Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US sets stage for antitrust probes into Microsoft, OpenAI and Nvidia

Source: Reuters

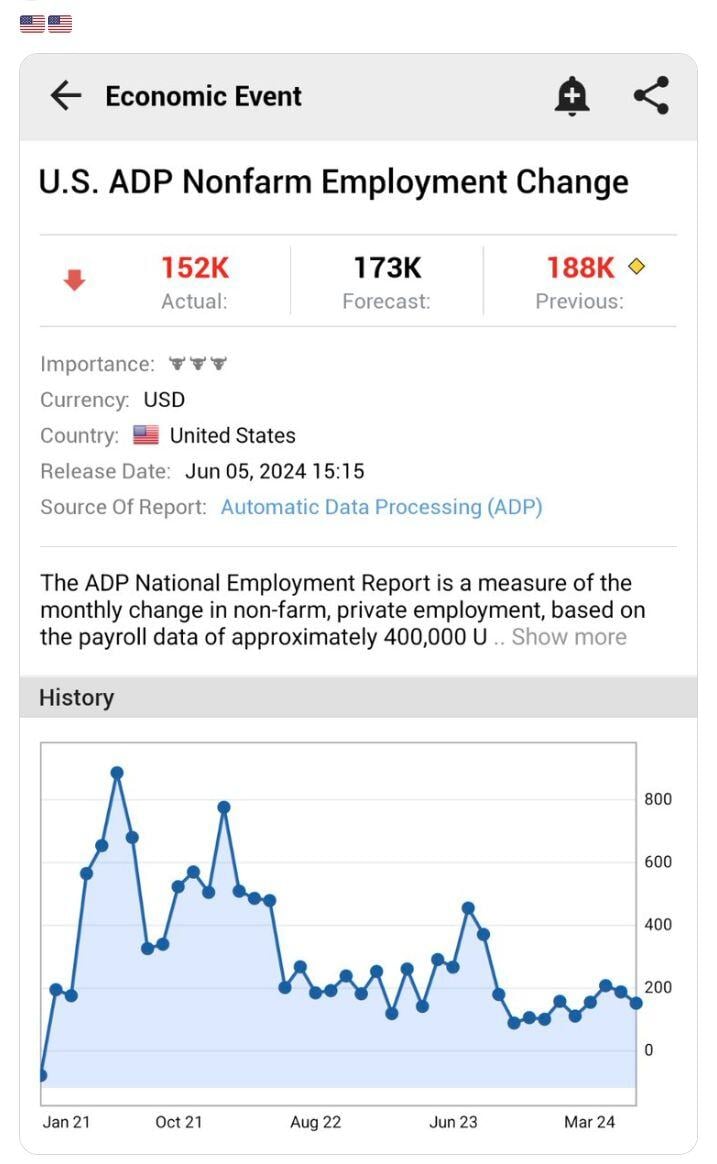

*U.S. MAY ADP NONFARM PAYROLLS REPORT*

1. The U.S. economy added a lower-than-expected 152,000 jobs in May, as per ADP, missing forecasts for a gain of 173,000 (previous was 188,000). 2. This is the lowest number since February 3. The number of job gains for April was revised down from +192,000 to show a gain of +188,000. Key Takeaway: The weak ADP report adds to evidence of a slowing labour market. September rate cut bets will grow stronger as cracks begin to emerge in the economy. Source: www.investing.com

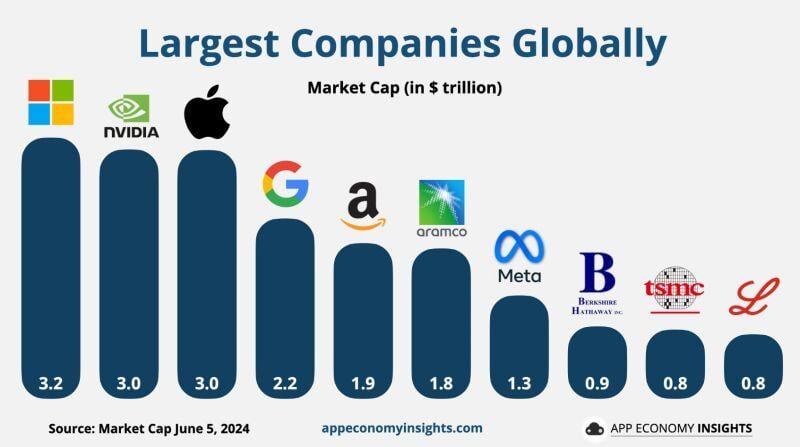

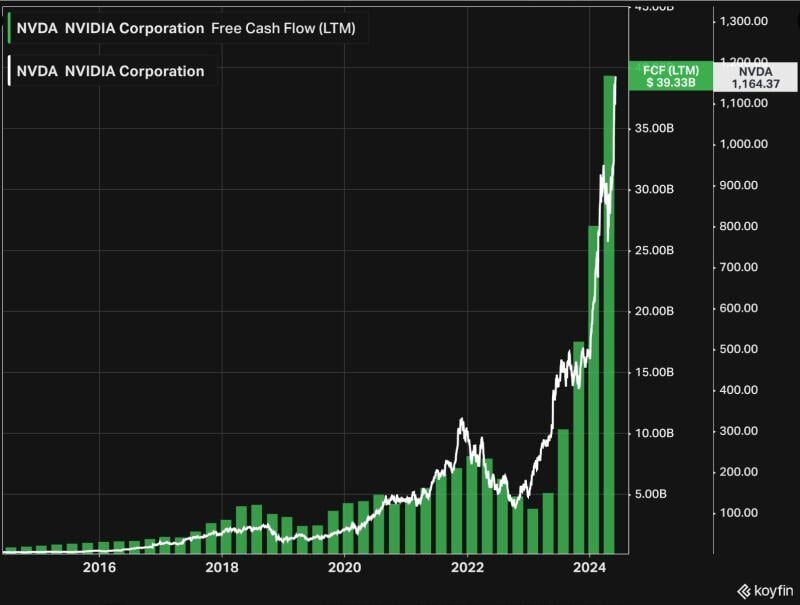

BREAKING: Nvidia stock, $NVDA, officially crosses above $1,200 for the first time in history.

Nvidia now has a market cap of $2.95 TRILLION and is just 3% away from passing Apple, $AAPL, as the largest public company in the world. To put things into perspective: the market cap per employee of Nvidia has hit almost $100,000,000. Source: Bloomberg, HolgerZ

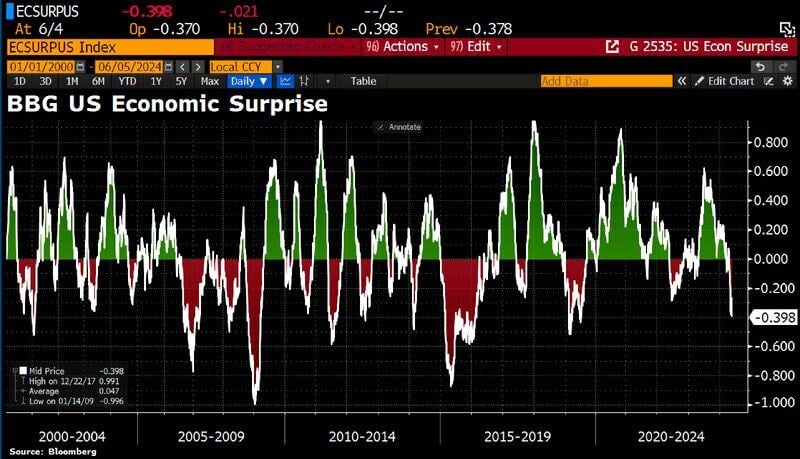

As economic data continues to underwhelm (ISM Manufacturing, JOLTs), the BBG US economic surprise index has plunged to its lowest level in 5 years.

Source: Bloomberg, HolgerZ

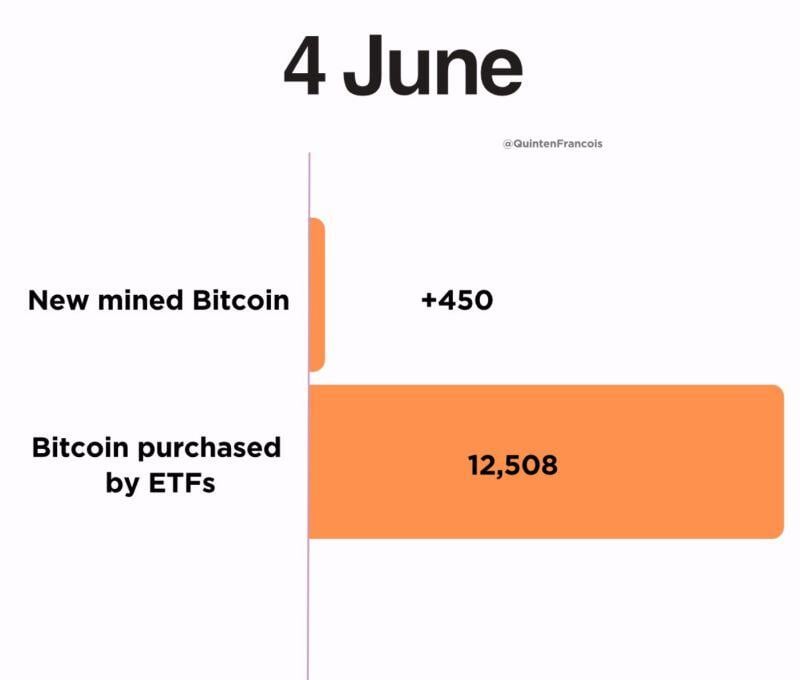

NEW: Spot Bitcoin

ETFs bought 12,508 BTC yesterday, while miners only produced 450 BTC.

NVIDIA $NVDA reaches a $3T valuation and overtakes Apple $AAPL as the 2nd largest company globally.

Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks