Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

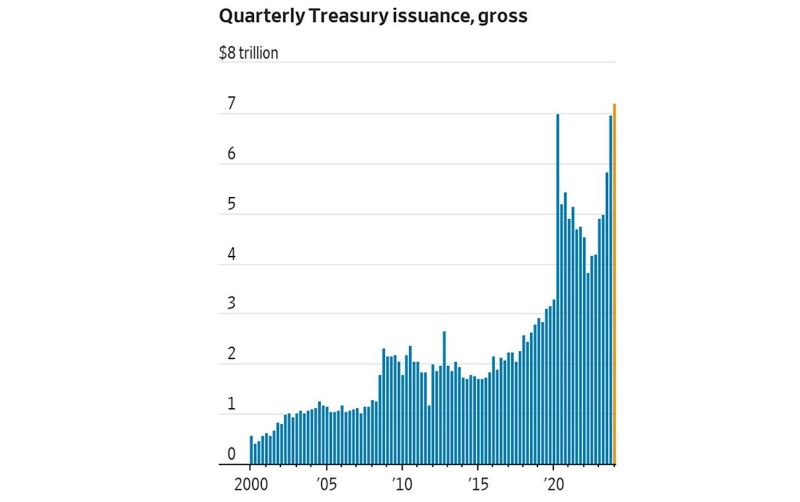

Current treasury issuance exceeded the level seen only during the deepest Covid lockdown.

At full employment, imagine what will happen during next recession. Source: Michel A.Arouet

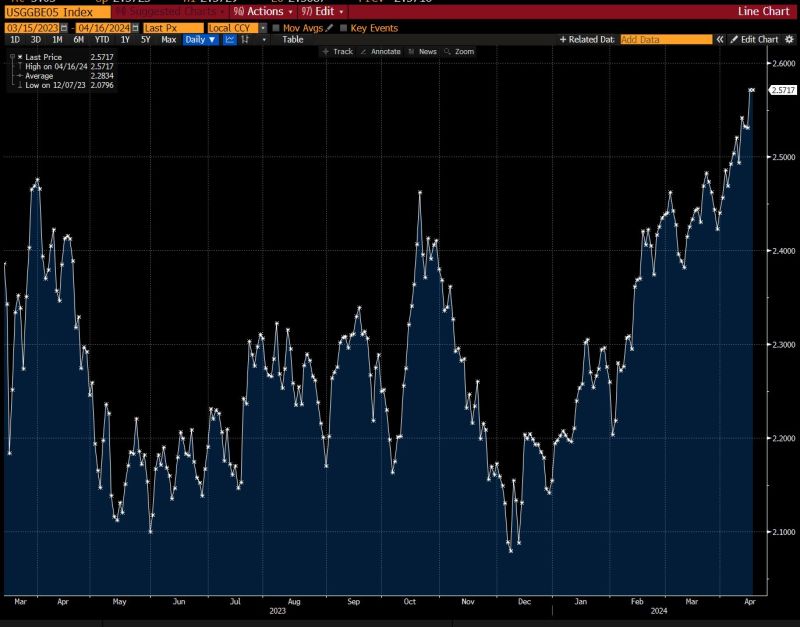

Longer-term inflation expectations are rising again.

The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates. Source: Bloomberg, Lisa Abramowitz

Mind the gap...

France debt to GDP ratio ihas been diverging in a meaningful way vs. Germany debt to GDP. Rating agency Fitch already cut country's credit rating from AA to AA- last year, rating agency S&P has placed France under review... Source: Bloomberg, HolgerZ

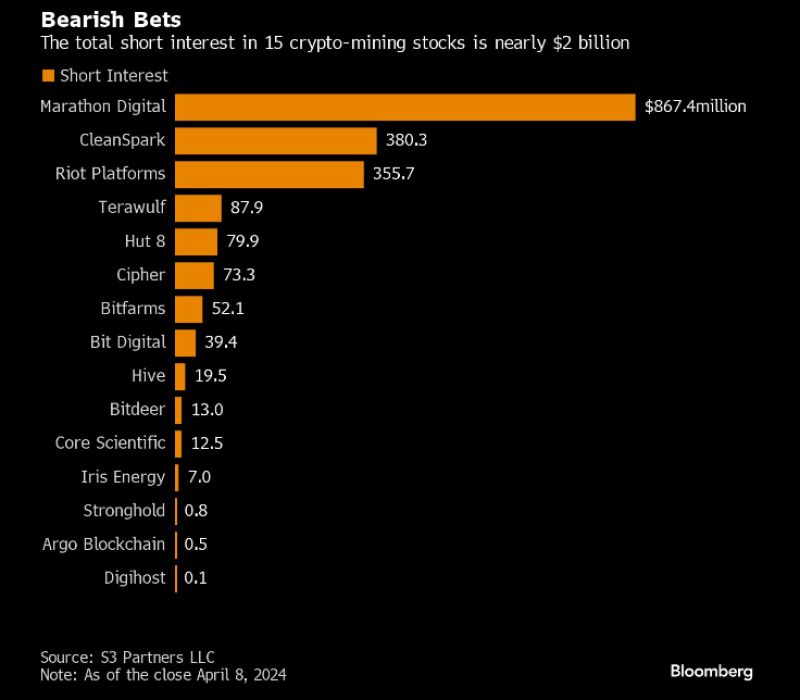

Bitcoin ‘halving’ will deal a $10bn blow to crypto miners.

Cryptocurrency’s update will slash new supply in late April. Competition for favourable electric rates is growing from AI firms. Some traders are thus betting that mining stocks will fall. Total short interest, dollar value of shares borrowed & sold by bearish traders, stood at ~$2bn. Source: HolgerZ, Bloomberg

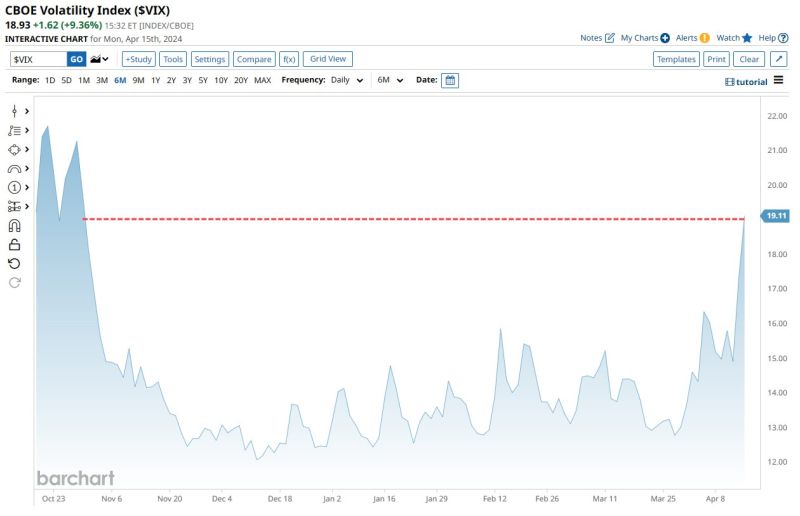

CBOE Volatility Index $VIX surges to highest level of fear since Halloween 👻🎃

Source: Barchart

According to Alfonso Peccatiello, a $1 trillion worth liquidity wave is about to be unleashed on the US economy!

He is not talking about Powell or the Fed. He is talking about Treasury Secretary Yellen unleashing a large sum of stimulus further boosting the US economy right before elections! How? By almost emptying a $1 trillion+ Treasury General Account!

China’s economy in the first quarter grew faster than expected, official data released Tuesday by China’s National Bureau of Statistics showed.

Gross domestic product in the January to March period grew 5.3% compared to a year ago, faster than the 4.6% growth expected by economists polled by Reuters, and compared to the 5.2% expansion in the fourth quarter of 2023. On a quarter-on-quarter basis, China’s GDP grew 1.6% in the first quarter, compared to a Reuters poll expectations of 1.4% and a revised fourth quarter expansion of 1.2%. Beijing has set a 2024 growth target of around 5%. https://lnkd.in/eNZgs7zp Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks