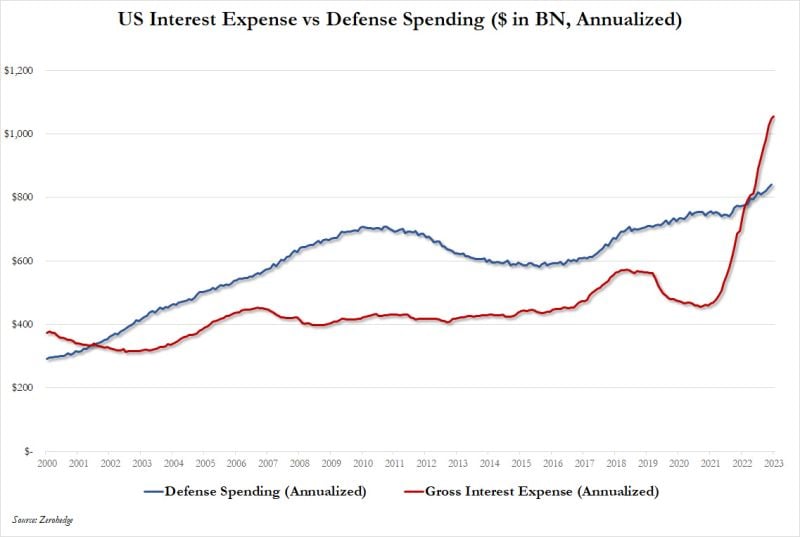

US defense spending vs interest on Federal debt

Source: www.zerohedge.com

New Year, New Low!

After a shallow rally, Chinese hashtag#equities just made a new low. Down 15% from their peak in May last year, down 22% from their 2021 peak. Sources: Jeroen Blokland, Bloomberg

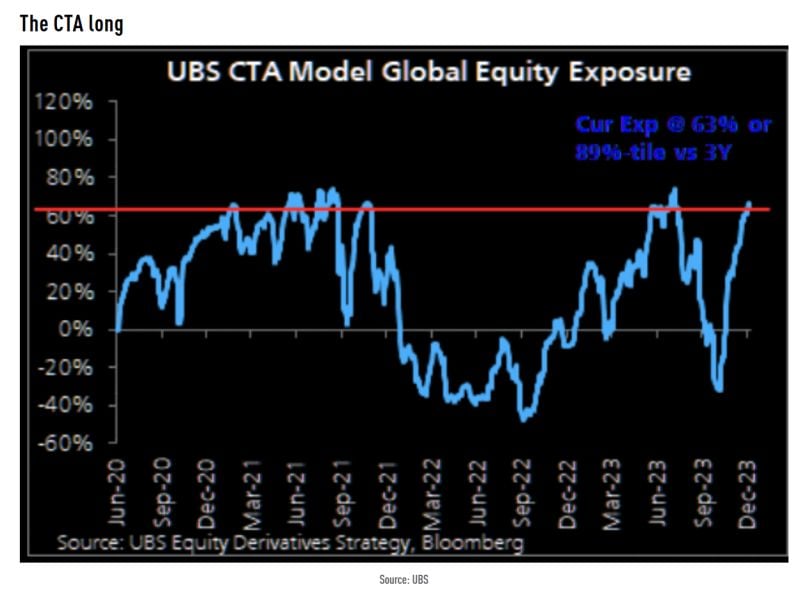

Long positioning by CTAs is extreme and creates some downside risk for the market.

According to UBS: "ES1 (sp500 futures) is already 100% long with first meaningful sell triggers @ -4% to -6%. NQ1 (nasdaq) is 92% long with first meaningful sell triggers @ - 4% to 6%". Source: TME, UBS

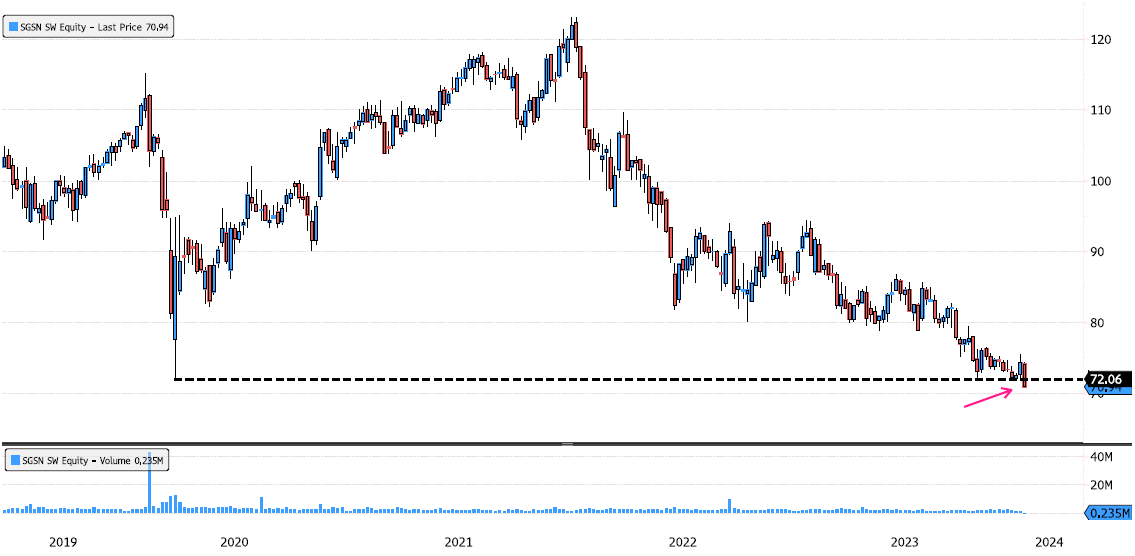

SGS under pressure, on long term swing support

SGS (SGSN SW) is down more than 5% this morning and 43% since January 2022 highs ! Keep an eye at 72.06 support over the next few days. Source : Bloomberg

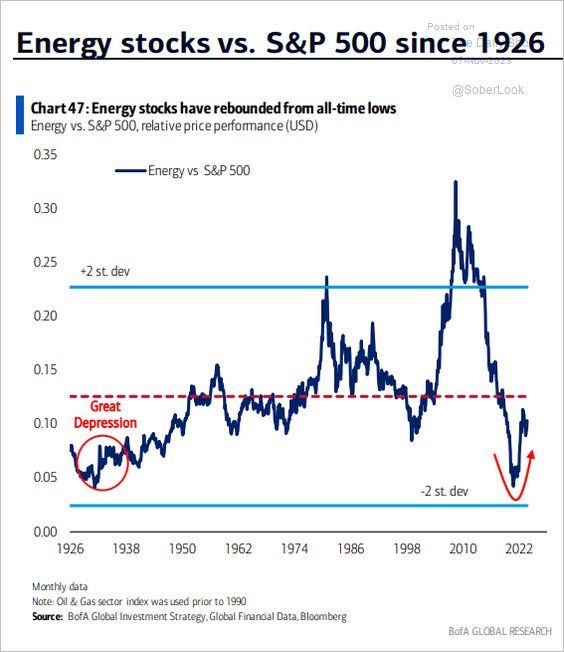

ENERGY STOCKS SINCE 1926 (relative to S&P)

Source: BofA, The Daily Shot

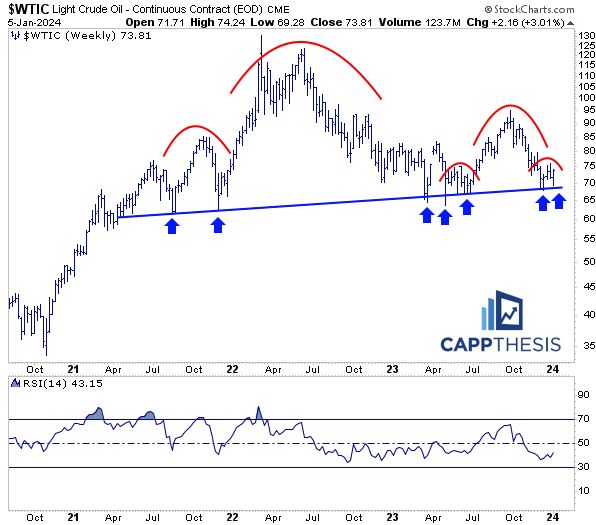

A topping pattern on crudeoil? Or simply finding support at a long-term trendline before a move higher? This one needs to be watched closely

A great chart from Frank Cappelleri thru Ryan Detrick, CMT.

The "multipolar world" will remain a major topic in 2024 as the rewiring of the global commerce system creates geopolitical risks & business model shifts that will last decades

The Dollar’s & Euro's share in global CenBank reserves dropped. Greenback accounted for 59.2% of globally allocated FX reserves in Q3 2023, down from a revised 59.4% in Q2, lowest since Q4 2022. Euro’s share in reserves also fell to 19.6% from 19.7%, while the participation of Japan's Yen rose to 5.5% from 5.3%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks