Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

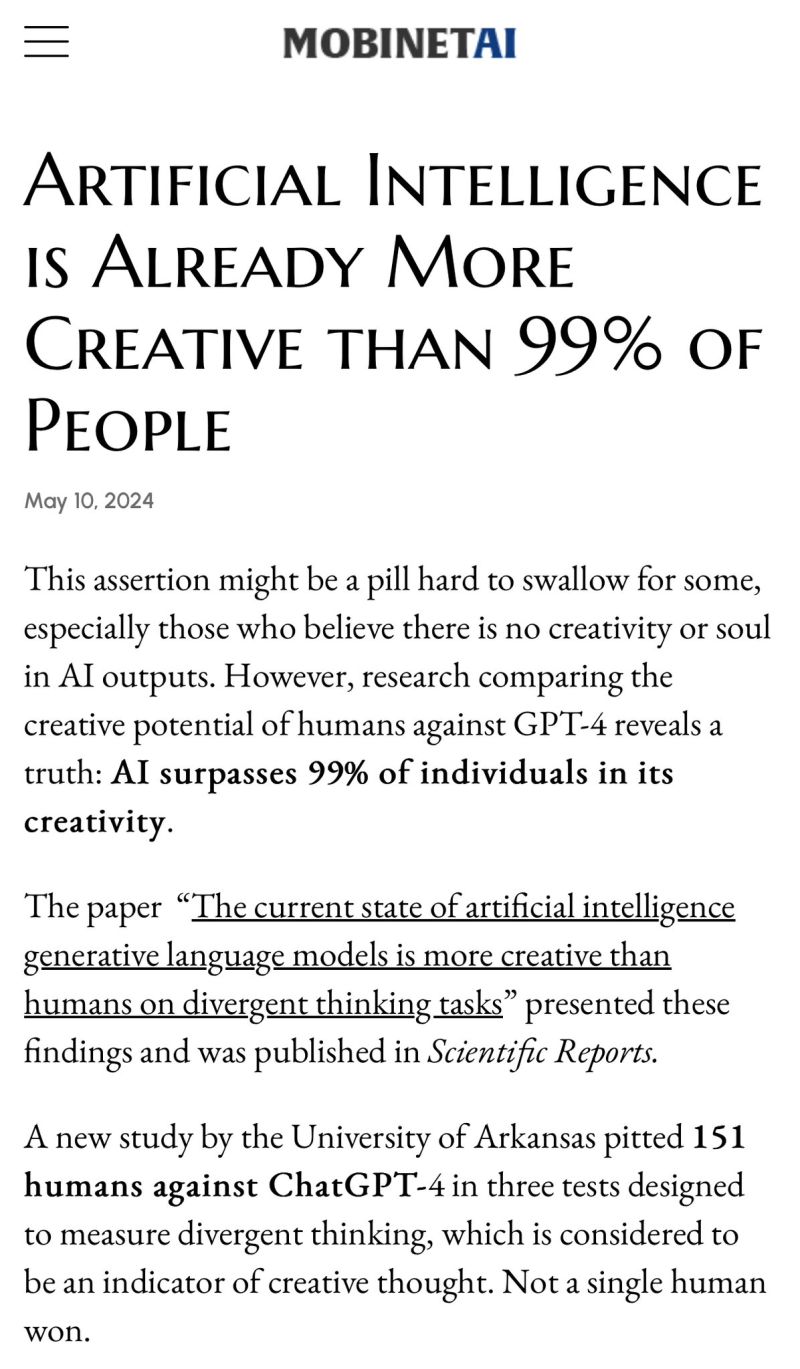

A new study by the University of Arkansas pitted 151 humans against ChatGPT-4 in three tests designed to measure divergent thinking, which is considered to be an indicator of creative thought

Not a single human won. Source: Jeremiah Owyang

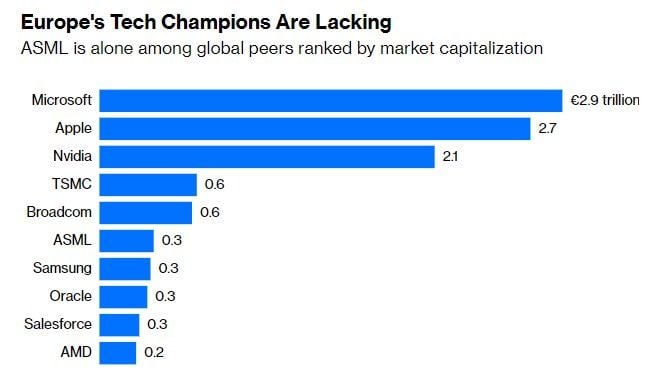

The issue with europe:

1) Over-regulation; 2) Too much bureaucracy: 3) Lack of hashtag#innovation. As shown below, Tech champions are lacking. Source: Bloomberg

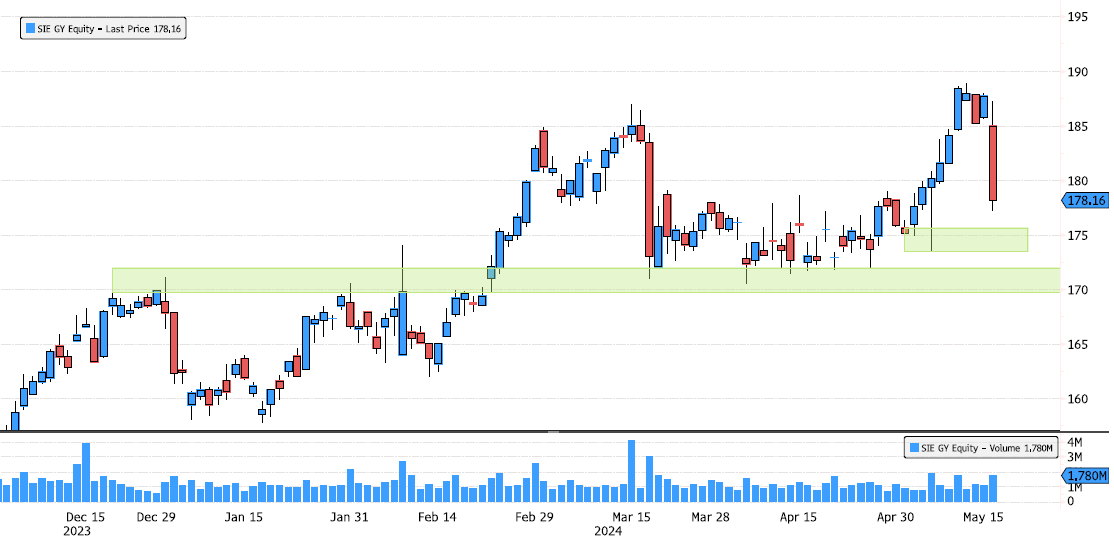

Siemens looking for support after earnings

Siemens (SIE GY) under a lot of pressure after earnings report. Trend remains bullish. For the moment consolidating after recent new all time high. Support zones to look at are 173,52-175.64 and major 169,70-171,95. Source : Bloomberg

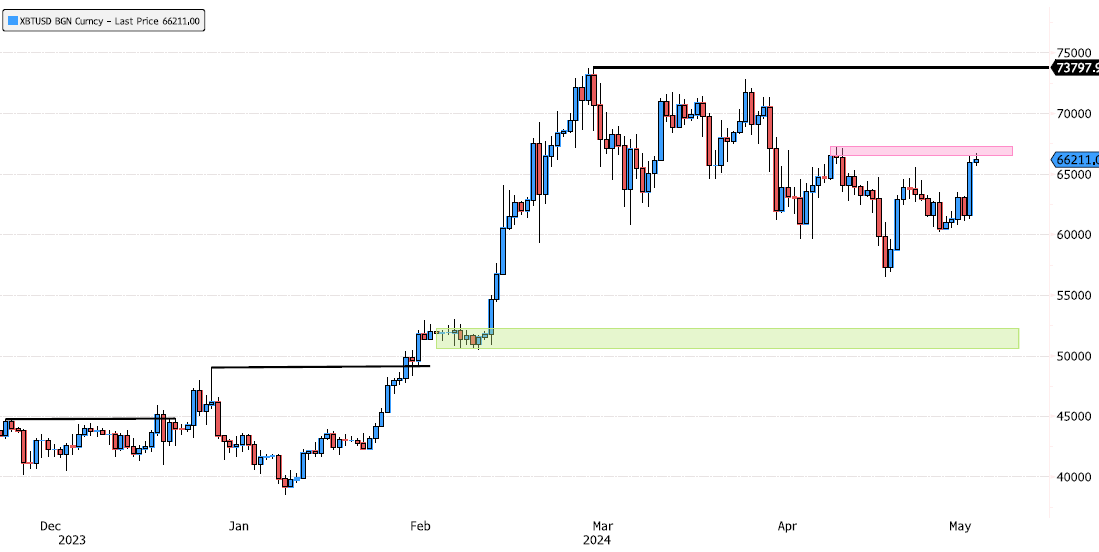

Bitcoin showing strenght but entering resistance zone

Bitcoin (XBTUSD) is approaching resistance zone 66'500-67'300. If it can close above that level, this could be the end of March consolidation. Keep an eye at this key level. Source : Bloomberg

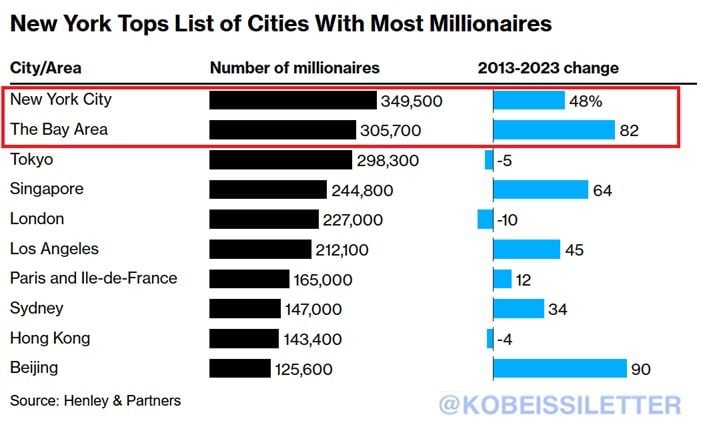

New York City now has 349,500 millionaires, more than any city in the world

Over the last decade, the number of millionaires in NYC has risen by a massive 48%. At the same time, in The Bay Area, the number of people with a seven-figure net worth has risen 82% to 305,700, the second-highest worldwide. This surge has been driven by a massive rally in financial markets and real estate prices. Meanwhile, 78% of Americans live paycheck to paycheck, according to the latest Payroll-org survey. The rich are getting richer at the fastest pace ever. Source: The Kobeissi Letter, Bloomberg

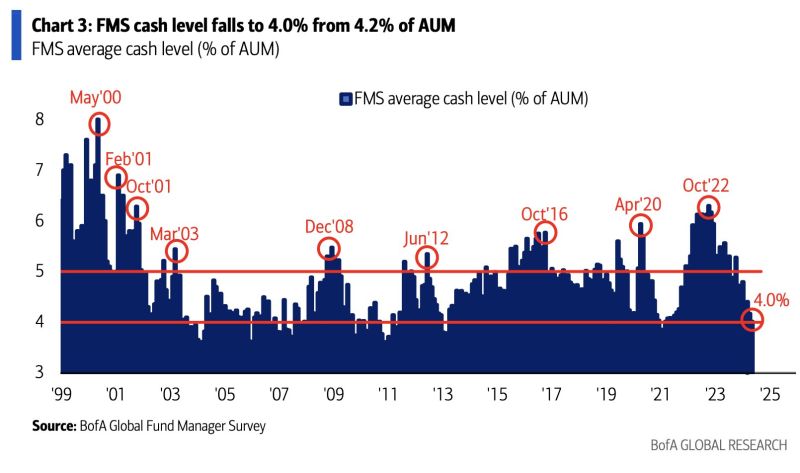

Are investors too complacent?

May Fund Manager Survey (FMS) sentiment is at the most bullish level since Nov’21, BofA says. The average cash level of FMS investors fell to 4.0% of AUM from 4.2%, the lowest level since Jun’21. Source: BofA, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks