Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

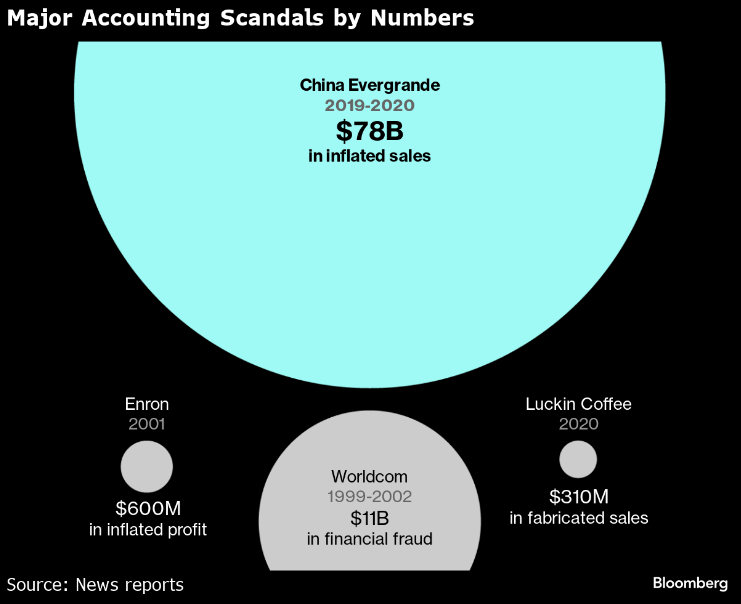

China scrutinizes PwC role in $78 billion Evergrande fraud case

Chinese authorities are examining the role of PWC in China Evergrande Group’s accounting practices after the developer was accused of a $78 billion fraud, ramping up pressure on the global accounting giant that audited a slew of developers before the sector’s meltdown.

Source: Bloomberg

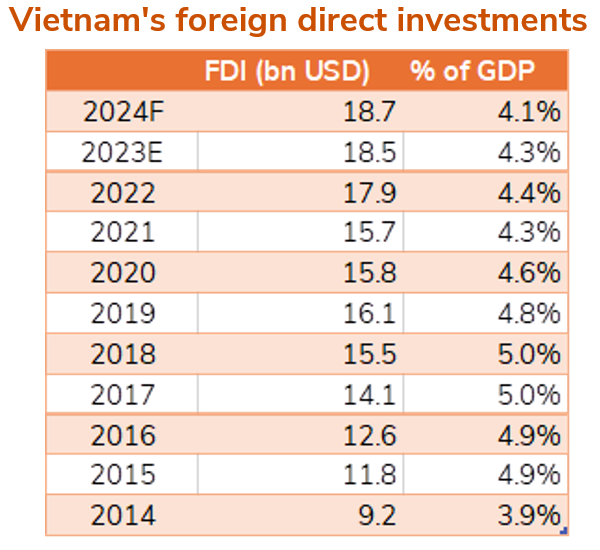

Despite facing the typical challenges of a frontier market, Vietnam offers many attractive characteristics contributing to its rapid economic growth.

Thanks to its young and well-educated workforce and its competitive labor costs, the country has emerged as one the main beneficiaries of the “China+1” trend; it is one of the preferred destinations of global manufacturers looking to diversify their supply chains away from China. Source: Lumen Vietnam Fund

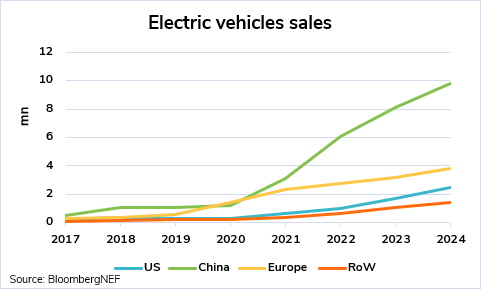

Electric Vehicles: batteries discharged

The end of internal combustion engines is scheduled for 2035 in the EU and Switzerland, yet electric cars sales are not taking off mainly due to their steep prices as well as drivers’ apprehensions surrounding the sparse recharging infrastructure. The mounting skepticism toward electric vehicles has cost Hertz CEO Stephen Scherr his position, last week, as he had heavily invested in electric vehicles only to reverse course. Apple has also recently halted its electric vehicle project after sinking USD 1 bn into it. For those who take the step, the preference goes to affordable Chinese models. China’s BYD has already overtaken Tesla becoming the world's largest EV manufacturer. In the face of this Chinese wave, western manufacturers are struggling to keep pace, and Tesla’s profitability has been declining due to the massive price reductions it has been making. In light of this shifting landscape, a question arises: should Europe and Switzerland reevaluate their strategy and consider easing or postponing their ban on combustion engines cars?

Current state of the stock market:

Wingstop, $WING, a chicken wing company, is now up 84% over the last year and worth $10 billion. It's trading at 144x earnings and tripling the S&P 500's return... Who needs AI when you have chicken wings? Source: The Kobeissi Letter

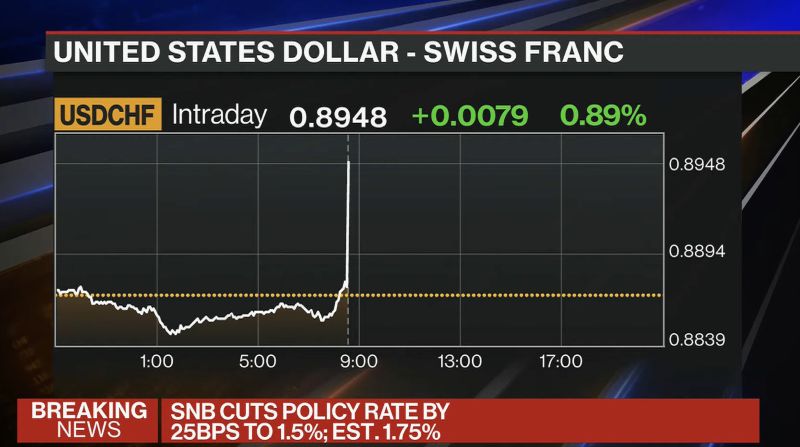

Swiss National Bank SNB cuts interest rates by 0.25%, chart

@BloombergTV

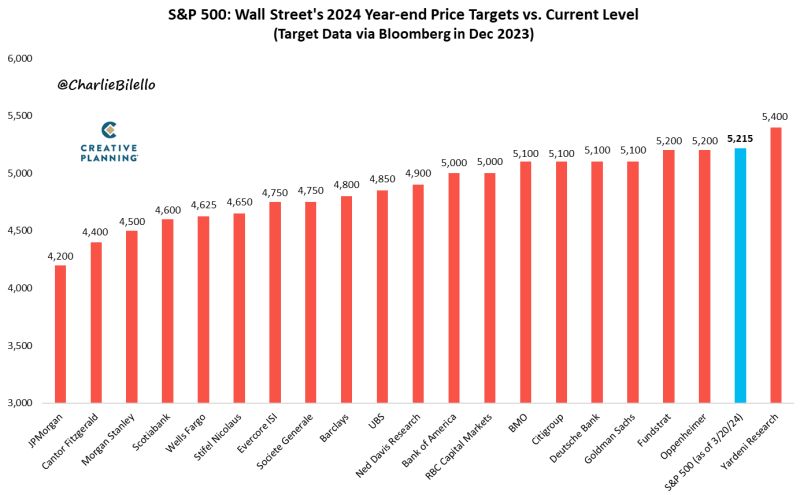

At 5,215, the S&P 500 is already 7.3% above the average 2024 year-end price target from Wall Street strategists (4,861). $SPX

Source: Charlie Bilello

Why are gold and digital gold (aka bitcoin) rallying?

Sometimes one chart is worth a thousand words... As explained by Tavi Costa, If easing monetary conditions with inflation re-accelerating is the next move, then this is probably the most compelling setup to own hard assets (and storer of values) that we've ever seen. Source: Tavi Costa, Crescat Capital, Bloomberg

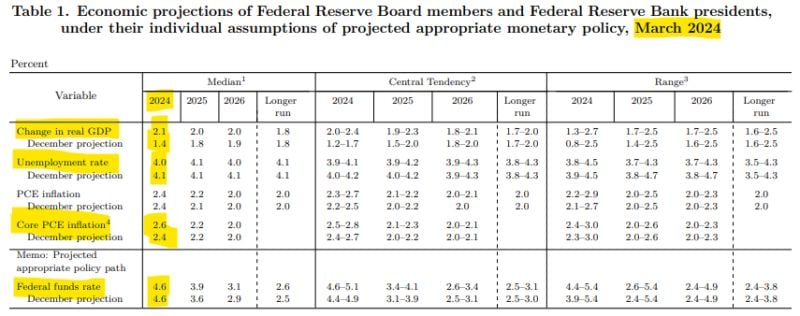

This table explains why markets were soooo... happy yesterday.

As shown by Charlie Bilello: as compared to their December forecasts, the Fed is expecting higher Real GDP growth (2.1% vs. 1.4%), lower Unemployment (4.0% vs. 4.1%), & higher Core PCE Inflation (2.6% vs. 2.4%) but is still anticipating 3 rate CUTS this year. This uber-dovish and bullish for risk assets and gold...

Investing with intelligence

Our latest research, commentary and market outlooks