Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

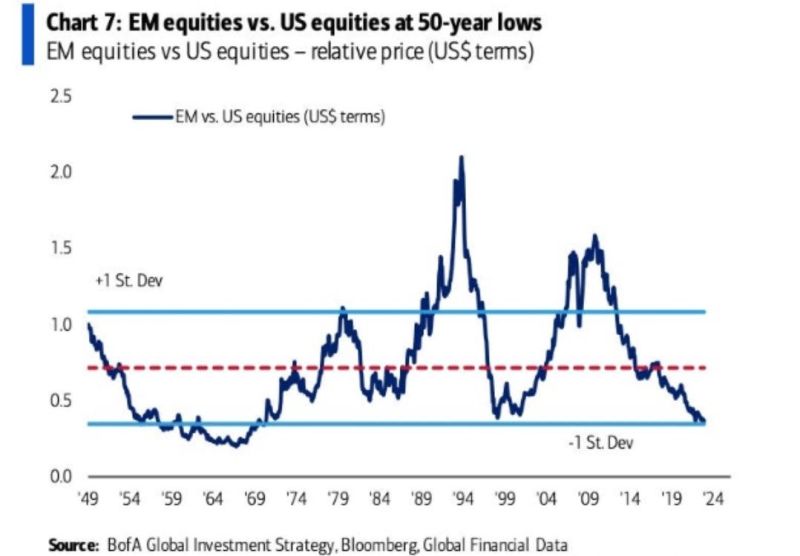

US big tech revolution steamrolling emerging markets equities in one chart.

What would make this trend reverse? Source: BofA, Michel A. Arouet

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

BREAKING: The 10-year note yield is now up 90 basis points YTD and nearing 4.70% for the first time since November 2023.

As treasury yields rise, we are seeing further pressure on stocks and other risky assets. Meanwhile, the base case now shows just 2 interest rate cuts in 2024. Higher for longer is officially back and interest rates are surging quickly. Source: The Kobeissi Letter

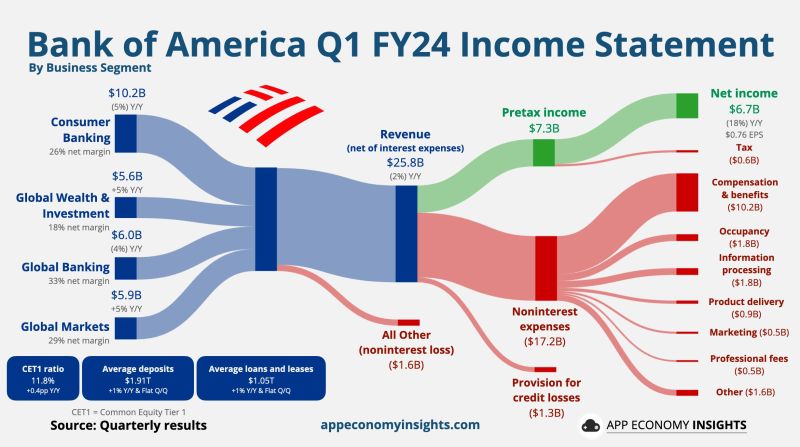

BANK EARNINGS >>> Bank of America $BAC stock is down -4% today after reporting earnings down -18% yoy.

$BAC Bank of America Q1 FY24. Revenue -2% to $25.8B ($0.4B beat): • Net Interest income: $14.0B (-3% Y/Y). • Noninterest income $11.8B (-0% Y/Y). Net Income $6.7B (-18% Y/Y). Non-GAAP EPS: $0.83 ($0.06 beat). CET1 ratio of 11.8%. Source: App Economy Insights

BREAKING >>> Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

SUMMARY OF FED CHAIR POWELL'S COMMENTS (4/16/24): 1. Recent data "shows lack of further progress on inflation" 2. Inflation has "introduced new uncertainty" on whether the Fed can cut rates later this year 3. Fed can maintain higher rates for "as long as needed" 4. Recent data has not given greater confidence on inflation 5. Restrictive Fed policy needs more time to work 6. It will likely take longer to "regain confidence" on inflation https://lnkd.in/eMaJZNZZ Source: CNBC, The Kobeissi Letter, Trend Spider

Bitcoin remains in trading range

Bitcoin (XBTUSD) is in a trading range 59'317-73'797 since January 2024. With halving taking place in a few days, keep an eye for a breakout !!! Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks