Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

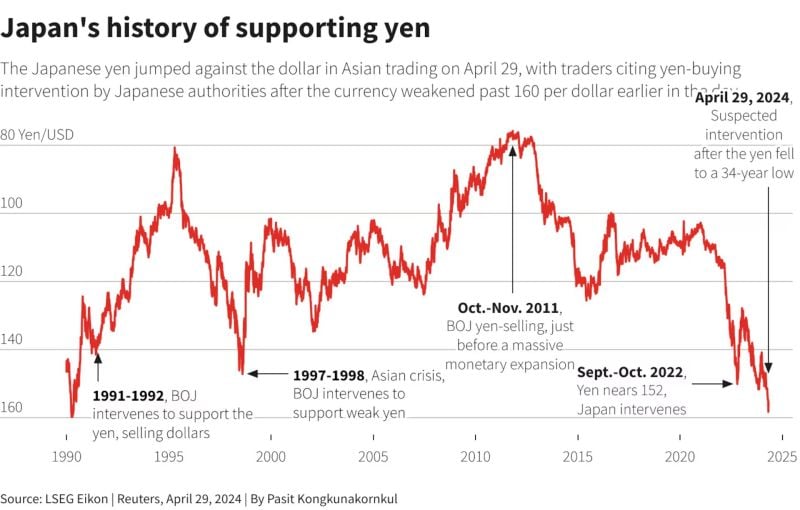

It's clear, Japan is intervening to support the Yen:

Twice this week, we saw the Yen fall to its weakest point against the US Dollar since 1990. This was the first time in 34 years that 1 US Dollar converted to 160 Yen. Immediately after the Yen neared 160 twice this week, we saw a steep drop in the conversion rate, strengthening the Yen. The BOJ reported Tuesday that its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD. This was clearly due to intervention equating to 5.5 trillion Yen, which we last saw in 2022 and 2011. The third largest currency in the world is in trouble. Source: The Kobeissi Letter

US job openings dropped in March to the lowest level in 3 years.

US available vacancies declined to 8.49 million from 8.81 million in February, hitting the lowest level since March 2021. Job openings have been declining for the past 2 years since the March 2022 peak of 12 million vacancies. Meanwhile, the quits rate has fallen to 2.1%, the lowest since August 2020. This suggests that many currently employed individuals are either losing confidence and/or are more dependent on their jobs. All eyes are on Friday's jobs report. Source: The Kobeissi Letter

BREAKING: Apple $AAPL climbed 7% in extended trading after the company announces a $110 BILLION share buyback.

Apple reported quarterly revenue of $90.8 billion and EPS of $1.53, both of which were above expectations. However, revenue in Greater China was down by 8.1% and iPhone sales fell 10%. Apple did not provide formal guidance, but Apple CEO Tim Cook told CNBC’s Steve Kovach that overall sales would “grow low single digits” during the June quarter. Apple announced that its board had authorized $110 billion in share repurchases, a 22% increase over last year’s $90 billion authorization. It’s the largest in history, ahead of Apple’s previous repurchases, according to data from Birinyi Associates. Apple is the latest tech giant to announce a massive share buyback after $META and $GOOGL. We are on track to see over $1 trillion in share buybacks this year for the first time in history. Mixed earnings but buybacks are all the market wants. Source: The Kobeissi Letter

Amazon Web Services launched in 2006.

Sales that year were $21 million. Today, it’s $21 million in LESS THAN TWO HOURS... Source: Jon Erlichman

Roche on a very important level

Roche (ROG SW) has consolidated 47% since April 2022 all time high ! It's now entering a very important support zone 206-215. Keep an eye over the next few days for price action. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks