Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

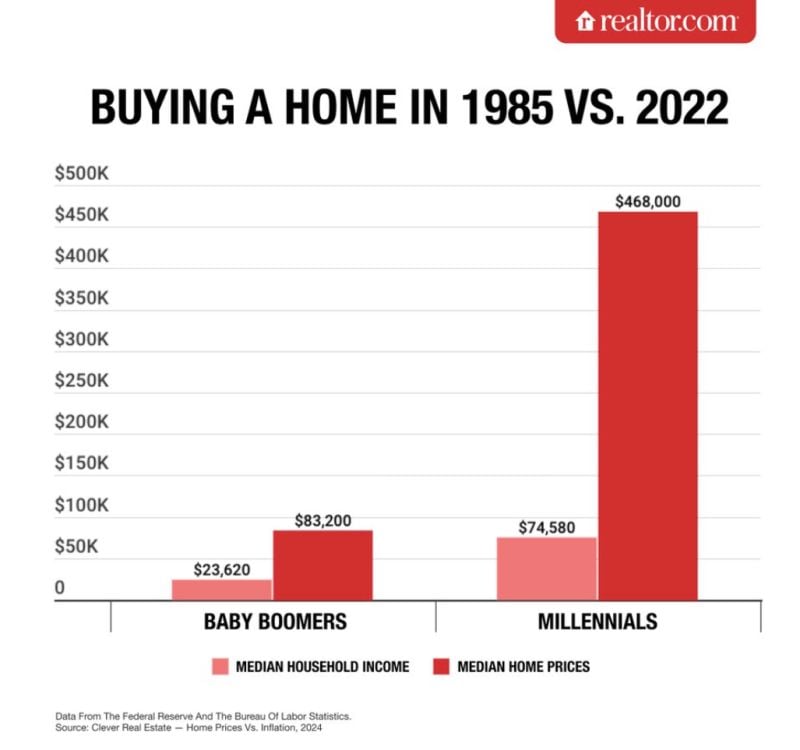

Want to buy a home?

1980: save for a couple years 2024: forget about it Source: Michael Burry Stock Tracker

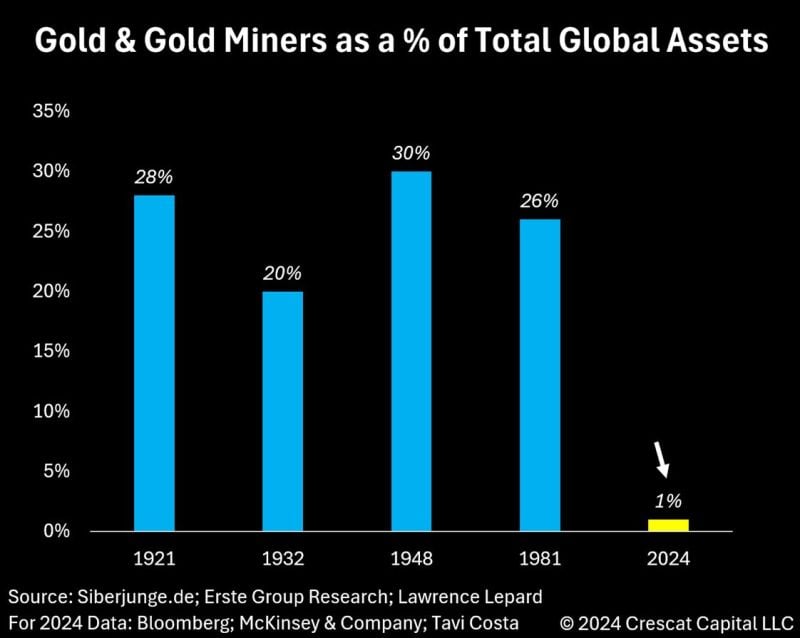

Multiple times in history, the precious metals industry was considered the largest market among global assets.

Today, however, it has shrunk so much that it's almost a rounding error. Will capital start to flow back into this industry? If yes, the impact on prices could be substantial... Source: Crescat Capital, Bloomberg

🚨 A MASSIVE $1,250 spread between Coinbase and Binance for Bitcoin! 😳

Watch out below the BTC prices differential between the 2 exchanges a few hours ago!!! Coinbase is the most expensive place to buy BTC right now 💰 As supply dwindles, we're likely to see CRAZY spreads emerge! Great time for arbitrage and for hedgefunds !!! Source: InvestAnswers

FREIGHT RATES ARE RISING AGAIN

"No news (out of Gaza) is bad news for Shipping-flation Freight rates out of China are rising rapidly again and we are likely to see the pass-through to goods-flation in the West already in May/June". Source: Andreas Steno Larsen

China now settles half of its crossborder trade in renminbi, up from zero in 2010

• Rise in RMB use highlights sanctions-proofing strategy of Beijing and its allies, such as Russia • China's promotion of CIPS, its homegrown alternative to Swift, may support rise in RMB use Source: Agathe Demarais

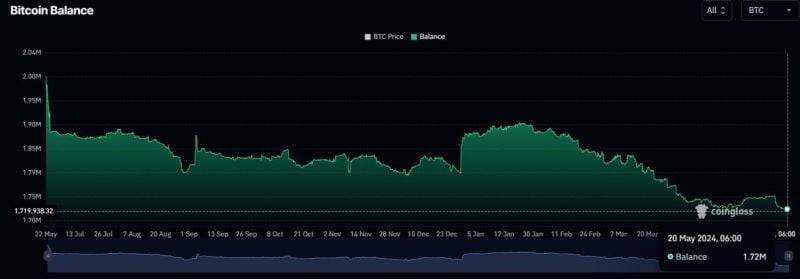

NEWS: Bitcoin exchange reserves fall to an all-time low of 1.7 million 😳

Is a supply shock coming? Source: Coinglass, SimplyBitcoin

The cost of servicing US government debt is on course to surpass defense spending

Source: Bloomberg, Michael McDonough

Investing with intelligence

Our latest research, commentary and market outlooks