Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

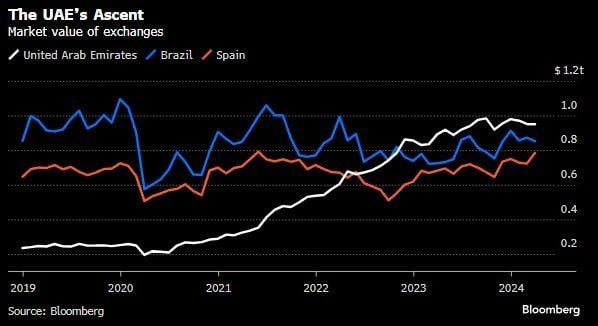

The UAE's ascent.

Do you know that the UAE's stock markets have a larger market capitalization than Brazil's or Spain's? Do you also know that the UAE's IPOs have been 2nd worldwide in raising capital? Source: Ryan Lemand, PhD, Bloomberg

WELCOME TO FOMC WEEK. Here's what's happening:

In the US: ◦ April ADP employment ◦ April ISM manufacturing ◦ March Job openings ◦ FOMC interest rate decision ◦ Fed Chair Powell press conference ◦ April employment rate ◦ $AAPL, $AMZN, $LLY, $MA, $KO, $AMD, $MCD, $QCOM earnings Rest of the world: ◦ In Europe, the focus will be on April CPI prints as well as the Q1 GDP reports. ◦ The latest economic activity and labour market indicators will also be in focus in Japan, and PMIs are due in China. Source: Trend spider

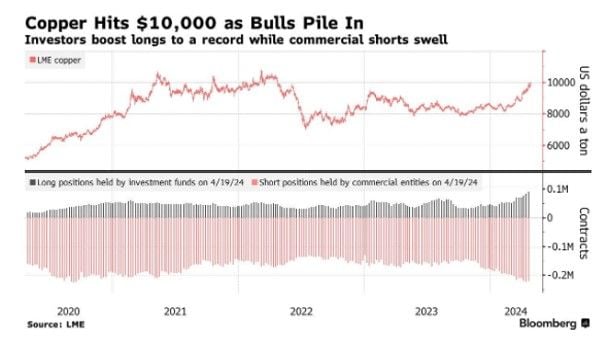

Copper hits $10,000 for the first time in 2 years as speculation builds that the world’s mines will struggle to meet a coming wave of demand from green industries.

BlackRock, Trafigura see supply shortfalls unless prices gain. This week, Mining giant BHP Billiton has offered to buy rival Anglo American (ex-its South African iron ore and platinum assets) for USD 39 bn. According to Bloomberg, if the deal proves successful, “BHP-Anglo could control 11% of the mined copper supply”. This deal highlights copper’s dominance as the primary metal in the energy transition. Source: Bloomberg

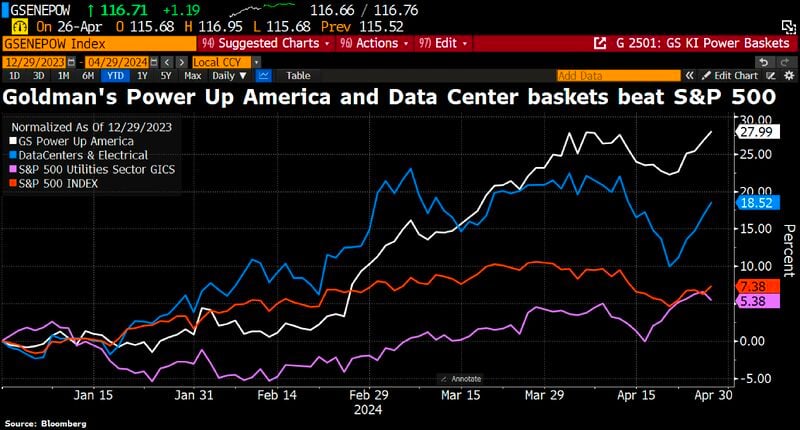

AI Boom’s Secret Winners? The Companies Expected to Power It

The AI boom is set to drive a rally in what's traditionally the most boring corner of the stock market: utilities. Utilities to see booming demand as more data centers go online. Power consumption will increase massively. Goldman's Power Up basket has soared 28% and the Data Center Equipment basket is up more than 18%. Source: Blomberg, HolgerZ

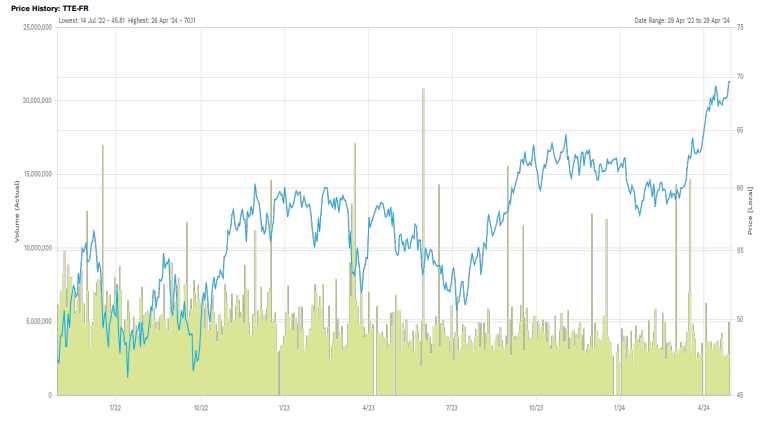

TotalEnergies is assessing to move its primary listing to the US.

On Friday, TotalEnergies’ CEO Patrick Pouyanné declared that the company’s board is considering moving its primary listing to the US as the European shareholder base now holds a minority position in the company’s capital mainly due to the strict European ESG standards that discourage investments in fossil fuels. The American shareholder base, on the other hand, represents over 45% of Total’s capital. Source: FactSet

Japan's currency official declined to comment regarding possible intervention

Japan's Masato Kanda says "No comment for now" when asked whether Tokyo had intervened in the currency market Today following a sharp move in the market that sliced more than 2% off the dollar-yen exchange rate shortly after the Japanese currency went over 160.

Source: Bloomberg

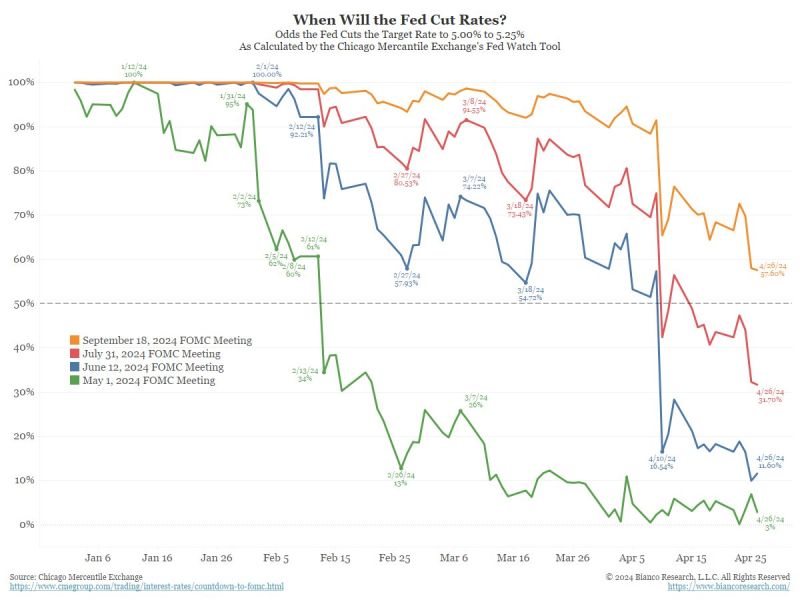

Fed Cut Probability Update - Jim Bianco (Bianco Research)

- May 1 FOMC meeting (green) less than 50% (meaning no move) - June 12 FOMC meeting (blue) less than 50% (meaning no move) - July 31 FOMC meeting (red) less than 50% (meaning no move) - September 18 FOMC meeting (orange) less than 60% (since it is 5 months away, effectively a coin-toss) After this, the next FOMC meeting is Thursday, November 7, two days after the election.

Investing with intelligence

Our latest research, commentary and market outlooks

%203%202024-04-29%2010-25-14.jpg)