Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

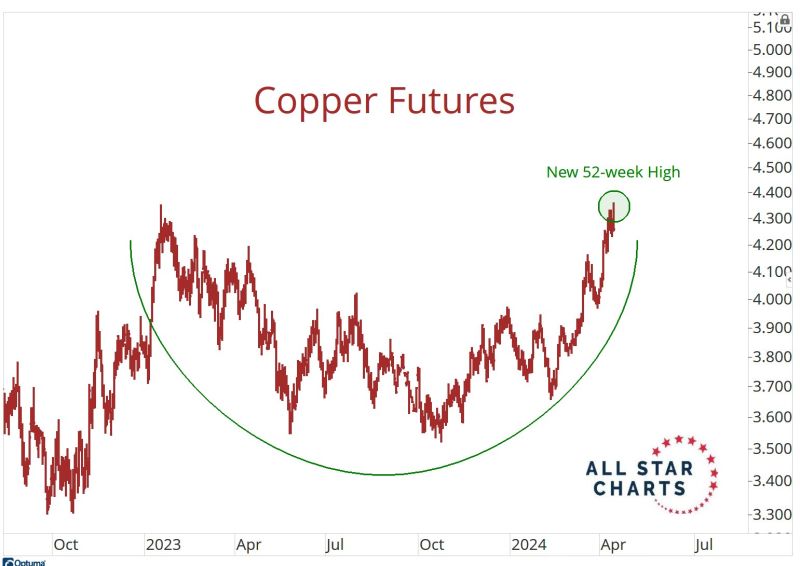

It's not just a Gold thing. It's a metals thing.

Copper hitting new 52-week highs. Source: J-C Parets

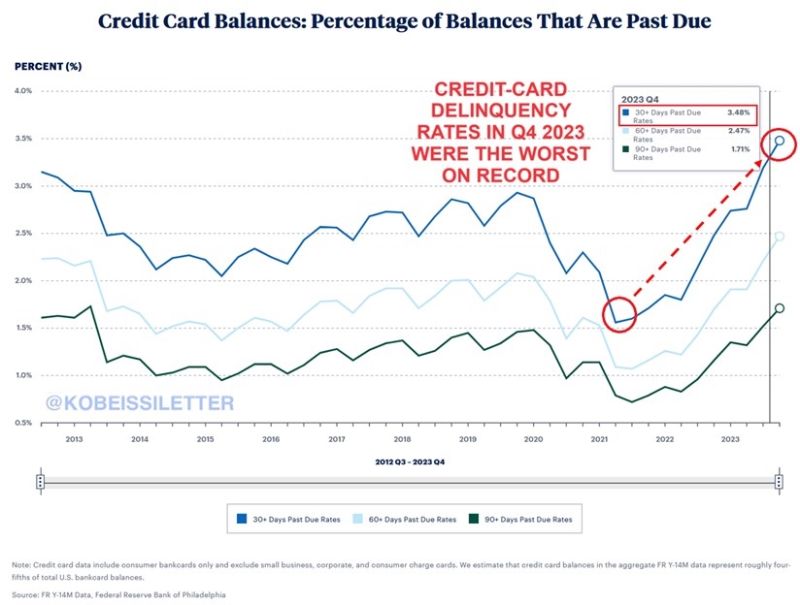

US credit card delinquency rates are now at their highest on record, according to the Philadelphia Fed.

In Q4 2023, more credit card balances were 30+ and 60+ days past due compared to any other period in history. The percentage of credit card balances at least 30 days past due is now ~3.5%. Meanwhile, total credit card debt has skyrocketed in recent months and is now at a record $1.3 trillion. The average credit card interest rate is also at record 28%, according to Forbes. Source: The Kobeissi Letter

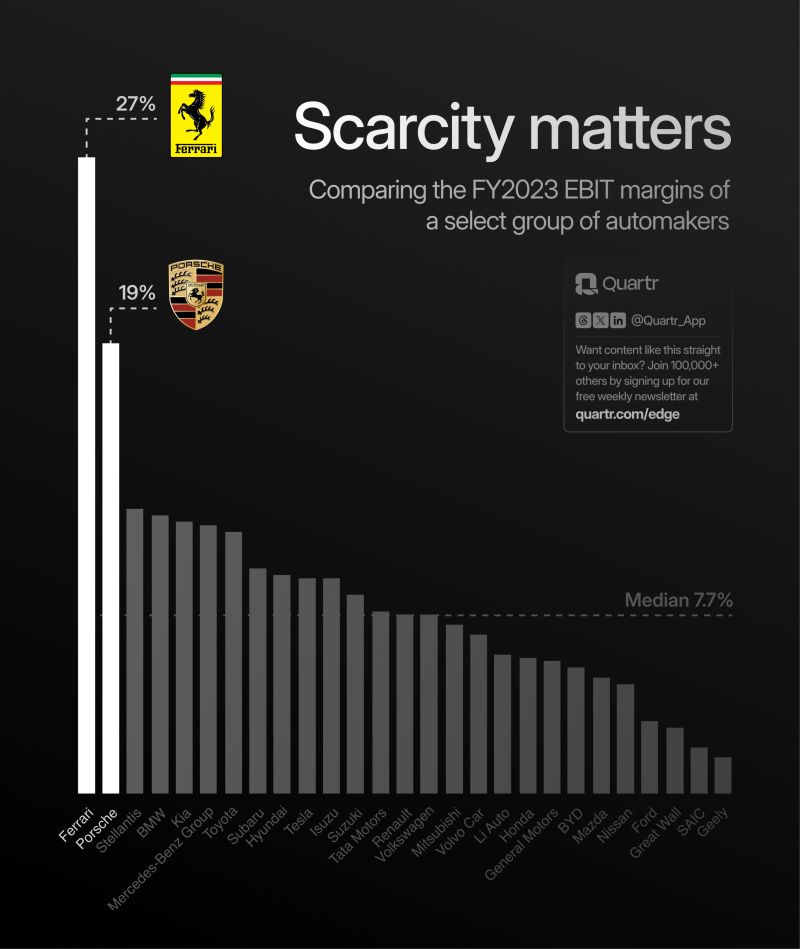

Scarcity matters by Quartr.

Enzo Ferrari's iconic quote "Ferrari will always deliver one car less than the market demands" remains deeply ingrained in $RACE's DNA until this day. While companies in this chart are leveraging different strategies, they are all automakers. Comparing the EBIT margins (FY 2023) of a select group of automakers:

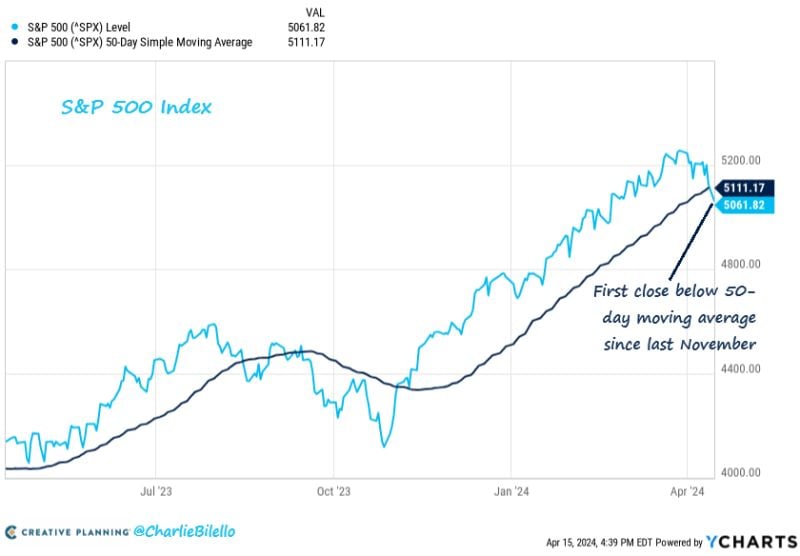

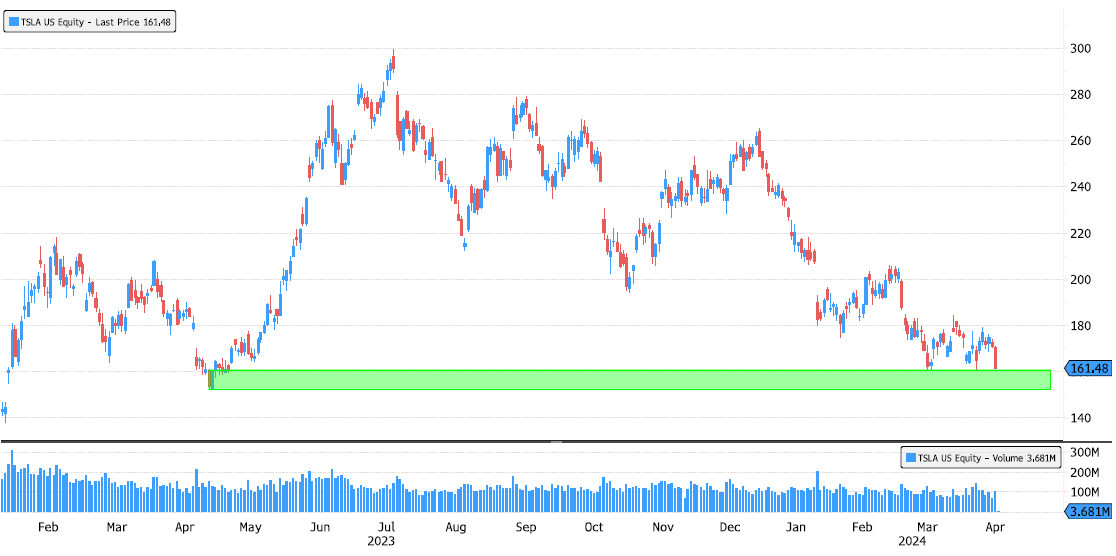

Tesla entering major support zone

Tesla (TSLA US) is entering major support zone 152-160. Keep an eye at this very important level. Source : Bloomberg

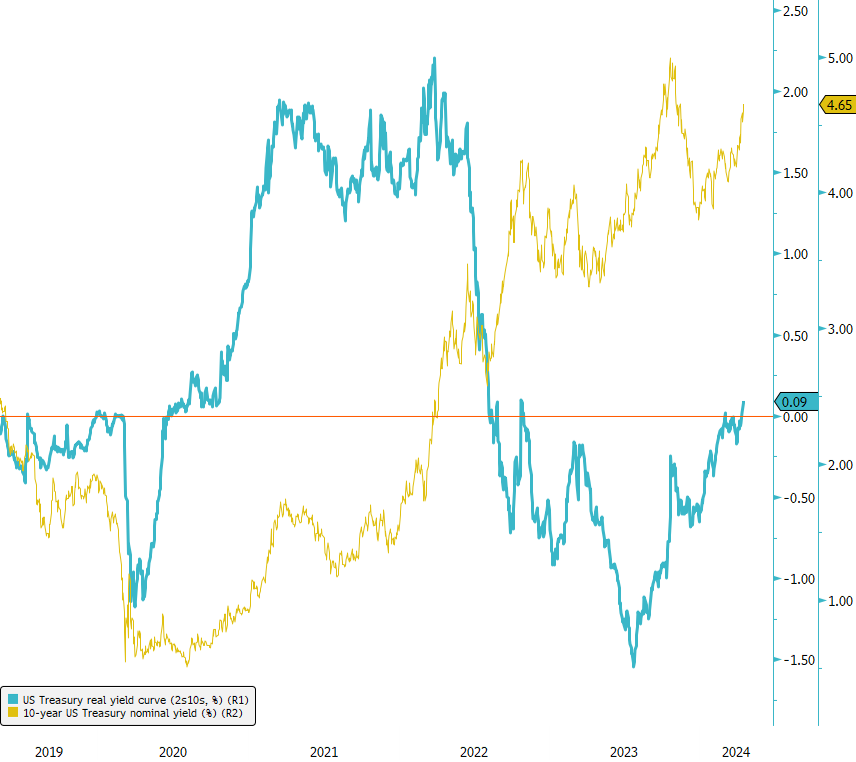

US Treasury Real Yield Curve Returns to Positive Territory!

The US Treasury real yield curve (2s10s) has shifted back into positive territory for the first time since 2022. This comes on the heels of a pronounced steepening trend that has unfolded since the beginning of the year. While this development is certainly noteworthy, it's essential to note that the current real yield curve level still trails its historical average, hovering around 0.6%. The recent uptick in interest rates, combined with the steepening of the real yield curve, raises questions about the potential implications for risky assets. Indeed, we're already witnessing some early signals in the High Yield market. The CDX HY index, which monitors single CDS of US HY companies, has shown notable widening from 310bps to 370bps over the past few weeks, indicating heightened risk perceptions among investors. With this in mind, how might further increases in interest rates, combined with a steeper real yield curve, impact risky assets moving forward? Source: Bloomberg

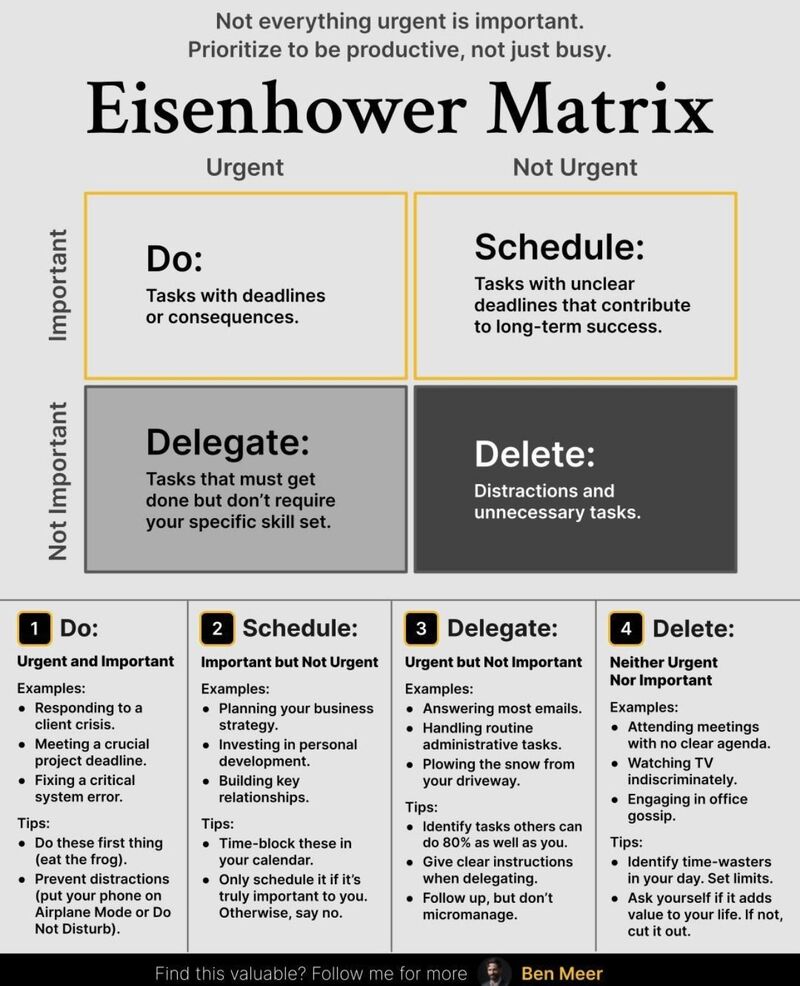

Eisenhower Matrix : Busy-ness doesn't equal productivity.

Credits : Ben Meer, Alvin Foo

Investing with intelligence

Our latest research, commentary and market outlooks