Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

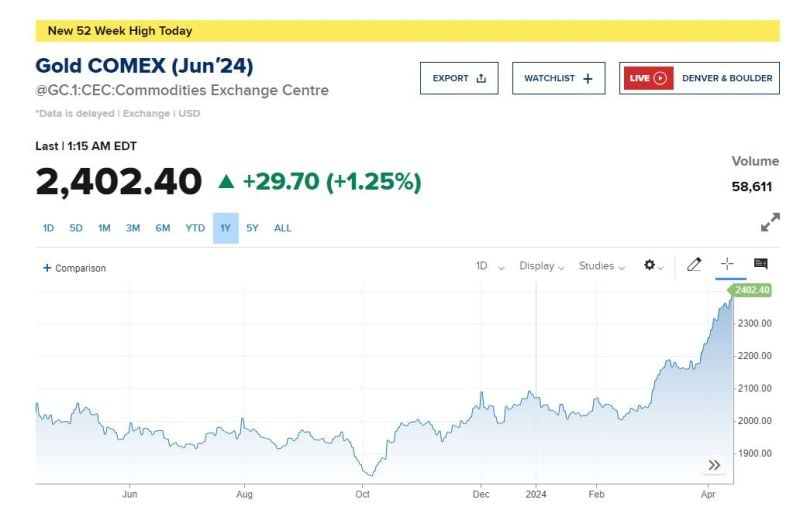

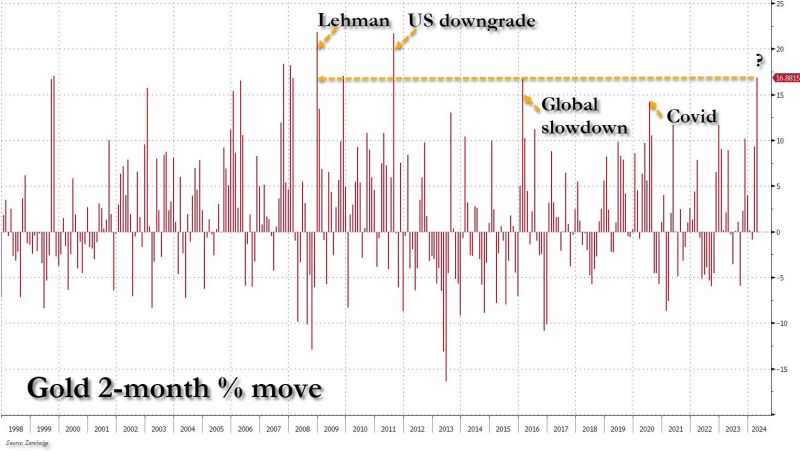

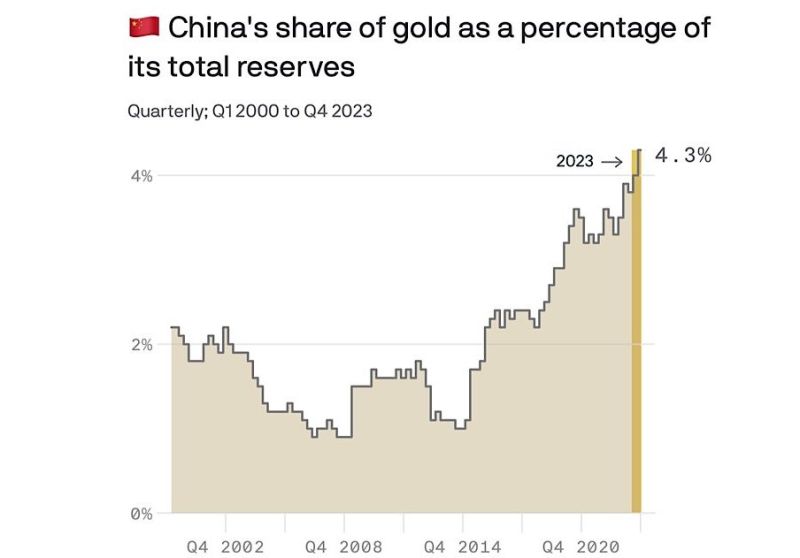

Just In: Gold rising to new all-time highs above $2,400 per ounce

for the first time in history.

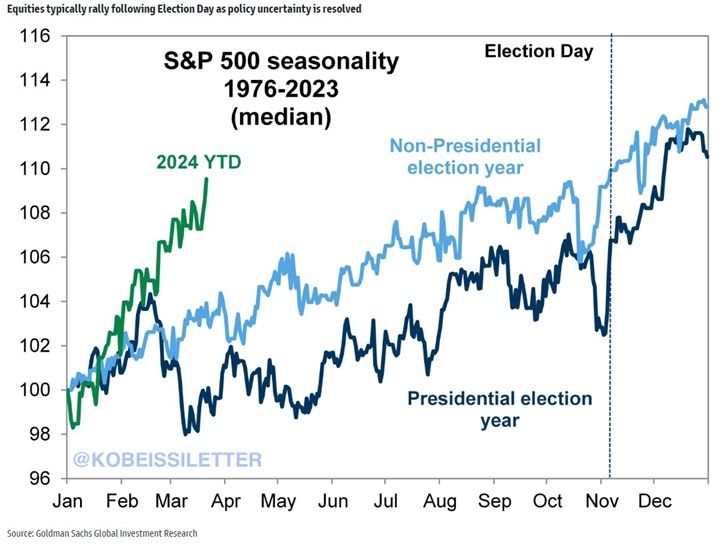

The S&P 500's performance has been truly outstanding this year.

The index is up 9% year to date which is more than DOUBLE the average YTD return in an election year. In the past, the median return during a US presidential election year was about 11%. There are still several months until the presidential election but the index is on track to significantly exceed its historical performance. Source: The Kobeissi Letter

BREAKING 🚨: St. Louis Commercial Real Estate

The Former AT&T Building in St. Louis just sold for $3.6 million. In 2006, it sold for $205 million. A total loss of more than 98%. Source: Barchart

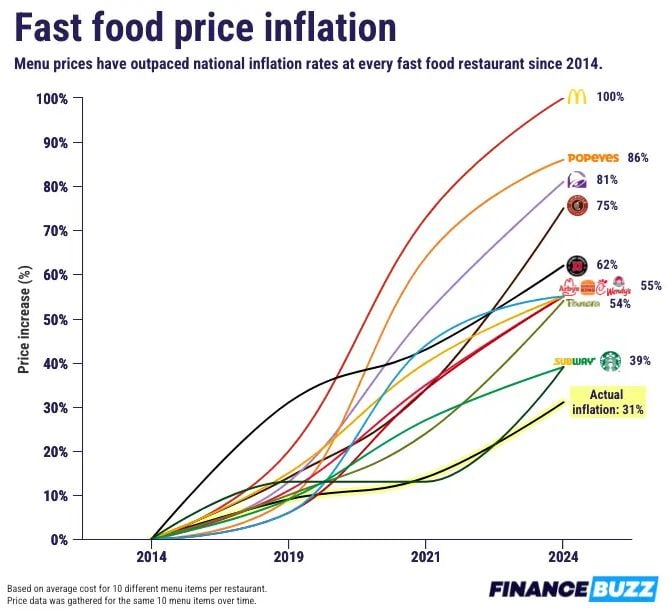

Price increases over last decade...

McDonald's: +100% Popeyes: +86% Taco Bell: +81% Chipotle: +75% Jimmy John's: +62% Arby's: +55% Burger King: +55% Chick-fil-A: +55% Wendy's: +55% Panera: +54% Subway: +39% Starbucks: +39% US Government Reported Inflation (CPI): +31% Source: Charlie Bilello

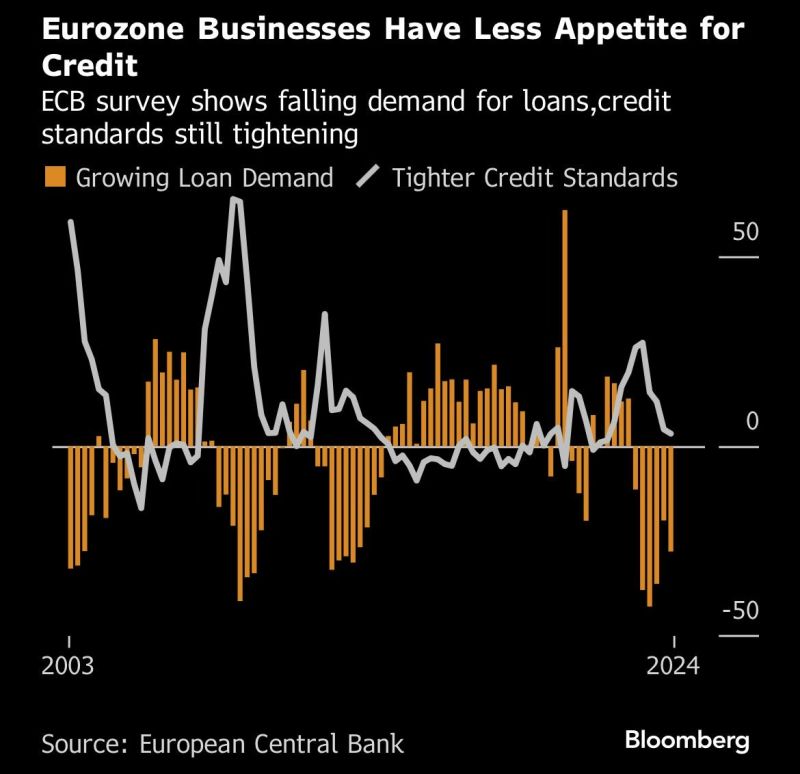

Could an ECB rate cut change reverse this trend?

It might not be enough to offset some of teh structural issues the old continent is facing (overregulation, demographics, lack of tech innovation and energy dependence among others). Source: Bloomberg, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks