Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

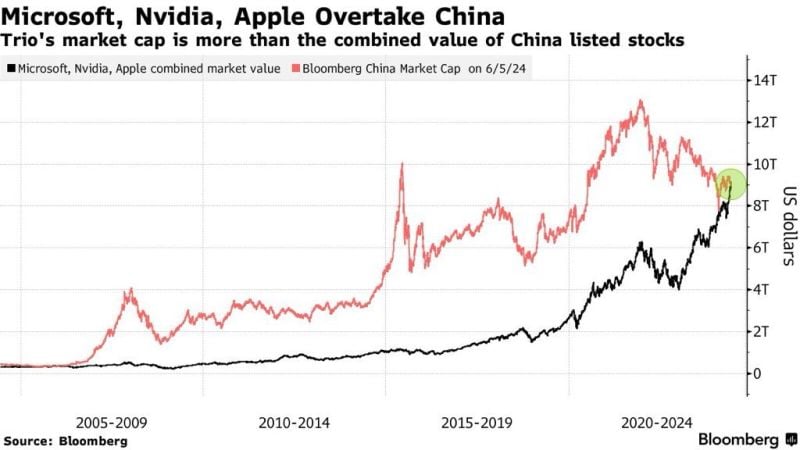

It’s official: Nvidia, Apple, and Microsoft are now bigger than China’s entire stock market.

Source: Bloomberg, www.zerohedge.com

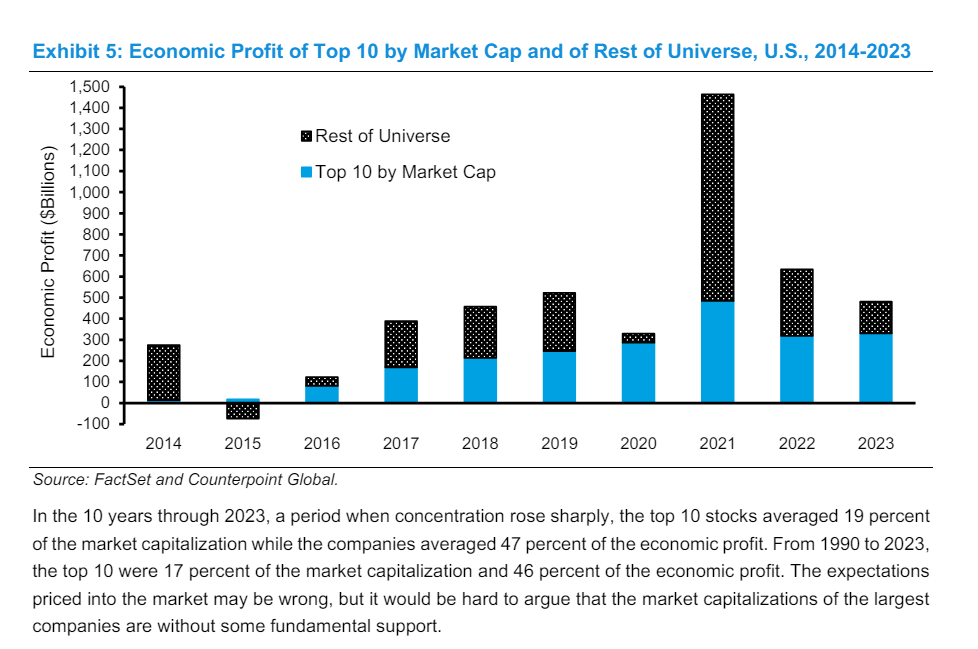

Michael Mauboussin latest research about stock market concentration: "How much is too much?"

Please read Michael Mauboussin’s (head of Morgan Stanley’s Consilient Research) latest article in which he argues that the rising concentration in the US stock market indices is justified by the companies’ underlying fundamentals. The article can be freely accessed on the Morgan Stanley Investment Management website. Source: Consilient Research for Morgan Stanley Investment Management’s Counterpoint Global

Bitcoin Logarithmic Monthly Chart

With a logarithmic chart, it is sometimes easier to identify a trend. The trend has been bullish since the start of Bitcoin. It’s now testing again a major resistance level. Will it be able to breakout ? Source : Bloomberg

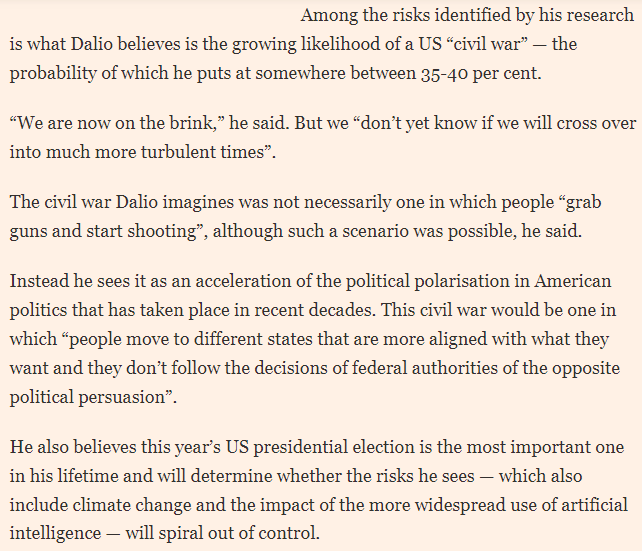

The US could be on the brink of the civil war according to Ray Dalio

In an interview given to the FT on 16 May, billionaire investor and founder of Bridgewater Associates warns about the risk of a civil war breaking in the US. Source: FT

Ray Dalio says benefits of investing in China outweigh risks

Source: South China Morning Post

The Bloomberg US Economic Surprise index is about the most negative since 2019.

DB's Jim Reid: Yesterday's ISM manufacturing report "was definitely one that dampened optimism about the state of the US economy right now. And it follows a run of weaker US data over recent days." Source: Bloomberg, Liza Abramowitz

Oil prices crash nearly 10% in 5 days over fears around weakening global demand.

Even as OPEC just extended oil production cuts of 2 million barrels per day, oil prices are nearing their 2024 lows. Recent data suggests that US economic activity in manufacturing and construction is slowing. As a result, oil prices are down 16% from their April peak and up just 3% year-to-date Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks