Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Industrial Metals relative strength (vs. $SPX) ready to turn?

Source: Nautilus Research

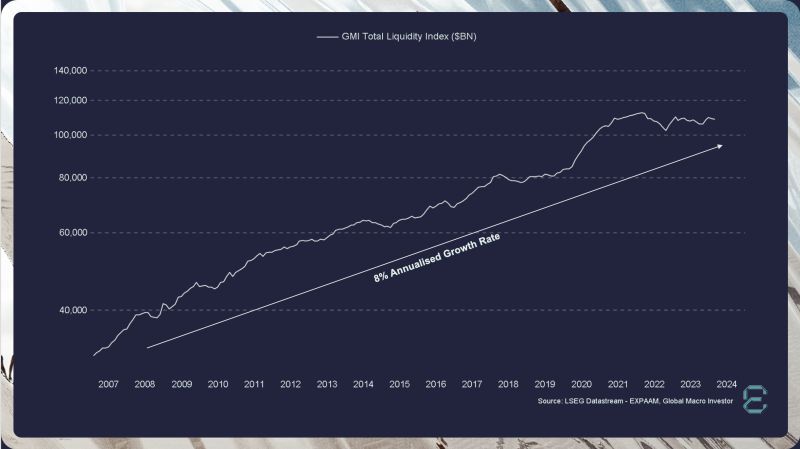

Raoul Pal - Global Macro Investors (GMI) has shared this chart on X showing Global liquidity growing at a CAGR of 8%.

His view: "While everyone is worried about 3.5% inflation, the real issue is the ongoing 8% per annum debasement of currency, on top of inflation. Your hurdle rate to break even is around 12%, which is the 10-year average returns of the S&P 500...just to keep your purchasing power". Key takeaway: if you want to protect your purchasing power in a global monetary debasement, you have 3 choices: 1/ spend; 2/ invest into risk assets; 3/ invest into store of values

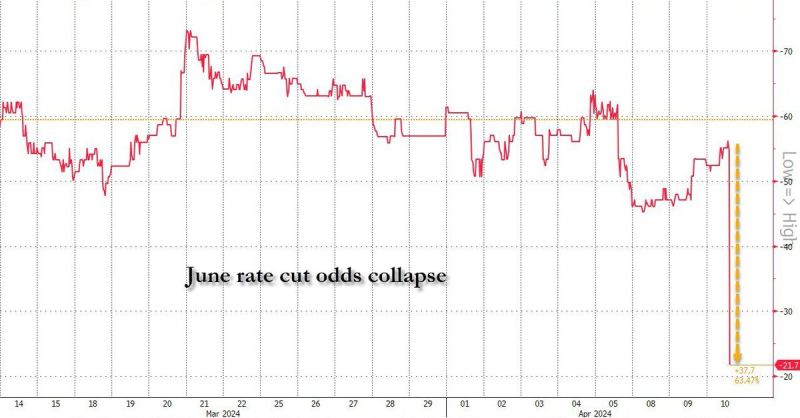

BREAKING: Interest rate futures are now pricing in just 2 interest rate cuts for the entire 2024.

This is the first time that markets are pricing-in LESS rate cuts than Fed guidance. Just 4 months ago, markets saw 6-8 rate cuts in 2024 with cuts beginning in March. Odds of a rate cut in June are down from ~60% before the CPI report to ~22% now. Source: The Kobeissi Letter, www.zerohedge.com

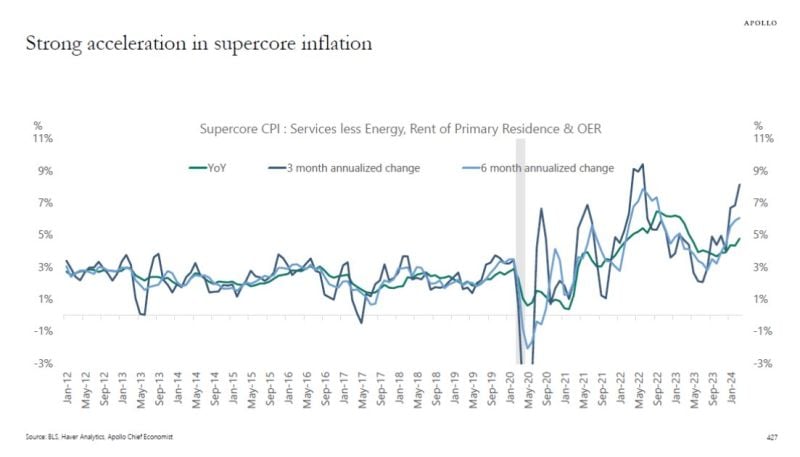

APOLLO: A strong acceleration in SUPERCORE INFLATION...

“.. The 3-month annualized change in supercore inflation is now over 8% and accelerating .. the Fed is not done fighting inflation and rates will stay higher for longer. .. We are sticking to our view that the Fed will not cut rates in 2024.” [Slok] CPI Source: Carl Quintanilla

BREAKING >>> Oups... March CPI inflation rate RISES to 3.5%, above expectations of 3.4%. Core inflation beat as well...

-> The Headline CPI for March came in at +0.4% above expectations of +0.3% month-over-month. On a YoY basis, Headline CPI increased 3.5% vs. 3.4% expected and 3.2% in February. This follows January and February being hotter readings than expected. This is the highest headline CPI reading since last September. -> The core CPI (ex-food and energy) also came in above estimates: +0.4% MoM (vs. +0.3% estimates) and 3.8% yoy vs. 3.7% expected and 3.76% in February. This is the first uptick in core inflation since March 2023. Transportation prices are up +10.7% yoy; Shelter is up +5.7% yoy -> Even the "Supercore services" index which FED policymakers have been emphasizing, which strips out housing, ROSE +0.65% on the month, continuing the trend of higher prints. It is up 4.77% yoy, a 11 months high... -> The fed and Powell are not going to like it. This number might decrease rate cuts expectations even more (they have gone from 7 to less than 3 in just a few months). Could we see 0 rate cuts in 2024? Markets don't like it either as S&P 500 futures decreased 90 points in a matter of minutes. The US 10-year Treasury yield ip up +12 basis points to 4.49%. The 2-year is up +17 basis points to 4.91%...

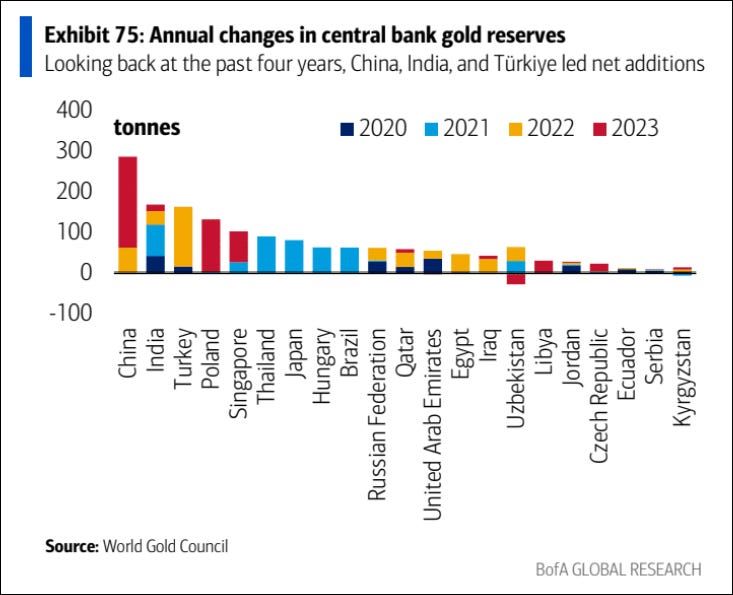

Nice chart by BofA showing central bank gold purchases from 2020-2023

Thru Ronnie Stoeferle

CLS declines delaying FX cutoff as US stock changes loom

CLS Group, the largest currency settlement system, said on Tuesday it will not change its cut-off time for payment instructions for foreign exchange trades, dealing a blow to foreign asset managers hoping for some reprieve from a new U.S. rule putting them at risk of transaction failure. Beginning May 28, the U.S. Securities and Exchange Commission requires investors start settling U.S. equity transactions one day after the trade, or T+1, instead of the current two days. source : investing

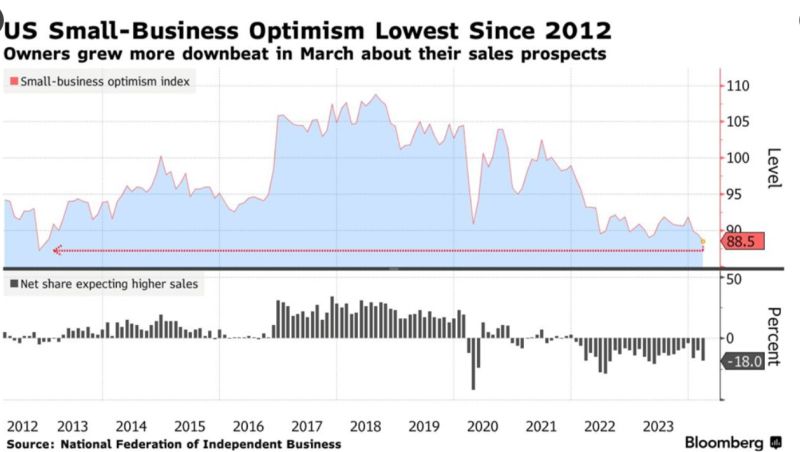

US Small-Business Optimism Falls to a More Than 11-Year Low

source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks