Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The attack on Israel by Iran was feared by markets already last week and partly explains the pullback on Friday.

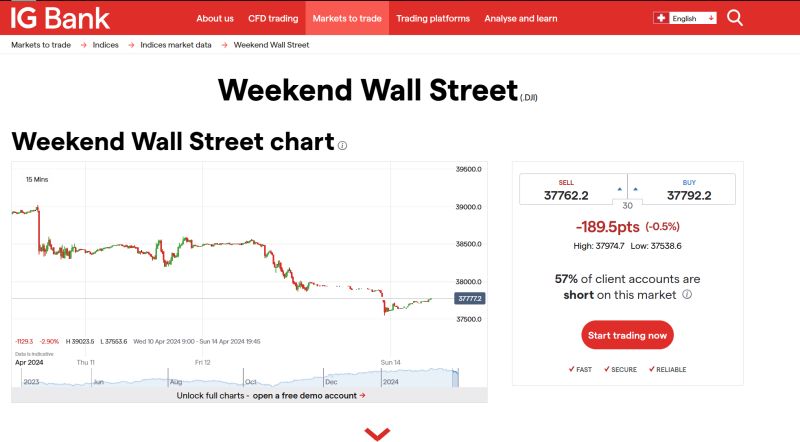

When the attack happened last night, bitcoin and cryptos (which are the only assets traded over the week-end) went down substantially (-10% in 30 minutes for the bitcoin). But it seems that the fact that 1) Israel and US were able to intercept the vast majority of drones and missiles; 2) Biden administration comment that they will not support any Israel counter-attack seem to calm down investors for the time being. Indeed, President Biden told Israeli prime minister Benjamin Netanyahu during a call on Saturday that the U.S. won't support any Israeli counterattack against Iran, a senior White House official told Axios. Bottom-line: Further escalation does not seem to be the core scenario at this stage. This morning, Bitcoin is back to $64k/$65k and Israeli stocks open slightly higher after Iran drone attack foiled. TA 35 index is up 0.5% after opening but trade remains nervous. However, stocks in the Arab world are down. Saudi Arabia’s main bourse opened 1.2% lower. Source: Bloomberg, HolgerZ

BREAKING >>> No WWIII... Biden told Bibi U.S. won't support an Israeli counterattack on Iran..."You got a win. Take the win," Biden told Netanyahu

-> President Biden told Israeli prime minister Benjamin Netanyahu during a call on Saturday that the U.S. won't support any Israeli counterattack against Iran, a senior White House official told Axios. -> Why it matters: Biden and his senior advisers are highly concerned an Israeli response to Iran's attack on Israel would lead to a regional war with catastrophic consequences, U.S. officials said. -> A U.S. defense official earlier said U.S. forces in the region shot down Iranian-launched drones targeting Israel. -> Biden told Netanyahu the joint defensive efforts by Israel, the U.S. and other countries in the region led to the failure of the Iranian attack, according to the White House official. -> "You got a win. Take the win," Biden told Netanyahu, according to the official. -> The official said that when Biden told Netanyahu that the U.S. will not participate in any offensive operations against Iran and will not support such operations, Netanyahu said he understood. -> U.S. Secretary of Defense Lloyd Austin spoke on Saturday with his Israeli counterpart Yoav Gallant and asked that Israel notify the U.S. ahead of any response against Iran, a senior Israeli official said. Source: Axios https://lnkd.in/etEV2wwm

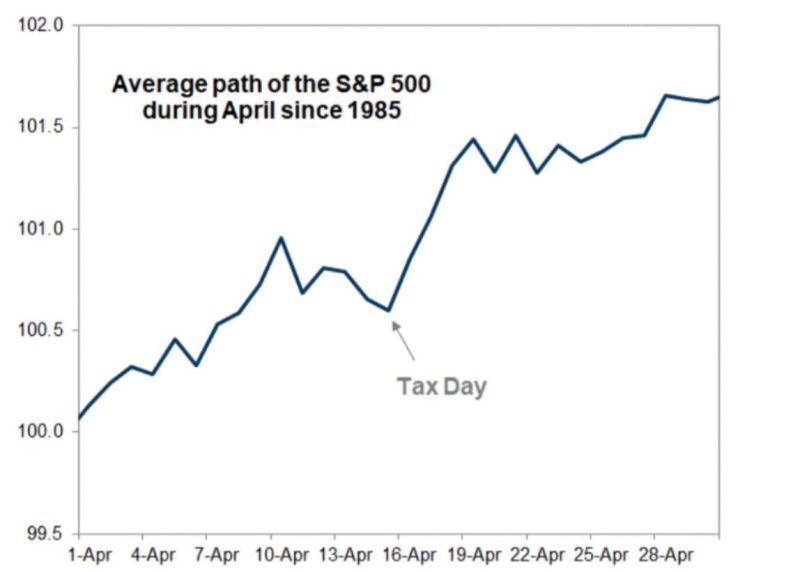

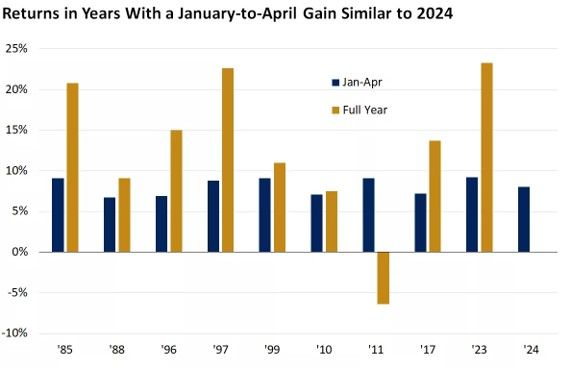

Healthy gains heading into May have historically been a good signal of a positive year for stocks.

Since 1982, when the stock market was higher on the year heading into May, it went on to post a full-year gain roughly 90% of the time. In that period, 1987, 2011 and 2015 were the only years in which the market was higher from January to April but finished the year lower.1 There were nine years in which the year-to-date increase heading into May was in the 6.5%–9.5% range, comparable to 2024’s 8% year-to-date gain. In those instances, the stock market went on to post an average full-year increase of 13%. Source: Edward Jones

Any person capable of angering you becomes your master

Source: Psyche Wizard

Investing with intelligence

Our latest research, commentary and market outlooks