Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

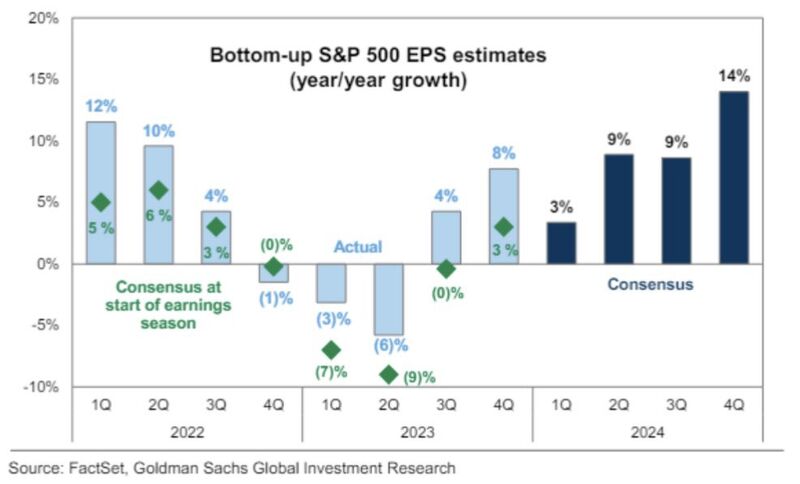

Consensus earnings estimates are projecting +3% YoY EPS Growth for the $SPX in Q1.

Last quarter, Wall Street was also modelling +3% EPS Growth and the realized number came in at +8%. Source: David Marlin, Goldman Sachs

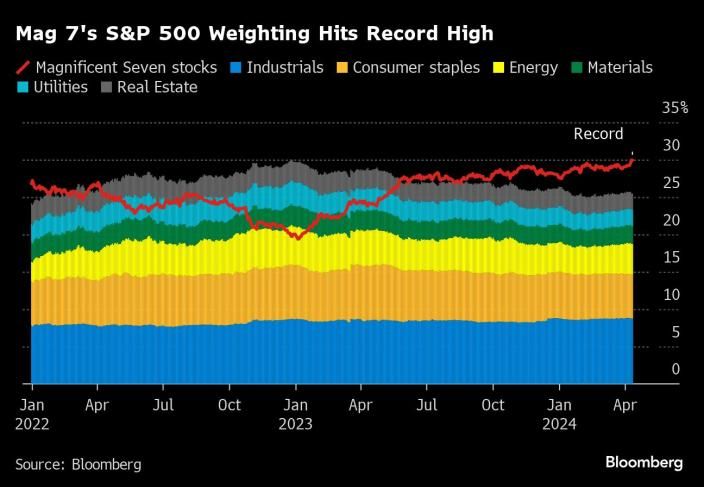

The Mag7's weighting in the SP500 just hit another new high

Source: Cheddar Flow

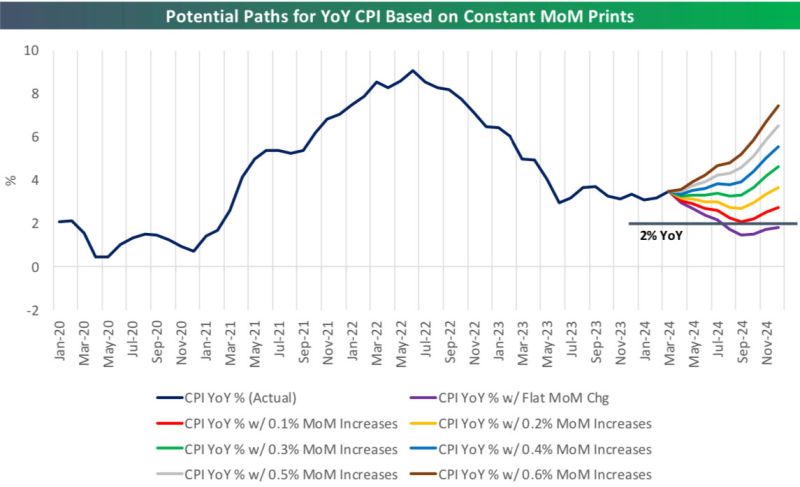

Getting to 2% YoY CPI by the end of 2024 means we need to average monthly CPI prints of 0.1% or less from here.

Source: Bespoke

The Paxos Gold token traded as high as $3,000/oz Saturday night...

"Each Pax Gold $PAXG token is backed by one fine troy ounce of gold, stored in LBMA vaults in London."

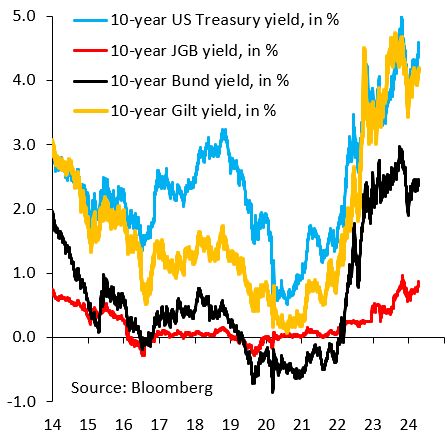

The 10-year US Treasury yield (blue) is marching back towards its high last October.

Recall that - at the time - US Treasury announced that it would issue less longer-term paper, which is what stopped that rise. That card has now been played and yields are rising again... Source: Robin Brooks

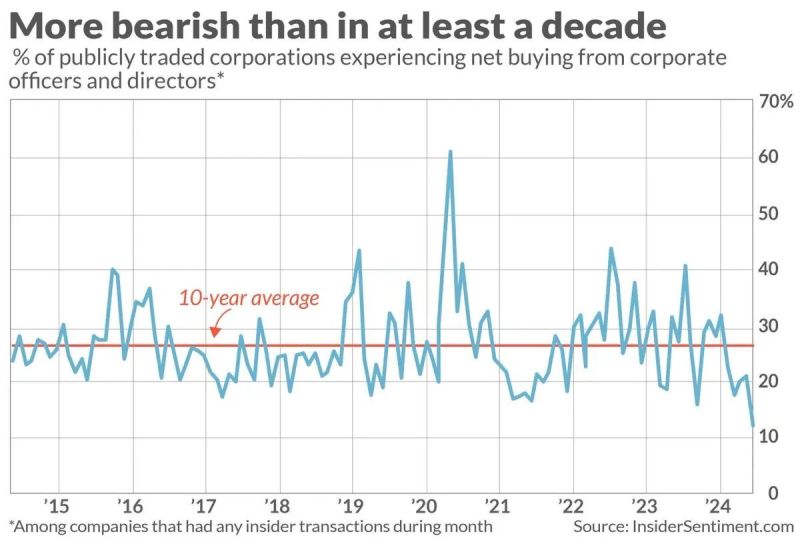

Corporate insiders are more bearish than they have been in at least one decade

Source: InsiderSentiment.com

Investing with intelligence

Our latest research, commentary and market outlooks