Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Federal Reserve's next move might be to raise interest rates warns Former Treasury Secretary Larry Summers.

Source: Barchart

JP Morgan and BlackRock were given insider information about Wednesday's inflation numbers by the Bureau of Labor Statistics 🚨

Source: Barchart

US inflation continues to rise, with no decrease in sight according to Zerohedge.

Since January 2021, inflation has not fallen in a single month, leading to an overall increase of 19% in less than four years. Additionally, the US has not seen a year-over-year inflation print below 3% in 36 consecutive months. The Fed's 2% target has also been surpassed for 37 straight months. This compounding inflation may have long-term impacts on the economy. Source: The Bobeissi Lezzer

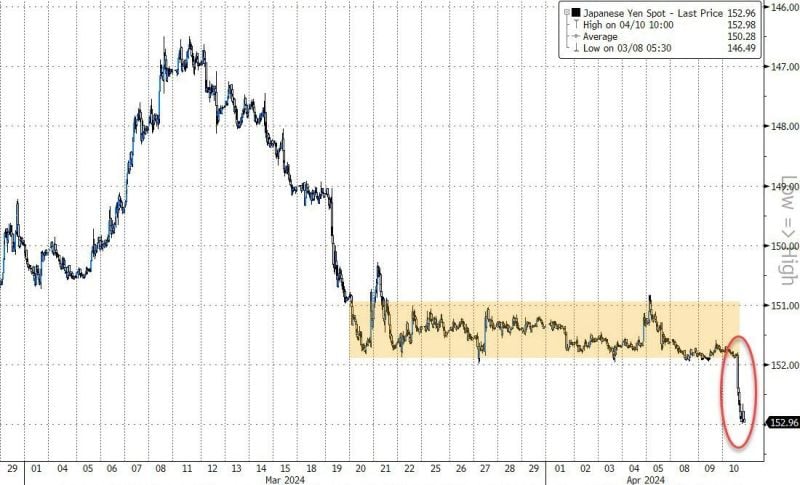

The Bank of Japan (BOJ) has a real problem now as USDJPY surged up to 153 - a fresh 34-year-low for the yen against the dollar and below the level at which the BoJ last intervened...

Source: Bloomberg, www.zerohedge.com

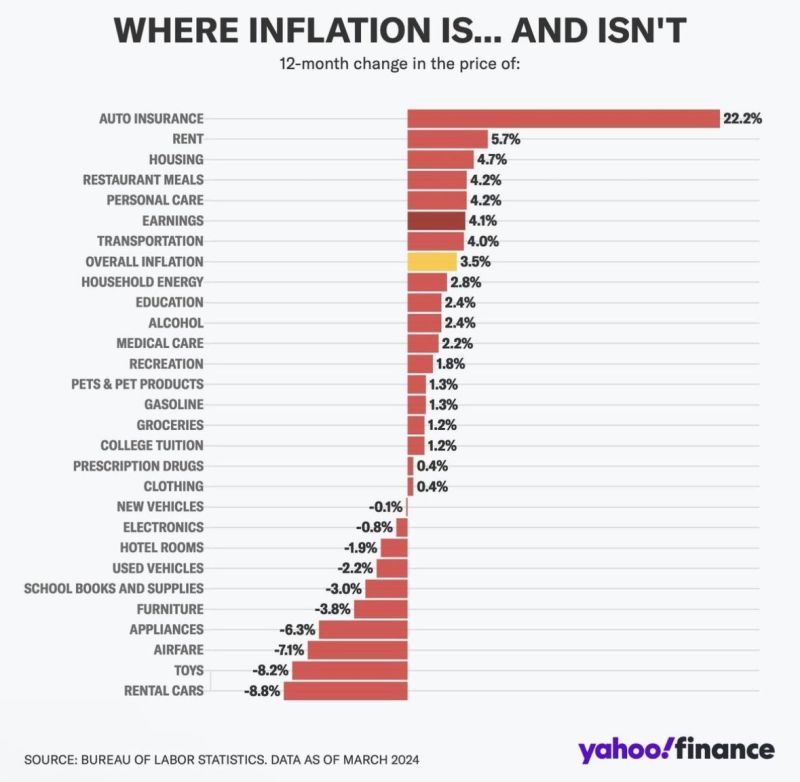

Where US inflation is and where it isn’t 👀

Source: Yahoo Finance, Evan

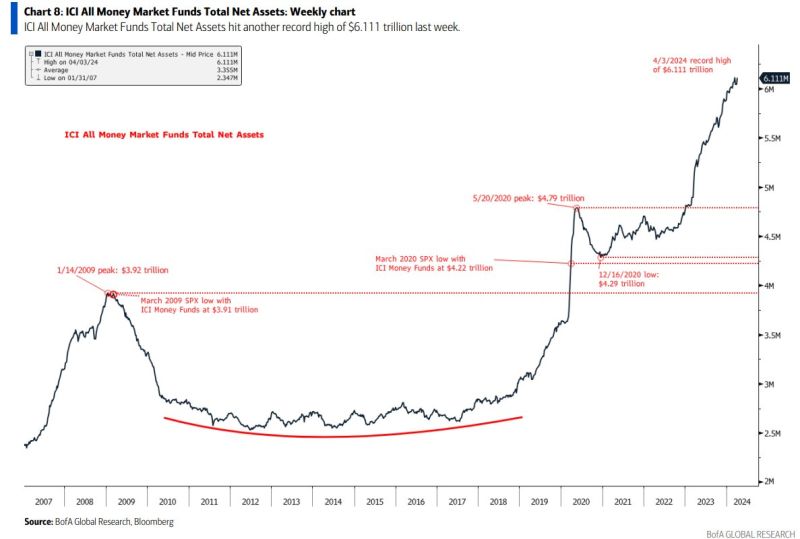

Money market fund levels to record high of $6.111 trillion

Source: WinfieldSmart

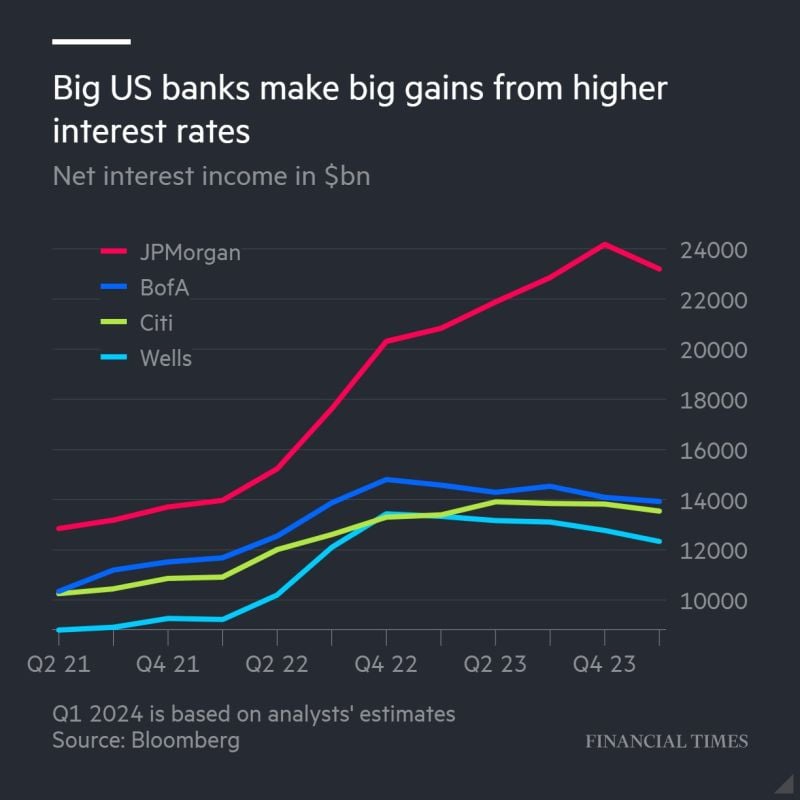

The largest US banks are set to earn higher profits than expected this year

As the Federal Reserve looks likely to make only modest cuts to benchmark interest rates. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks