Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

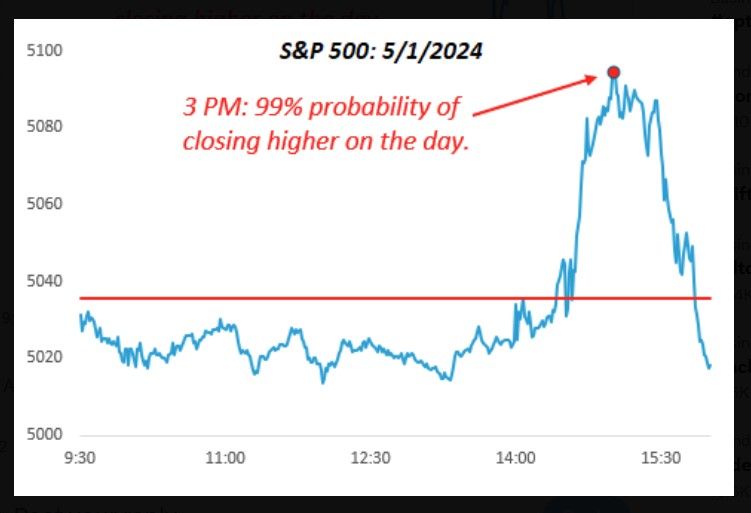

- &summary="Based on the history, with the index up 113 bps at 3:00pm, the SP500 had a 99% chance of closing green. Its failure to do so is a remarkable stumble, to say the least." Source: Bespoke&source=https://blog.syzgroup.com/syz-the-moment/bespoke-about-yesterdays-last-hour-of-trading-' target="_blank">

Bespoke about yesterday's last hour of trading =>

"Based on the history, with the index up 113 bps at 3:00pm, the SP500 had a 99% chance of closing green. Its failure to do so is a remarkable stumble, to say the least." Source: Bespoke

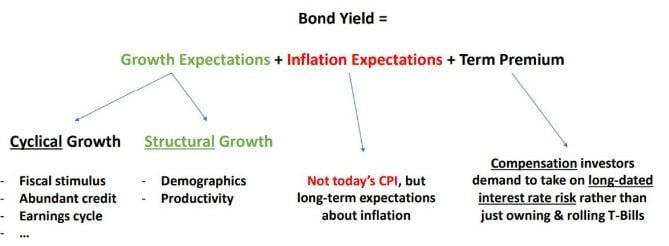

Bond Market 101: a useful way to think about bond yields by Alfonso Peccatiello.

Nominal bond yields can be thought of as the interaction between: 1️⃣ Growth expectations 2️⃣ Inflation expectations 3️⃣ Term premium

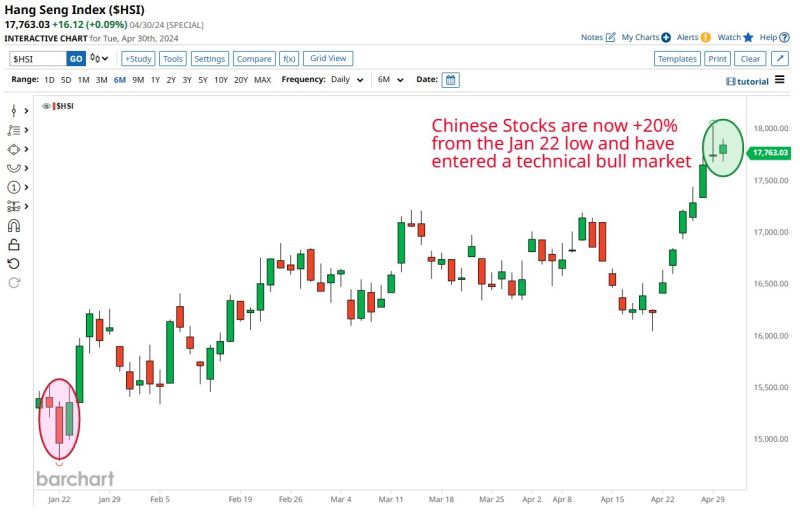

Chinese Stocks enter technical bull market after rallying 20% off the Jan 22 low

Source: Barchart

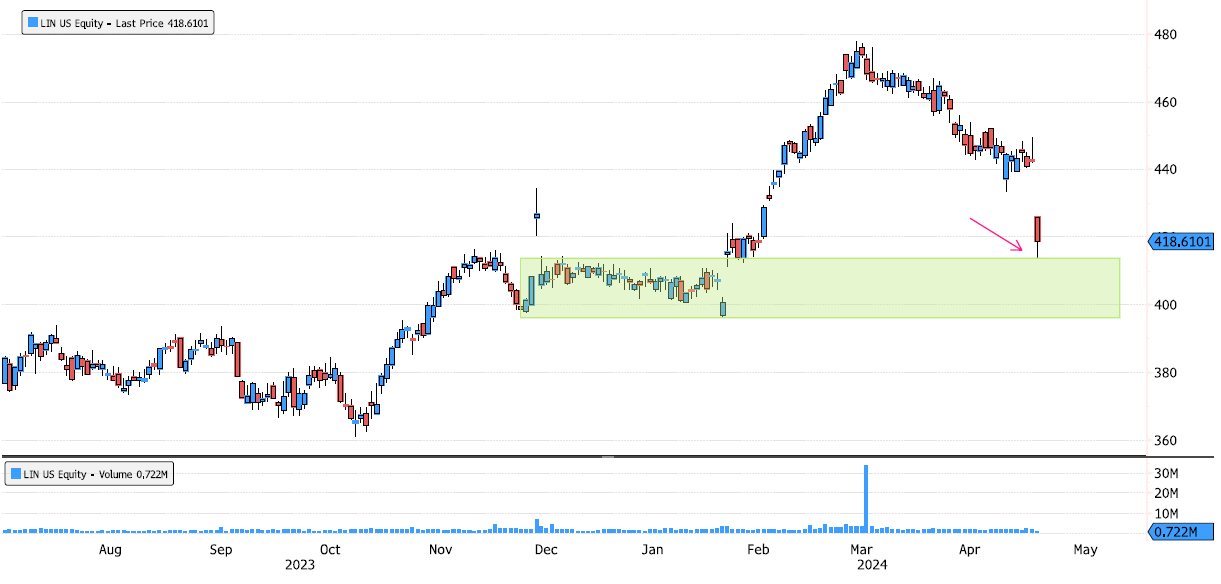

Linde under pressure but approaching support zone

Linde (LIN US) is continuing it's March consolidation. It's now approaching support zone 396-414. Swing low is 396. Source : Bloomberg

FOMC: No rate change, QT tapering in June is DOVISH (timing + amount)

Stocks, bonds, gold, bitcoin are all rallying. dollar dumped In a nutshell: 1. Fed leaves rates unchanged for 6th straight meeting *FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE 2. Rate cuts not appropriate until greater confidence inflation is heading to 2% 3. Fed adds following sentence to the statement: "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective." Inflation has eased "but remains elevated" 4. Fed to slow pace of balance sheet runoff starting in June. The Fed is tapering QT by MORE than the $30BN consensus estimate, instead will taper QT by $35BN, meaning monthly redemption cap on us treasuries goes down from $60BN to $25BN (starting June 1st). This means $105BN less gross issuance needed in Q3 (i.e The Fed implicitly saying 'yields are too high'). 5. Fed maintains mortgage-backed securities redemption cap at $35 bln per month, will reinvest excess MBS principal payments into treasuries. 6. Economic activity continues to expand at solid pace, job gains have remained strong, unemployment rate has remained low. 7. Risks to achieving employment and inflation goals 'have moved toward better balance over the past year,' as opposed to 'are moving into better balance' in the March policy statement. 8. Fed Chair Powell says it is "unlikely that the next policy move will be a rate HIKE." BOTTOM-LINE: There are some hawkish comments but overall Fed QT tapering in June is DOVISH (timing + amount) -> Stocks, bonds, gold, bitcoin are all rallying. dollar dumped Fed Chair Powell's press conference is dovish as well in terms of content and the tone of his remarks. As a reminder, we live at a time of fiscal dominance, i.e fiscal policy leads monetary policy.

