Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

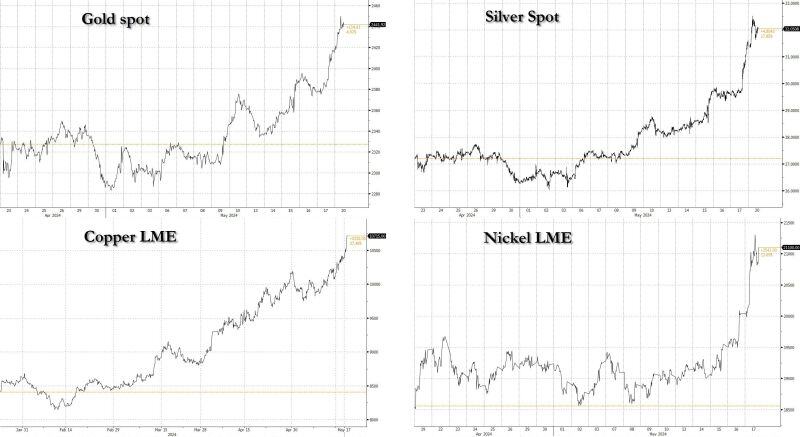

The metal bull market is broadening as Gold, Silver, Nickel and Copper are all exploding higher.

What is the message from Mr Market here? Source: www.zerohedge.com, Bloomberg

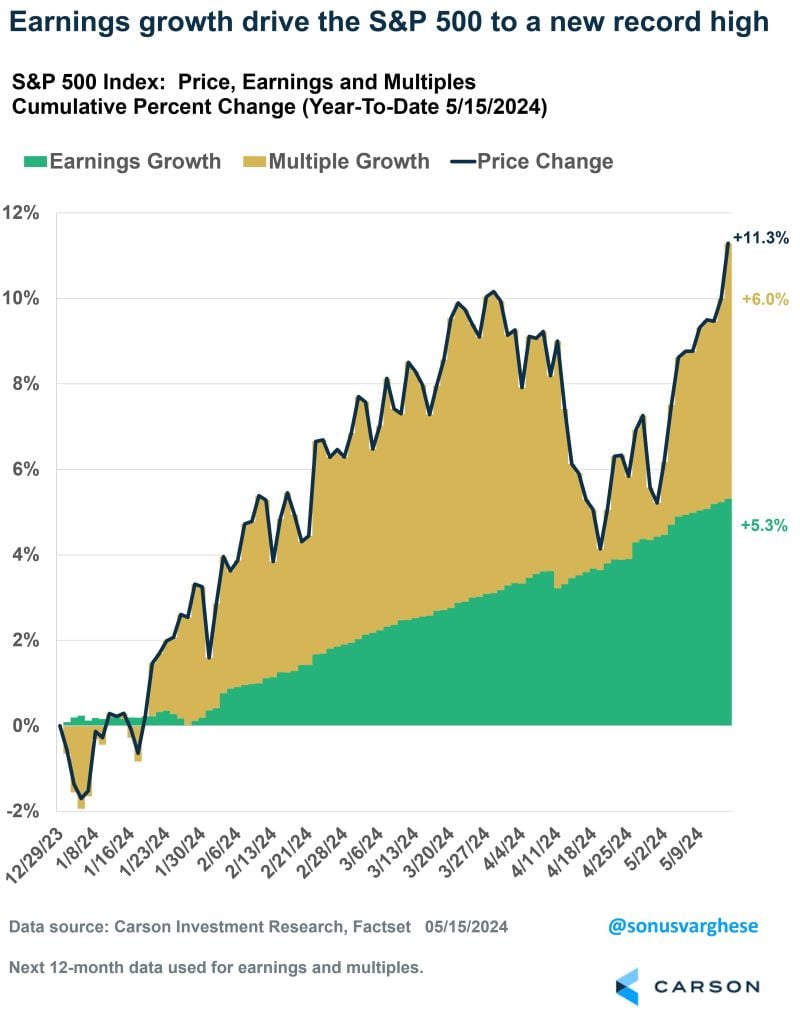

Not all new highs are the same.

Awesome chart from @sonusvarghese thru Ryan Detrick here. End of March, SPX up 10.2% YTD. Only 3.1% from EPS growth and the rest (7.1%) was from multiple expansion. On 5/15, SPX up 11.1% YTD. Now 5.3% from EPS growth and 6.0% from multiple expansion.

The Global X Uranium ETF $URA is already up 13.5% in May.

It's on track for its highest monthly close since March 2014... after spending the past several months consolidating. Source: Justin Spittler

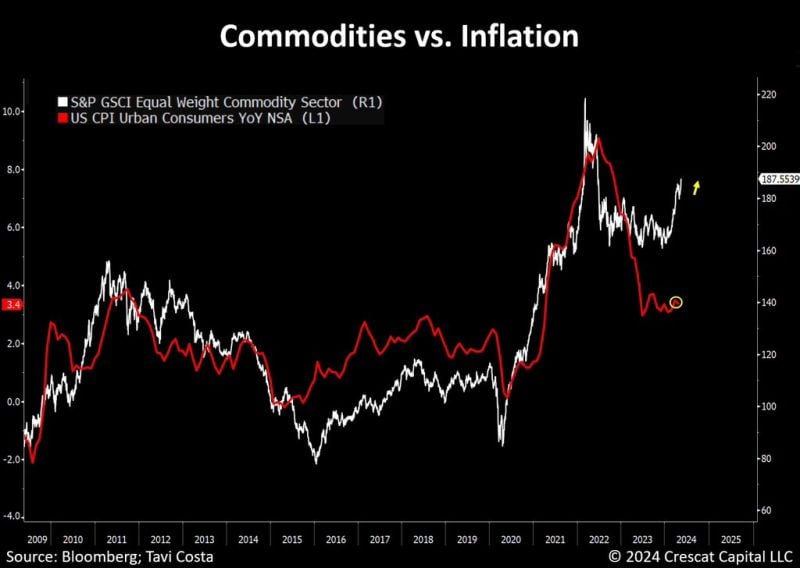

Could headline inflation start following the rebound in commodities prices?

Source: Tavi Costa, Bloomberg

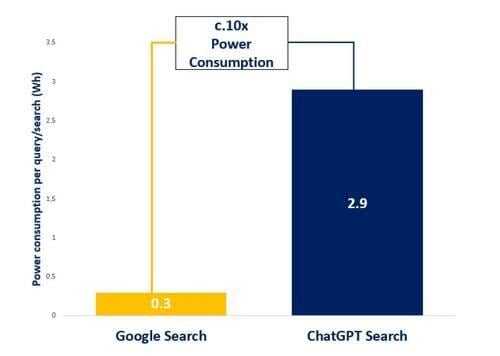

Emerson Electric CEO:

"AI data center racks consume significantly more power than traditional data centers with a search on ChatGPT consuming 6 to 10 times the power of a traditional search on Google" $EMR $GOOG $GOOGL $MSFT Source: The Transcript

Interesting article by Financial Times:

Three in four audit reports failed to warn that companies risked going bankrupt in the year before their collapse. Here's how each of the Big Four performed: https://on.ft.com/3UFVHLG

Bears are capitulating...

Mike Wilson chief equity strategist of Morgan Stanley has revised his price target of the S&P 500 from 4,500 to 5,400 Notoriously a market bear, he had previously predicted a 15% drop by December for the index. Source: Radar, The Macro Guy, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks