Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

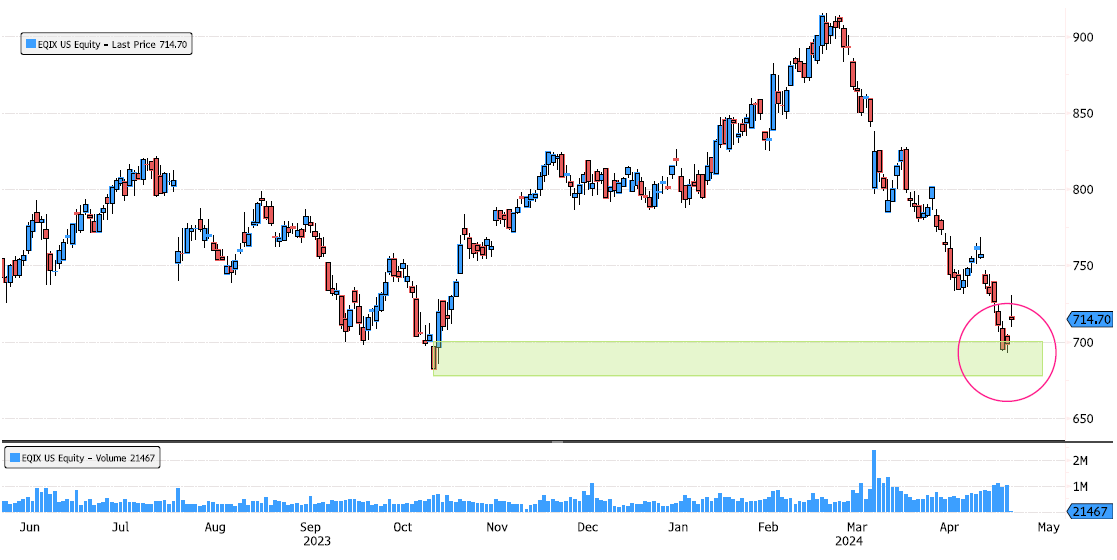

Equinix rebounding on support post earnings

Equinix (EQIX US) has consolidated 24% since March swing high ! Stock is rebounding from support zone 677-700. For the moment volume is a bit low. Keep an eye. Source : Bloomberg

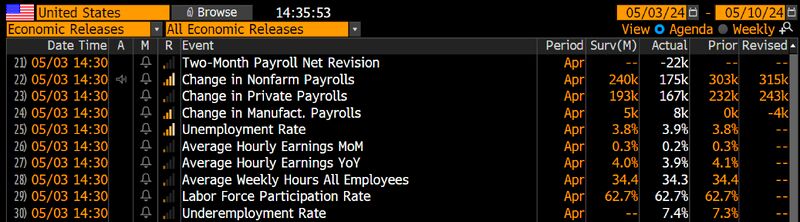

Stocks, bonds and cryptos rally following soft US jobs data.

Hiring slows to 175,000 jobs in April way below the forecasted 240k. This is the lowest figure since Oct 2023’s +165k. Household survey came in below forecasts as well with unemployment rate rising to 3.9% from March's 3.8%. Wage growth slows to 0.2% MoM vs 0.3% expected. Note that 0.2% is consistent with 2% inflation. Source: Bloomberg, HolgerZ

Satoshi Nakamoto explaining why Bitcoin is a breakthrough in monetary history, exactly 15 years ago.

Source: Rizzo on X

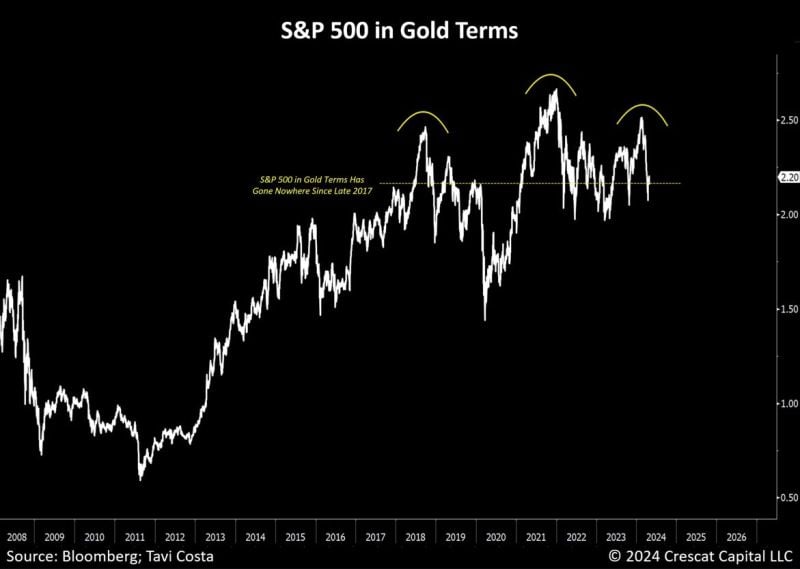

The SP500 in gold terms has gone nowhere since 2017 + it’s hard to ignore this massive head and shoulders taking shape.

Source: Tavi Costa, Bloomberg

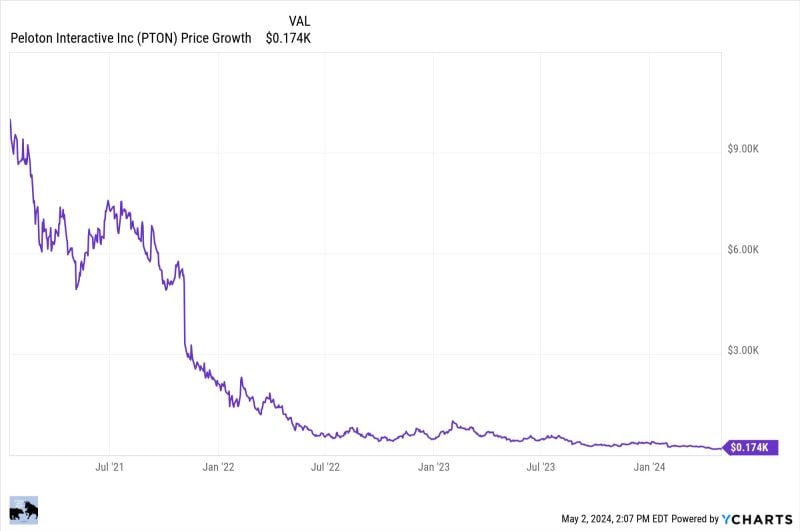

If you had invested $10,000 into Peloton $PTON at its peak in January 2021 and held to today you'd currently have ... $174

Source: Evan, Ycharts

Hong Kong growth beat estimates by the most in 13 years in the first quarter.

Source: David Ingles, Bloomberg

Apple $AAPL CEO Tim Cook during earnings conference:

Apple has “big plans to announce” from an “AI point of view” during its iPad event next week as well as at the company’s annual developer conference in June - CNBC

Investing with intelligence

Our latest research, commentary and market outlooks