Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bonds rally as the Fed’s preferred inflation metric cam out not as bad as feared.

PCE deflator rose to 2.7% in March from 2.5% in Feb vs 2.6% expected. Core PCE, the Fed's preferred measure of underlying price pressures, remained at 2.8%, compared with an anticipated fall to 2.7%. First full rate cut is now priced for November. Note that we now have CPI, PPI and PCE inflation RISING for 2 straight months. Source: HolgerZ, Bloomberg

BHP Billiton approached Anglo American to create the world's largest copper producer.

Yesterday, mining giant BHP Billiton has offered to buy rival Anglo American (ex-its South African iron ore and platinum assets) for USD 39 bn. According to Bloomberg, if the deal proves successful, “BHP-Anglo could control 11% of the mined copper supply”. This deal highlights copper’s dominance as the primary metal in the energy transition and underscores the significant consequences of the recent disruptive events affecting global supply. Copper’s upward trajectory is accelerating.

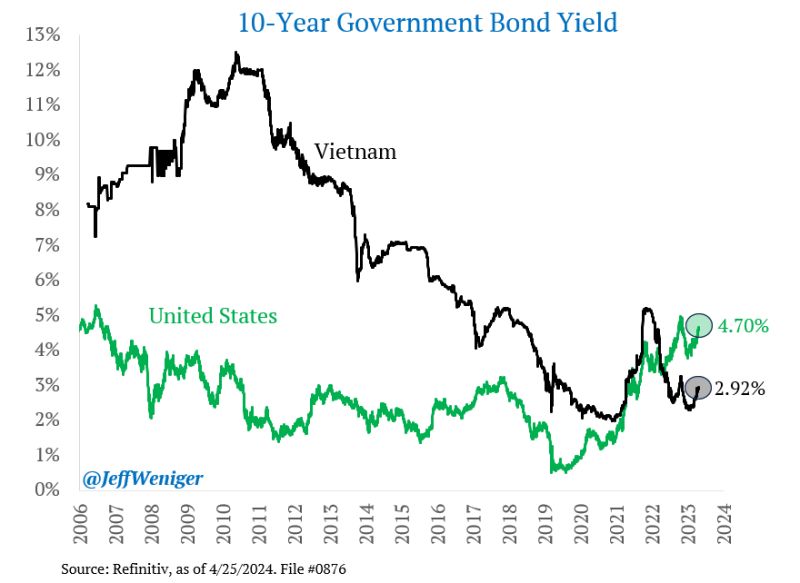

In case you missed it... U.S. 10-year government bonds yield 4.70%, about two percent more than Vietnam's 2.92%.

Source: Jeff Weniger

Investing with intelligence

Our latest research, commentary and market outlooks