Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

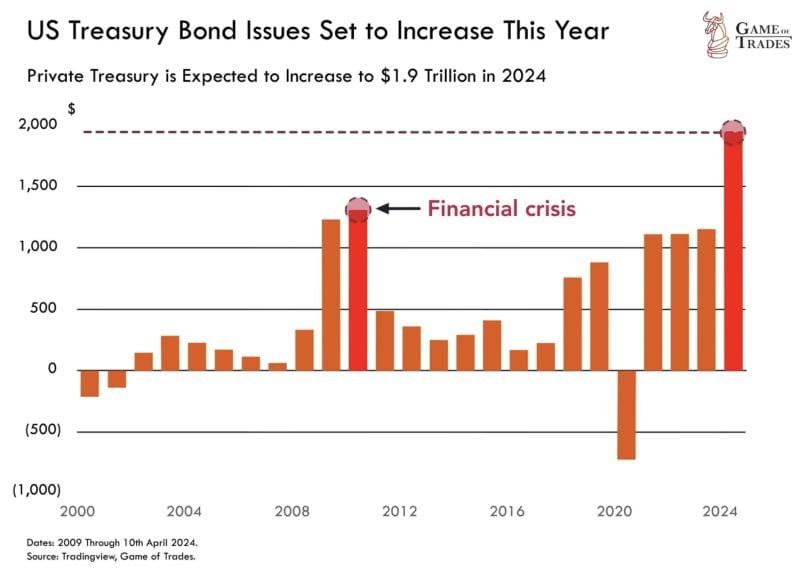

Treasury bond issuance in 2024 is expected to hit $1.9 TRILLION.

Surpassing levels seen even during the 2008 financial crisis and 2x 2023 levels. Source: Game of Trades

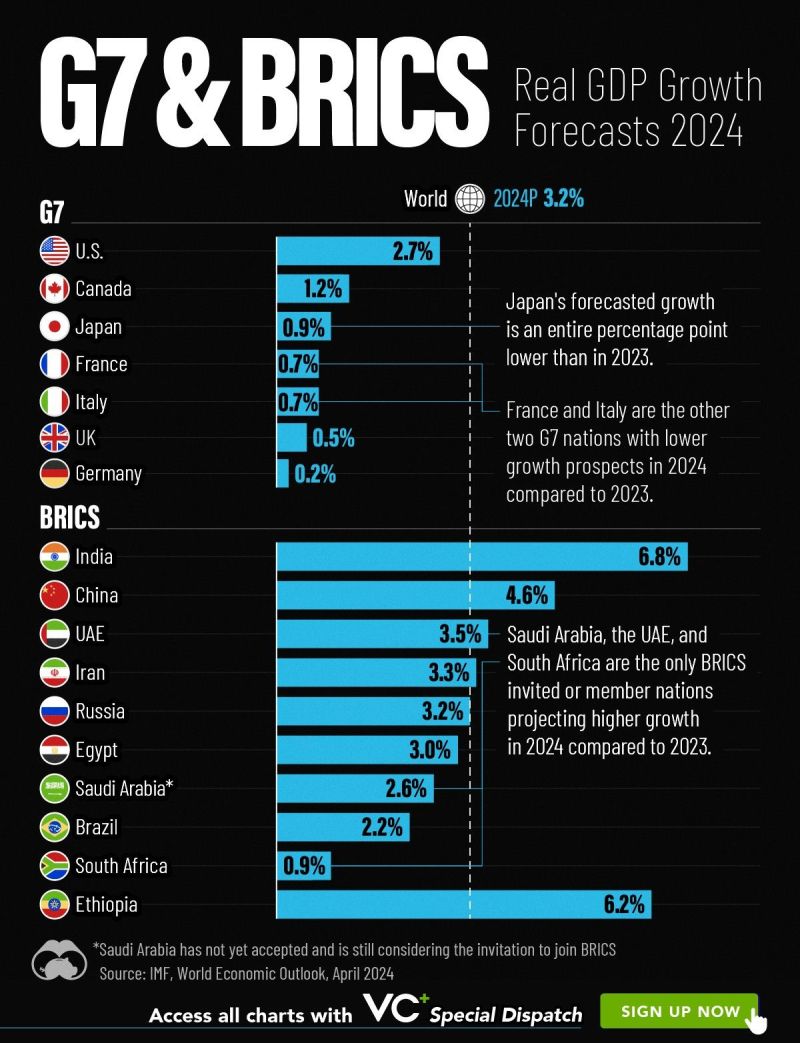

Economic Growth Forecasts for G7 and BRICS Countries in 2024 🗺️

Source: Visual Capitalist

Economic Growth Forecasts for G7 and BRICS Countries in 2024 🗺️

Source: knownquotes

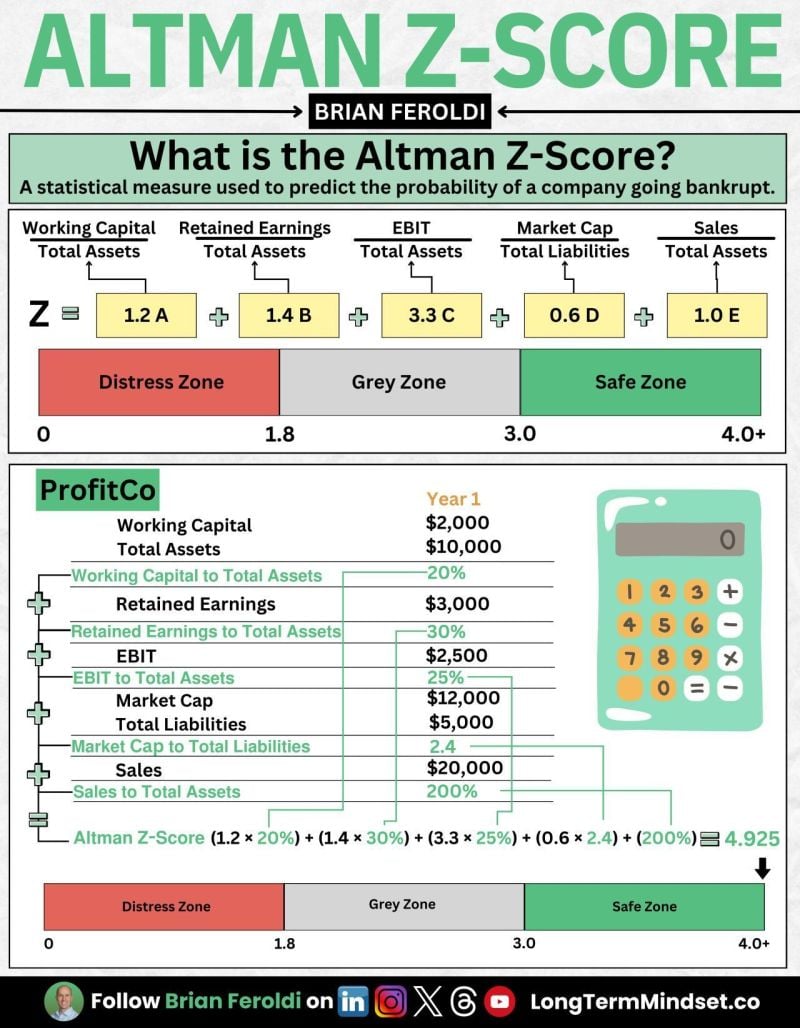

The Altman Z-score as explained by Brian Feroldi

The Altman Z-Score is a formula developed by Edward Altman in the 1960s. It is used to predict the likelihood of a company going bankrupt within two years. The Z-Score uses five different financial ratios to come up with a single number that measures the company's financial health. Altman Z-Score breaks down into five major components: • 𝗪𝗼𝗿𝗸𝗶𝗻𝗴 𝗖𝗮𝗽𝗶𝘁𝗮𝗹 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗹𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆 • 𝗥𝗲𝘁𝗮𝗶𝗻𝗲𝗱 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗽𝗿𝗼𝗳𝗶𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 • 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗕𝗲𝗳𝗼𝗿𝗲 𝗜𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗮𝗻𝗱 𝗧𝗮𝘅𝗲𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗼𝗽𝗲𝗿𝗮𝘁𝗶𝗻𝗴 𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝗰𝘆 • 𝗠𝗮𝗿𝗸𝗲𝘁 𝗩𝗮𝗹𝘂𝗲 𝗼𝗳 𝗘𝗾𝘂𝗶𝘁𝘆 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗟𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝗶𝗲𝘀 - A measure of 𝘀𝗼𝗹𝘃𝗲𝗻𝗰𝘆 • 𝗦𝗮𝗹𝗲𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗮𝘀𝘀𝗲𝘁 𝘁𝘂𝗿𝗻𝗼𝘃𝗲𝗿 𝗛𝗲𝗿𝗲'𝘀 𝗮 𝗯𝗿𝗲𝗮𝗸𝗱𝗼𝘄𝗻 𝗼𝗳 𝘁𝗵𝗲 𝗳𝗼𝗿𝗺𝘂𝗹𝗮: (1.2 × Working Capital/Total Assets) + (1.4 × Retained Earnings/Total Assets) - (3.3 × EBIT/Total Assets) + (0.6 × Market Value Equity/Total Liabilities) - (1.0 x Sales/Total Assets) = Altman Z-Score Altman Z-Score RESULTS: 0.0 - 1.8 = Distress Zone 1.8 - 3.0 = Grey Zone 3.0 - 4.0+ = Safe Zone

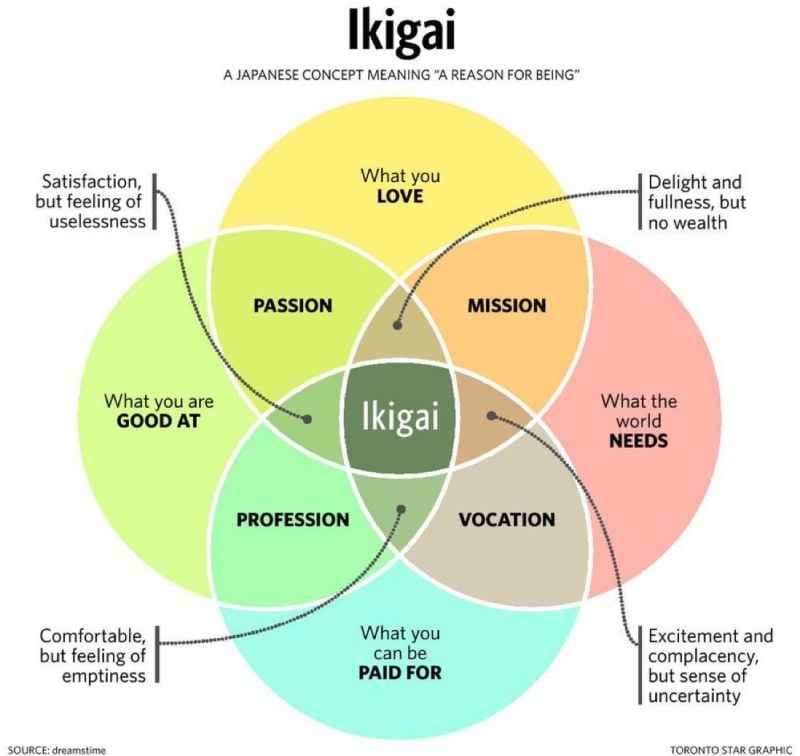

The Japanese secret to a long, happy and meaningful life: Ikigai

Ikigai: passion | mission | vocation | profession • What you love • What you are good at • What the world needs • What you can get paid for Source: Vala Afshar, Dreamstime

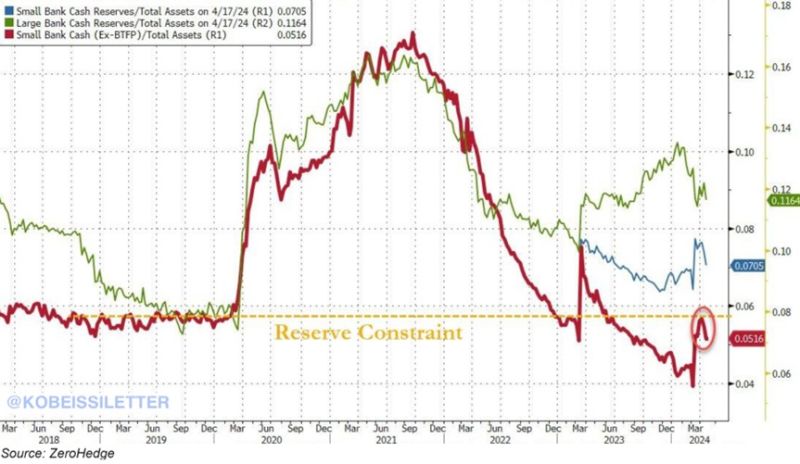

US small bank cash reserves plummeted by $258 billion last week below the level considered a constraint, according to ZeroHedge.

This excludes a $126 billion still sitting at the Fed’s emergency lending program that expired in March. It marked the largest decline in bank deposits since April 2022 when $336 billion came out of the banking system. Meanwhile, US regulators have seized Republic First Bank on Friday and agreed to sell it to Fulton Bank, another regional bank with $6 billion in total assets. The FDIC projects the failure will cost the fund around $667 million. Is the US regional bank crisis really over? Source: The Kobeissi Letter, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks