Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

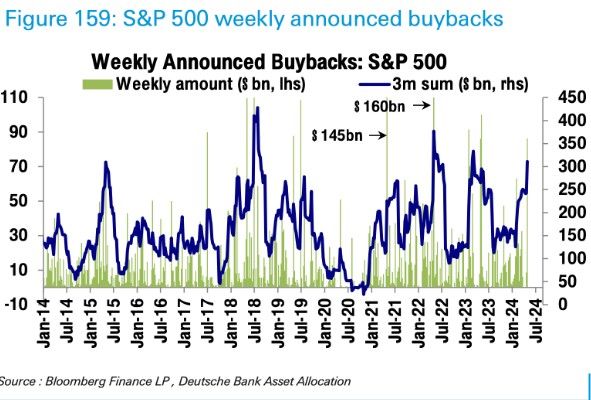

Halfway thru earnings season and buyback announcements are ticking up..

DB notes $85B announced last week. Source: DB

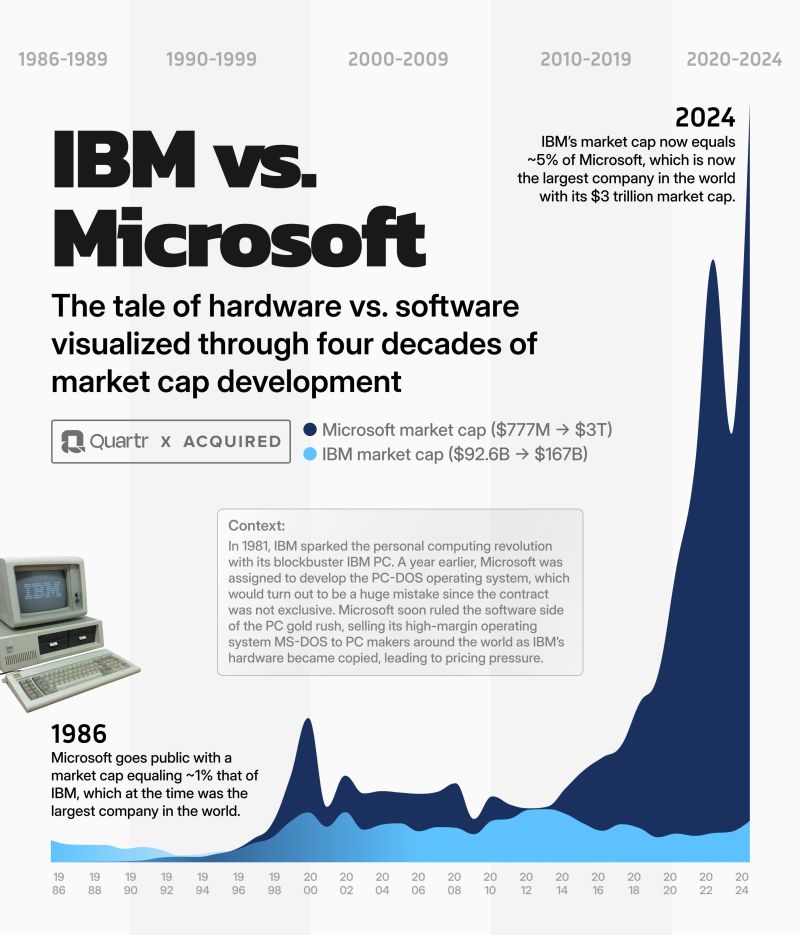

The tale of hardware vs. software visualized through four decades of market cap development by Quartr

Four intriguing facts: → In 1981, $IBM sparked the personal computing revolution with the release of its blockbuster IBM PC. → $MSFT was assigned to develop the operating system under a non-exclusive deal, instantly catapulting the company into a market-leading position in software. → In 1986, Microsoft went public with a market cap equaling 1% of IBM's, which at the time was the largest company in the world. → IBM's market cap now equals ~5% of Microsoft's, which now is the largest company in the world with a market cap exceeding $3 trillion.

Goldman Sachs and HSBC are saying that funds and global investors are rotating out of US and Japanese stocks

To reposition on the Hong Kong stock market which appears to offer significantly better opportunity. Hong Kong listed companies mainly do business across Asia with limited interference from the Chinese government. Source: Bloomberg

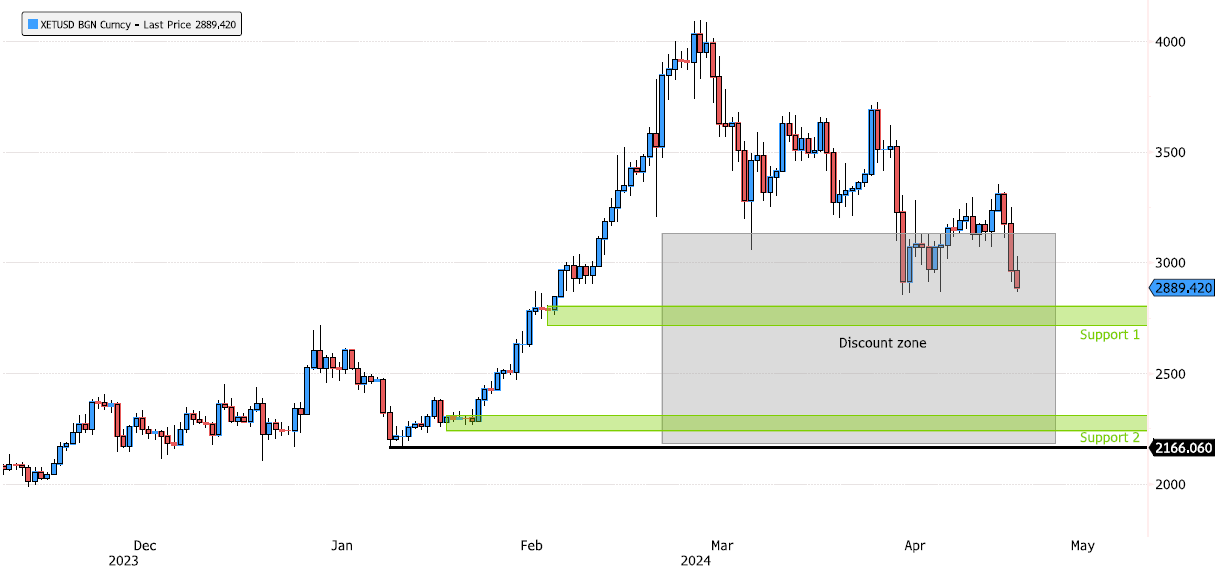

Ethereum still consolidating but in discount zone

Ethereum (XETUSD) is still consolidating since March. It's now in discount zone (below 50% Fibonacci retracement). For the moment no signs of reverse but keep an eye at next support zone 2720-2800 and if that level doesn't hold next support could be arround 2240-2310. Source : Bloomberg

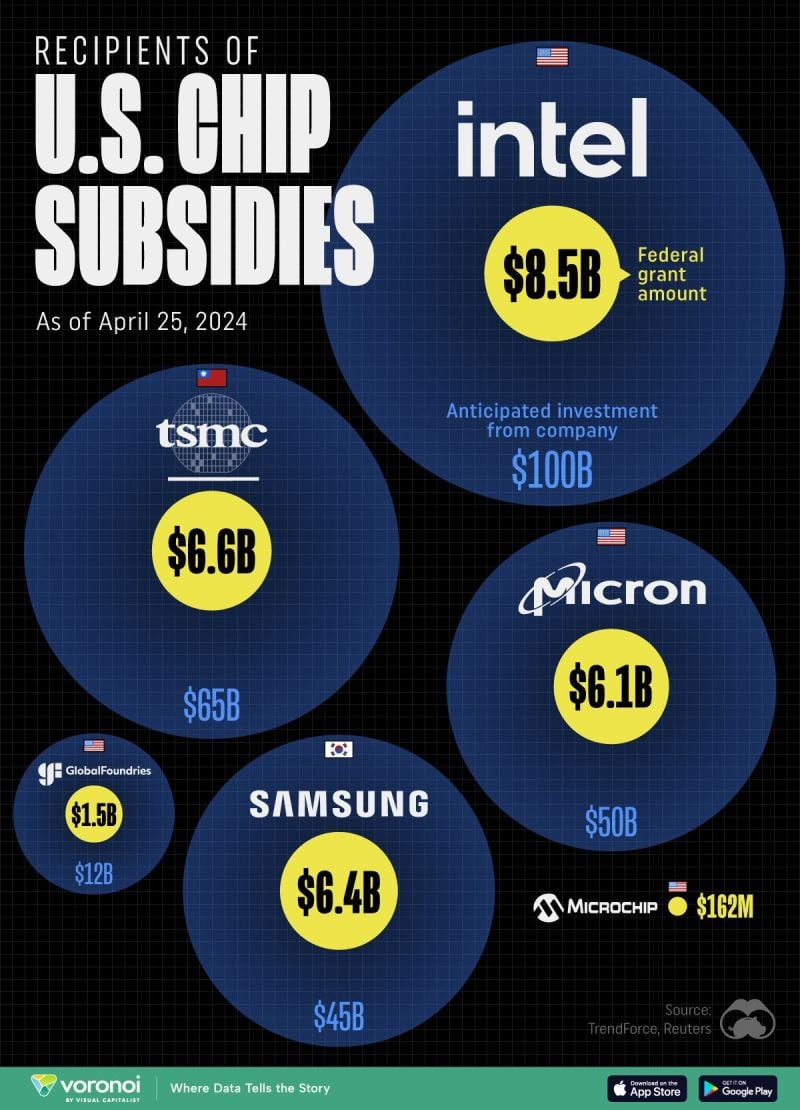

All of the Grants Given by the U.S. CHIPS Act 💻️

Source: Visual Capitalist

Coca-Cola reaching major supply zone

Coca-Cola (KO US) is reaching major supply zone 62.70-64.99 . Keep an eye at that level. Source : Bloomberg

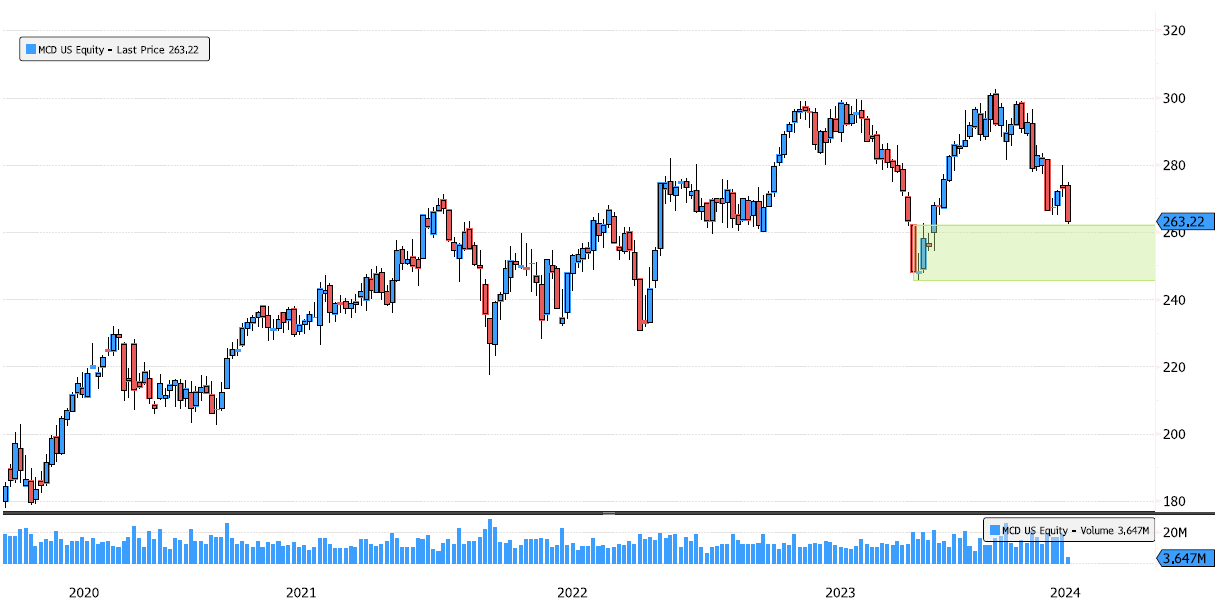

MacDonald reaching strong support demand zone

MacDonald (MCD US) is reaching strong demand zone 245-262. Long term trend remains bullish. Keep an eye at this important level. Source : Bloomberg

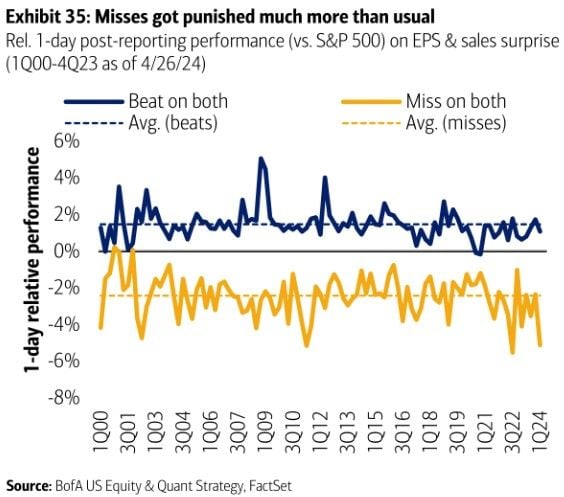

US earnings season update >>>

Double beats are being rewarded by less than the historical average while double misses are being punished by more than usual. Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks