Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Beware tesla shorts... the short interest is at 3-year high

Source: Bloomberg, www.zerohedge.com

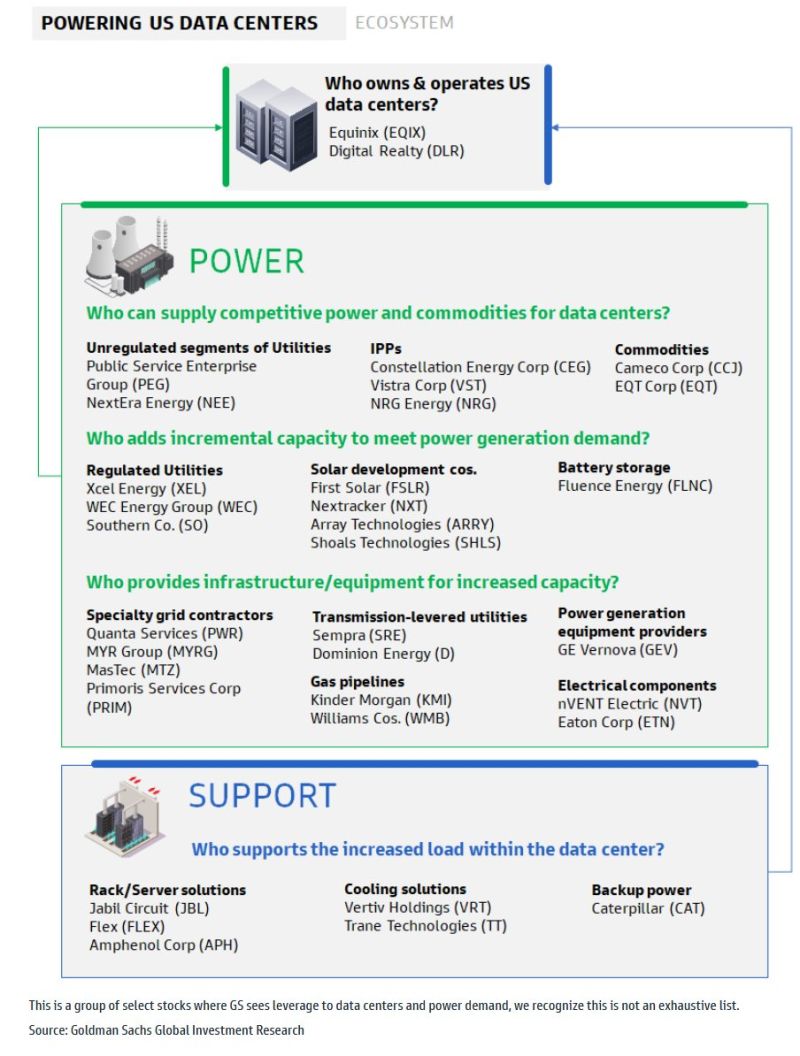

Goldman Sachs is pounding the table on AI energy theme, and pitching uranium miner cameco ($CCJ) as top commodity idea for the space.

Source: www.zerohedge.com

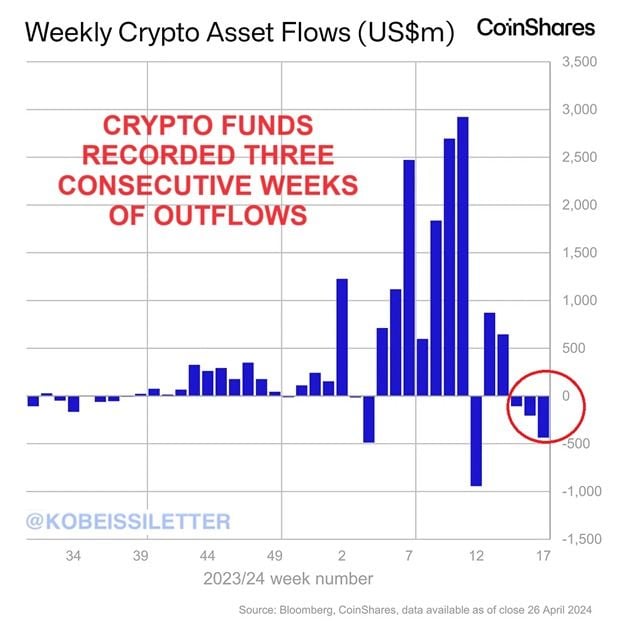

Global crypto funds just recorded 3 consecutive weeks of outflows for the first time ever.

Over the last 3weeks, total crypto fund outflows were $767 million. Last week alone, ~$435 million of crypto assets were removed from these funds, the most since late March. The majority of the outflows were recorded in Bitcoin which saw $423 million of fund withdrawals. Meanwhile, Bitcoin is down 12% in April but is still up 48% year to date. Crypto is taking a breather. Source: The Kobeissi Letter, CoinShares

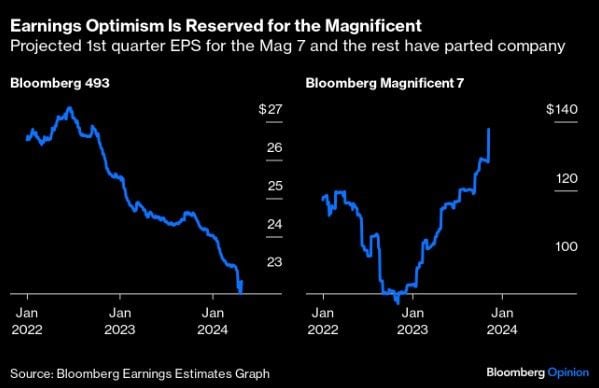

Projected Q1 earnings for the S&P 500 ex-Mag 7 (left-hand chart) vs. Projected Q1 earnings for the Mag 7...

Source: Bloomberg

To the moon!!! US Treasury boosts April-June borrowing estimates to $243b from $202b.

US reiterates a cash-balance estimate of $750bn for the end of June. US Treasury cites lower cash receipts for bigger borrowing estimates. No Mrs Yellen, this is not virtual reality... (picture stollen to Jim Bianco)

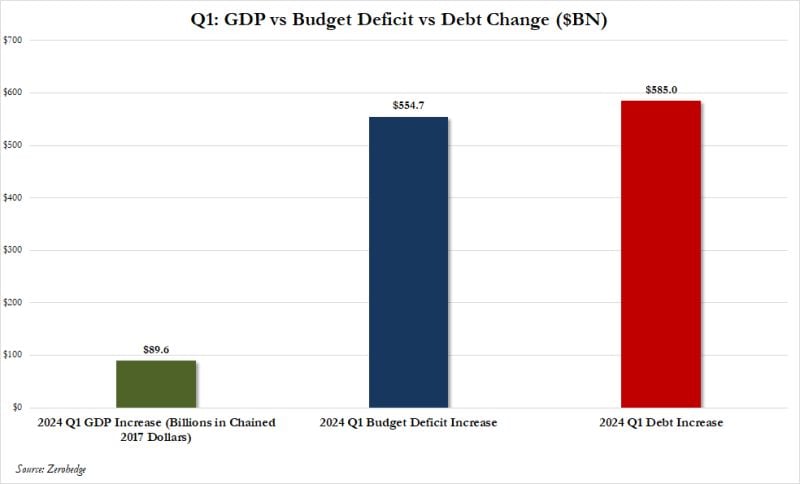

Here's the most shocking part of Q1 us GDP numbers...

Source: www.zerohedge.com

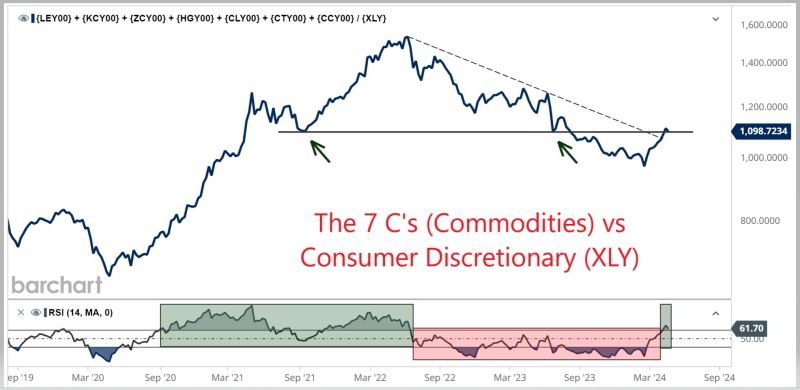

Nice relative price chart by Jay R. Ligon at TheeDisruptor

The 7 C's (Cattle, Corn, Crude, Cocoa, Cotton, Copper, Coffee) vs Consumer Discretionary $XLY Why? It is a clear measure of the inelastic demand for commodities (the ultimate staples) versus elastic demand of discretionaries. Plus we can eye inflation at work and the strength of commodities.

Investing with intelligence

Our latest research, commentary and market outlooks