Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

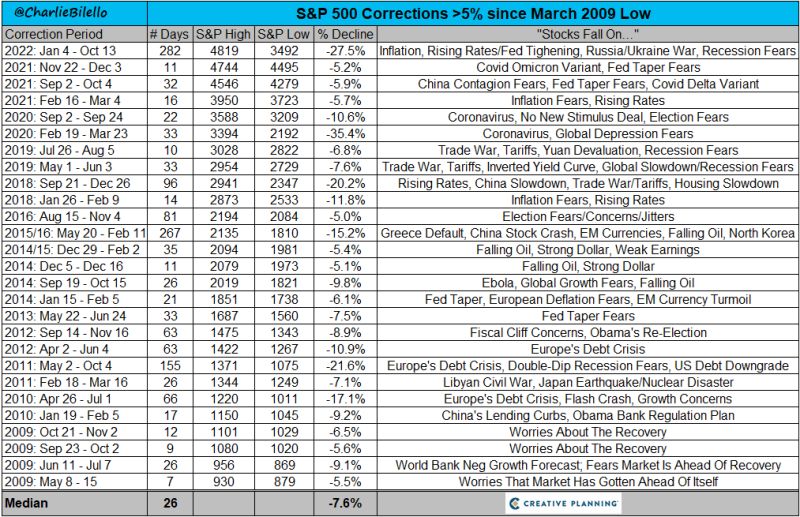

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” - Peter Lynch

Source: Charlie Bilello

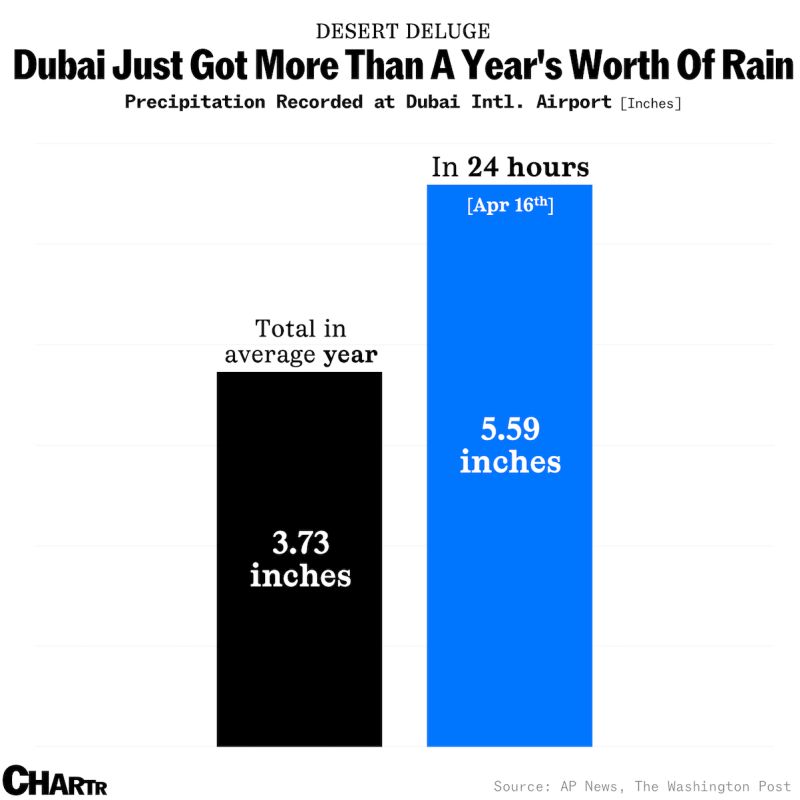

Heavy thunderstorms sent the typically arid United Arab Emirates into chaos yesterday, with Dubai recording more than 5.59 inches (142 mm) of rain in just 24 hours since Monday night

The most in 75 years and equivalent to 1.5x the total seen in a typical year. Source: Chartr, The Washington Post

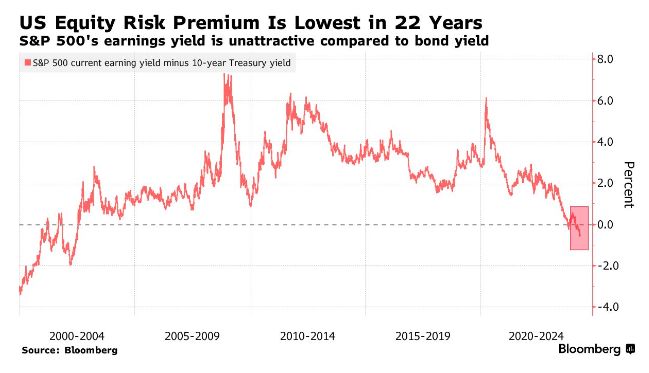

Equity Risk Premium (the benefit of owning stocks over treasuries) has fallen to its lowest level in 22 years

Source: Barchart, Bloomberg

Oil prices are now down nearly 10% from their highs as fears over higher interest rate policy spread.

With markets now seeing less than 2 rate cuts in 2024, demand outlook is questionable. This has put oil prices at their lowest level since March 28th. However, prices are still up more than 15% from their February 2024 lows. Source: The Kobeissi Letter

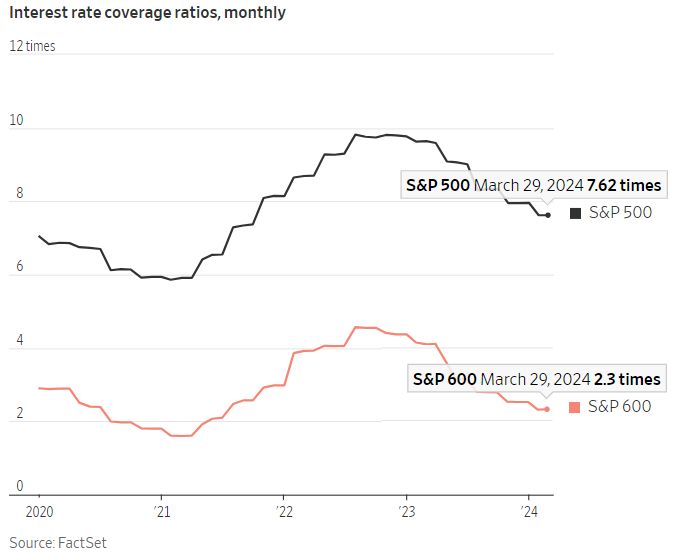

Smaller companies generally spend a much higher % of their income on debt service, making them more sensitive to rising rates.

The interest coverage ratio (operating income / interest expense) for the small cap S&P 600 is 2.3 times vs. 7.6 times for the large cap sp500. Source: Charlie Bilello

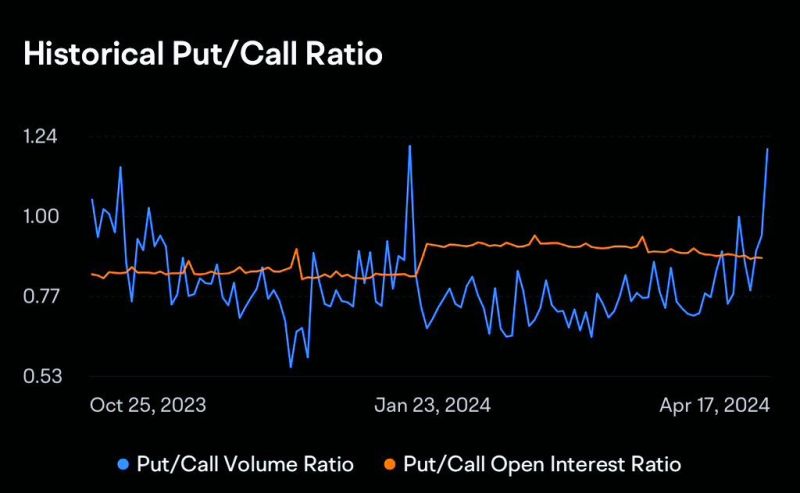

SP500 Put/Call Ratio has risen to multi-year highs amid the recent market sell off.

Source: David Marlin

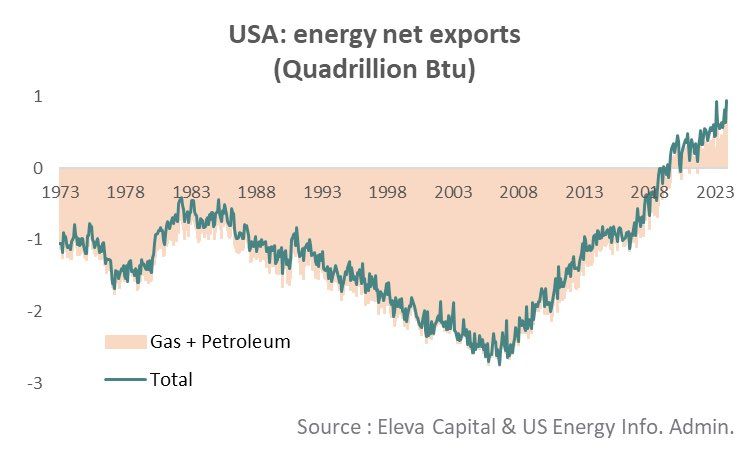

The US being a net energy exporter in one chart

Chart: Stephane Deo, Michel A. Arouet, Eleva Capital

Investing with intelligence

Our latest research, commentary and market outlooks