Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

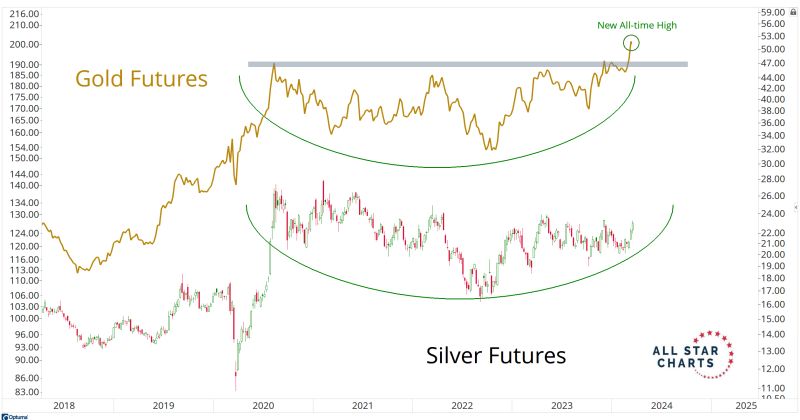

Look at this base on silver... could it follow the steps of gold ?

Source chart: J-C Parets

Powell: " We expect a bit more inflation and higher growth, but... we’re still going to be cutting rates very soon while also slowing down QT..." Mr market:

source: Geiger Capital

Does it mean that the nvidia's party is over?

Source: The Great Martis, Time Magazine

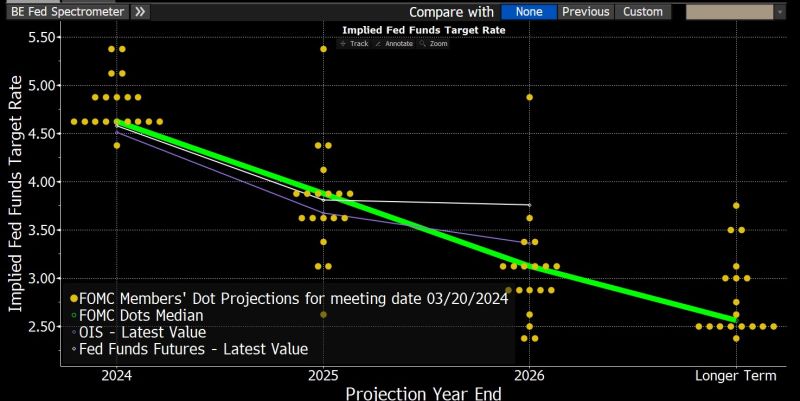

BREAKING: The Federal Reserve on Wednesday held interest rates steady as expected but signaled that it still plans multiple cuts before the end of the year.

FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE - BBG *FOMC MEDIAN FORECAST SHOWS 75 BPS OF RATE CUTS IN 2024 TO 4.6% *FED REPEATS WAITING FOR GREATER CONFIDENCE ON INFLATION TO CUT As expected, the Fed kept the Federal Funds Rate unchanged. The main news is that the 2024 median rate forecast in the new Federal Reserve dot plot remains UNCHANGED! The Fed continues to expect three rate cuts (-75BPS) for 2024 ! Fed Officials median view of Fed funds rate at end of 2024 4.6% (prev 4.6%). Fed projections show only one official sees more than three 25 bp rate cuts in 2024. Fed now only sees 2 rate cuts in 2025 and fewer cuts in 2026. Fed made only one change to the FOMC statement: Thus is in January: "Job gains have moderated since early last year but..." replaced by this in March: "Job gains have remained strong and..." The projected change in real GDP for 2024 was 2.1% in the March projection, up from 1.4% in December. Core PCE inflation projections also ticked up to 2.6% from 2.4%.. Fed says inflation "has eased but remains elevated". Fed does not expect rate cuts until "greater confidence" inflation is moving to 2%. Market reaction: Equity markets are rallying after the FOMC announcement: The S&P 500 has officially broken above 5200 for the first time in history. The dollar is weakening and US Treasury yields are stable (the 10 year initially lost 5 basis points). Our take: Markets are rallying on the initial headlines from this Fed rate decision. Primarily because Fed projections for 3 rate cuts in 2024 have been reaffirmed. Indeed, the risk of a hawkish surprise (lower dot plots for 2024) was quite elevated ahead of the FOMC decision based on recent economic activity data (Atlanta Fed GDPNow currently at 2.5% for Q1 24). The fact that the Fed keeps 2024 DOTS unchanged was the best scenario for the market. The two objectives of the Fed (maximum employment and stable prices) are (almost) perfectly reached. The Fed can relax and afford to “wait-and-see” before eventually recalibrating (most likely in June). Note that Powell’s press conference will also be important for the nuances and context around the potential adjustments to dots and economic projections. In terms of portfolio positioning, we remain constructive on equities but more cautious on fixed income. We keep some allocation to Gold.

Investing with intelligence

Our latest research, commentary and market outlooks