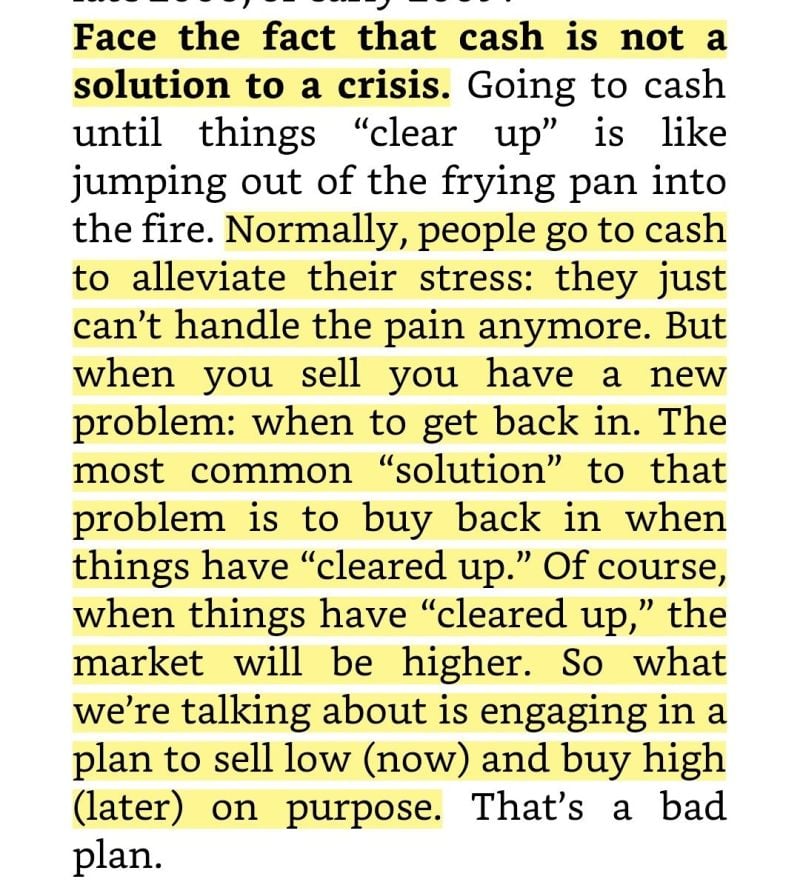

Face the fact that cash is NOT a solution to a crisis

Source: Investment Books (Dhaval)

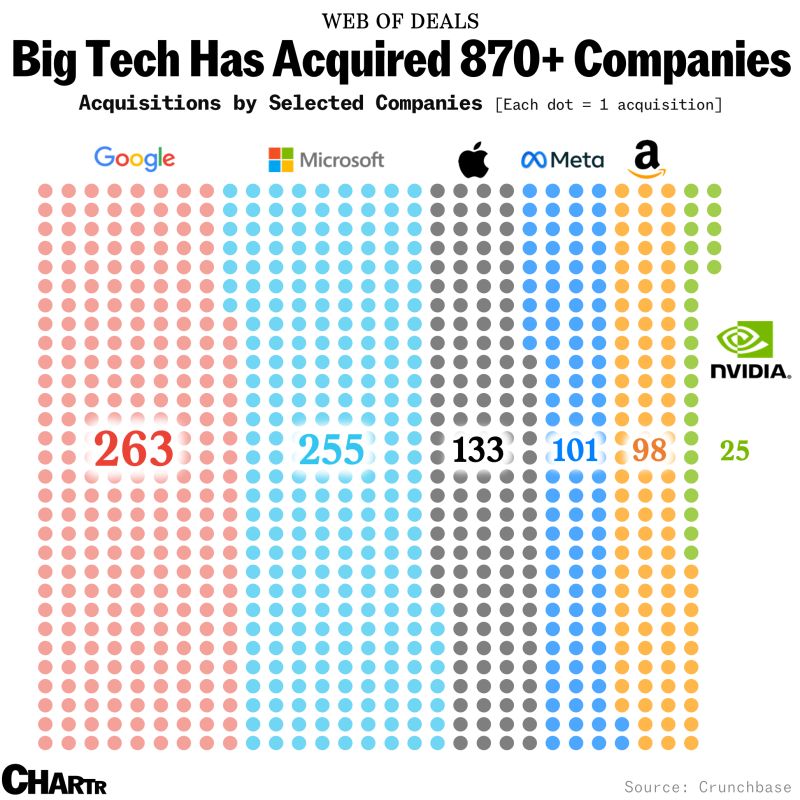

The number of public companies has fallen fast

https://lnkd.in/d3w7QajA Source: Barry Ritholtz, Chartr

Investing with intelligence

Our latest research, commentary and market outlooks