Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

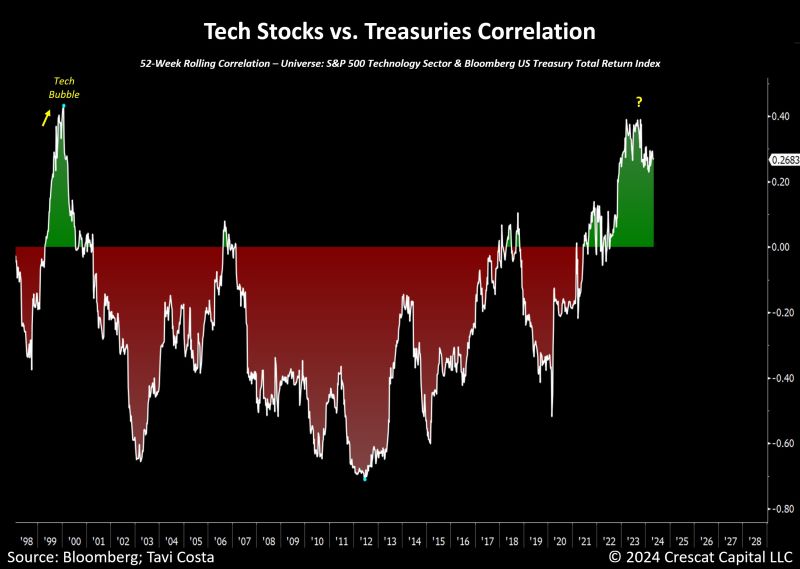

One of the most important chart in the asset allocation decision process:

Stocks vs. long duration US Treasuries. The trend is your friend Source: J-C Parets

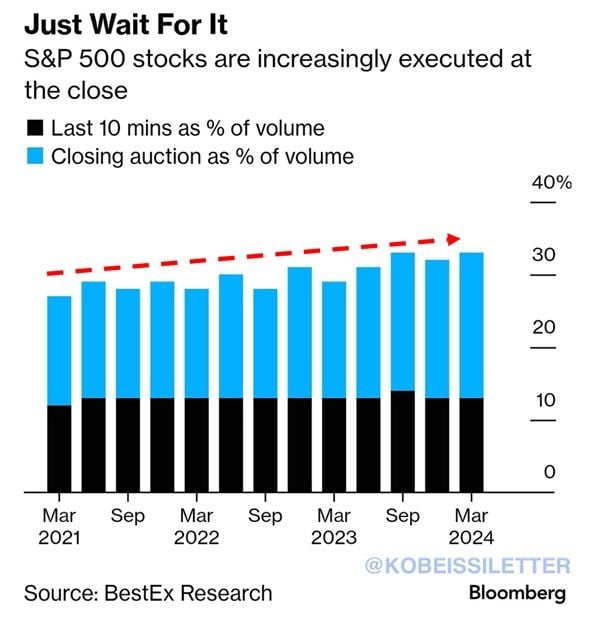

~33% of all S&P 500 stock trades are now executed in the last 10 minutes of the trading session.

This is up from ~27% in 2021 and has been steadily increasing over the last few months. The entire trading session lasts for 390 minutes, but ONE THIRD of all trades are done in the last 10. Interestingly, assets of passive equity funds such as ETFs have risen to nearly $12 trillion in the US, according to Bloomberg. These funds usually execute their trades near the end of a trading session. This explains the significant spike in volatility at the end of the day. Source: The Kobeissi Letter, Bloomberg

The correlation between tech stocks and treasuries is now as positive as it was during the peak of the tech bubble in early 2000.

This issue strikes at the heart of conventional 60/40 portfolios, as the risk of overweighting these two asset classes has significantly increased. Source: Tavi Costa, Bloomberg, Crescat Capital

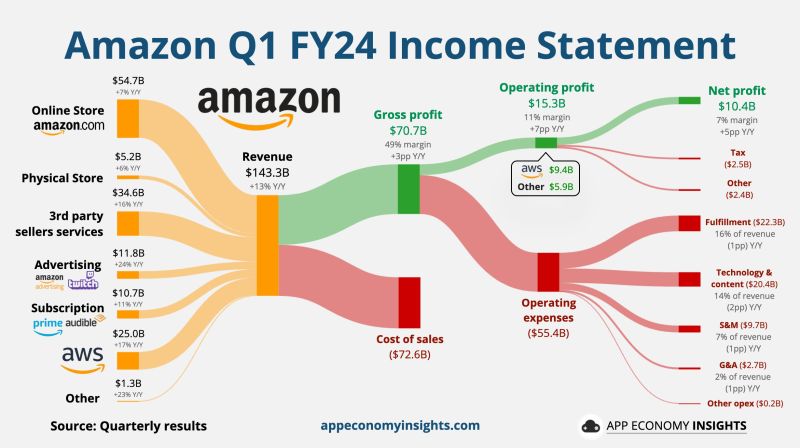

Amazon beats on top and bottom lines. Guidance is mixed.

Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. The stock was volatile in extended trading. Amazon expects a continued jump in profitability for the second quarter but at a more measured pace. The company said operating income will be $10 billion to $14 billion, up from $7.7 billion a year earlier. $AMZN Amazon Q1 FY24: • Revenue +13% Y/Y to $143B ($0.7B beat). • Operating margin 11% (+7pp Y/Y). • FCF $50B TTM. • Earnings per share: 98 cents vs. 83 cents expected by LSEG AWS: • Revenue +17% Y/Y to $25.0B. • Operating margin 38% (+14pp Y/Y). Q2 FY24 Guidance: • Revenue ~$144-$149B ($150B expected), representing growth of 7% to 11%. Source: App Economy Insights

Apple has poached dozens of artificial intelligence experts from Google and has created a secretive swiss laboratory in Zurich

As the tech giant builds a team to battle rivals in developing new AI models and products. According to a Financial Times analysis of hundreds of LinkedIn profiles as well as public job postings and research papers, the $2.7tn company has undertaken a hiring spree over recent years to expand its global AI and machine learning team. The iPhone maker has particularly targeted workers from Google, attracting at least 36 specialists from its rival since it poached John Giannandrea to be its top AI executive in 2018. While the majority of Apple’s AI team work from offices in California and Seattle, the tech group has also expanded a significant outpost in Zurich. Professor Luc Van Gool from Swiss university ETH Zurich said Apple’s acquisitions of two local AI start-ups — virtual reality group FaceShift and image recognition company Fashwell — led Apple to build a research laboratory, known as its “Vision Lab”, in the city. Source: FT

BREAKING: Binance ex-CEO CZ Zhao sentenced to FOUR months in prison.

Former Binance CEO Changpeng "CZ" Zhao was sentenced to four months in prison Tuesday, punished after pleading guilty to money laundering violations last year. Zhao founded Binance in 2017, and under his leadership, the company grew into crypto’s largest exchange by trading volume—cementing Zhao’s presence as a key business figure in the nascent crypto industry. But the former CEO was forced to step down from Binance last November as part of a $4.3 billion settlement between him, the exchange, and U.S. law officials. U.S. Justice Department officials said that Zhao created a company culture in which Binance’s growth was prioritized over compliance with U.S. financial rules. By serving American customers without the proper controls in place, funds linked to virtual theft and terrorism were able to flow through Binance undetected, officials said. Source: Decrypt

Investing with intelligence

Our latest research, commentary and market outlooks