Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

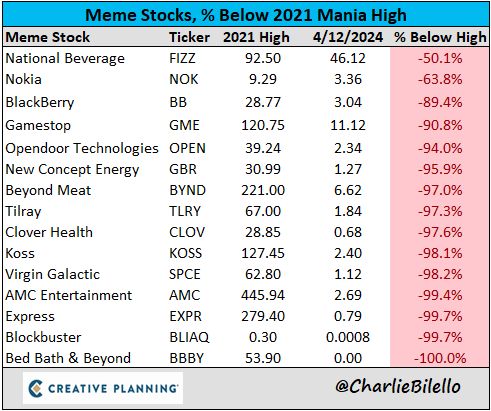

Did you know that the US is the only G10 economy where the latest core inflation print surprised to the upside?

Source: Goldman Sachs, TME

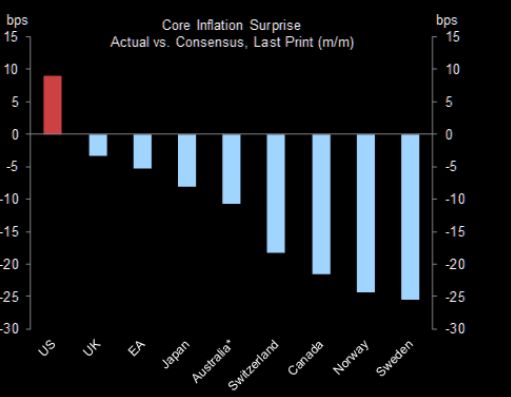

U.S. President Joe Biden reportedly intervened to prevent Israeli Prime Minister Benjamin Netanyahu from authorizing an immediate retaliatory strike against Iran

Following Iran's launch of approximately 300 attack drones and missiles at Israel. The New York Times reveals that despite support from some members of Israel's war cabinet for a response attack, the limited damage caused by Iran and Netanyahu's conversation with Biden resulted in the strike being called off. Source: i24 News

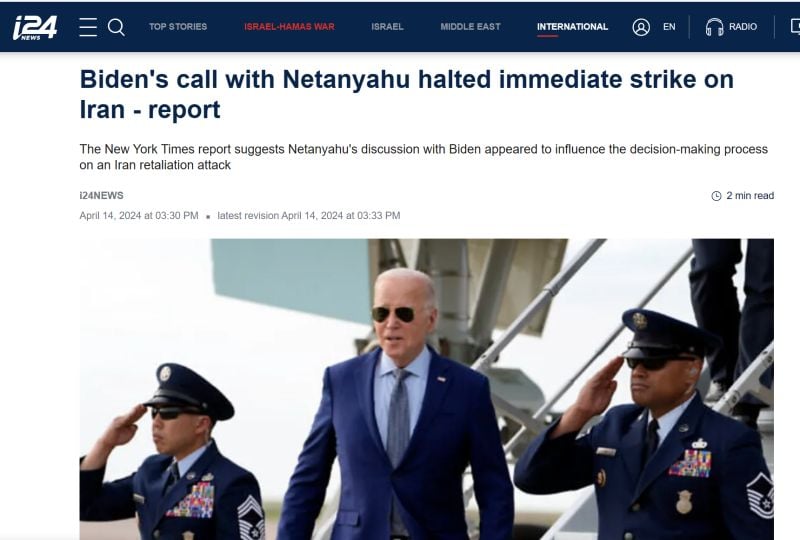

Big Mac inflation vs. CPI... which one is right?

While many investors are more confused than ever looking at "CPI", whatever that is, the real inflation gauge is giving off a serious warning. Source: J-C Parets

Who would’ve thought a 2-century-old Japanese porcelain maker would benefit from AI?

Source: FT

The "East-West divide" in one cartoon.

China is dumping their US Treasury debt and buying hard assets. Many other countries around the world are doing the same. Source: WallStreetSilver

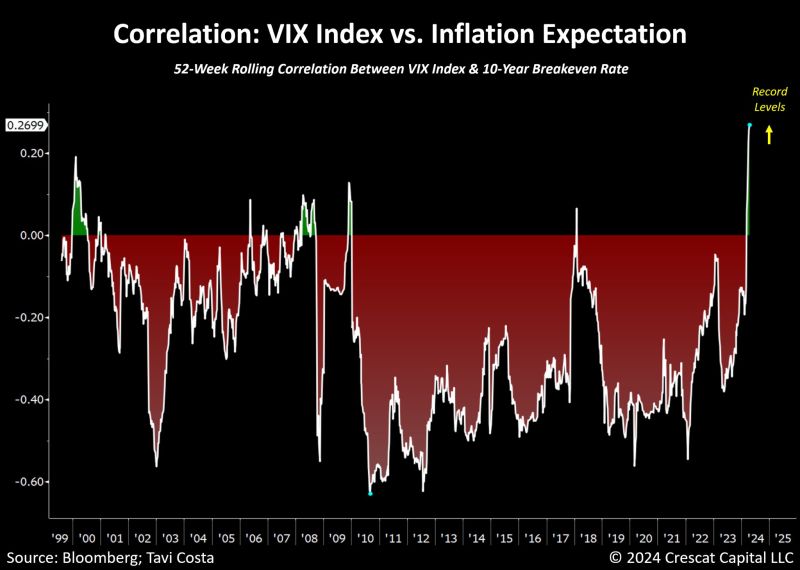

The correlation between equity market volatility and inflation expectations is at the highest level we've seen in decades.

Although the chart below doesn't extend as far back, a similar phenomenon occurred in 1973-1974 as markets faced difficulties whenever inflation reaccelerated. This is especially pertinent now, with energy prices, agricultural commodities, precious metals, copper, global freight costs, and other inflation indicators showing significant resurgence. Source: Tavi Costa, Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks