Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

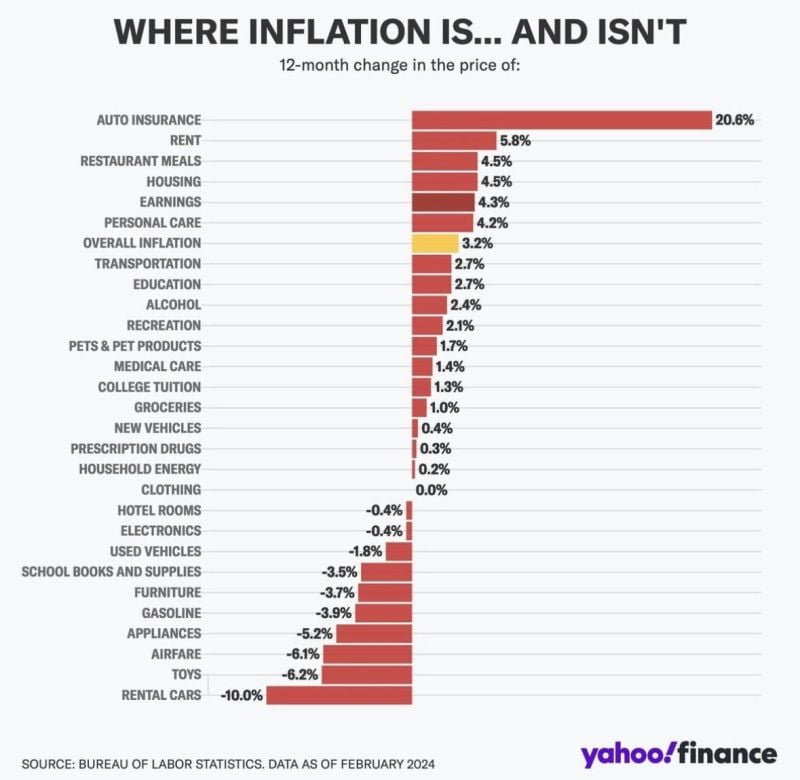

Where us inflation is and where it isn’t

Source: Evan, Yahoo Finance

Nice one by Barclays...

The CNY's share of cross-border payments has overtaken the USD Source: Ronnie Stoeferle, Barclays, Bloomberg

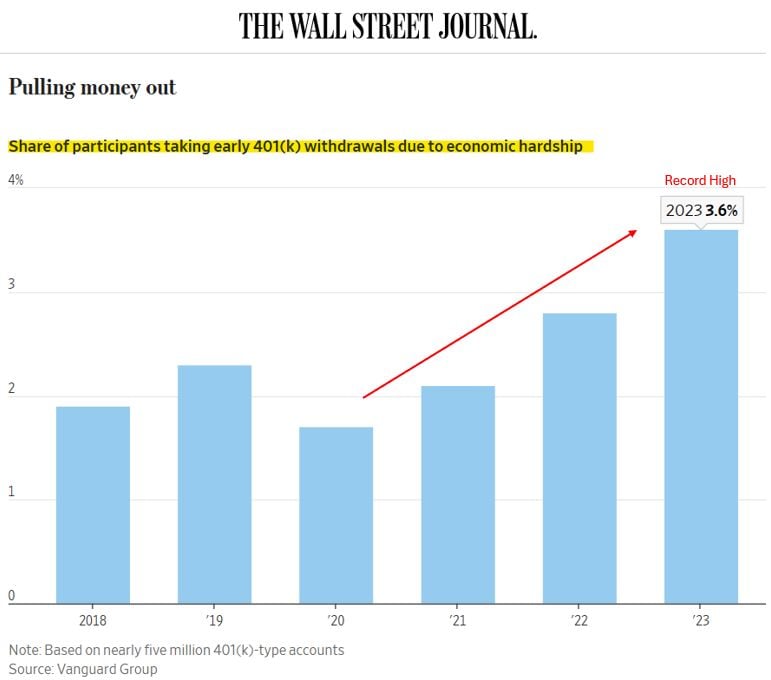

A record number of Americans are taking hardship withdrawals from their 401k.

The figure has nearly doubled over the last four years. 40% of these hardship withdrawals are to avoid foreclosure. Source: Nick Gerli, Wall Street Journal

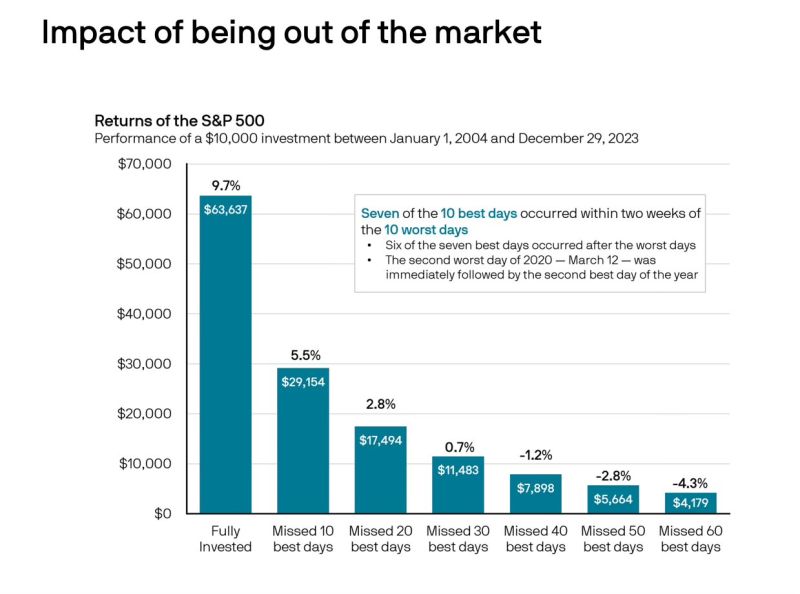

It is about missing the best days, not missing the worst days.

Source: Eugene NG

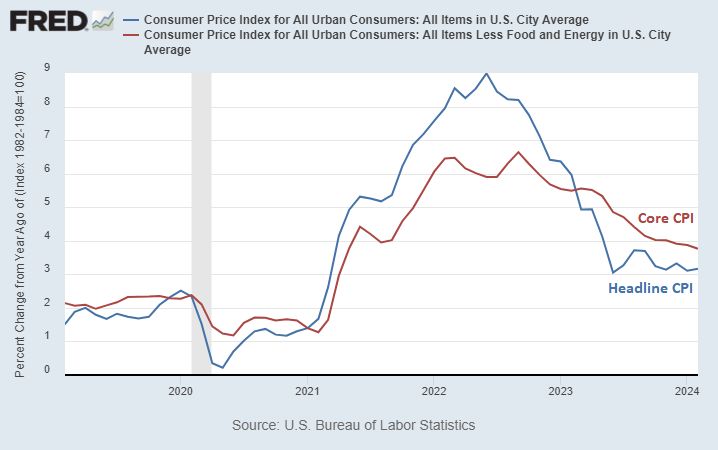

Yesterday's hot CPI prints shows that headline inflation is sticky around the 3% level.

Source: Lyn Alden, FRED

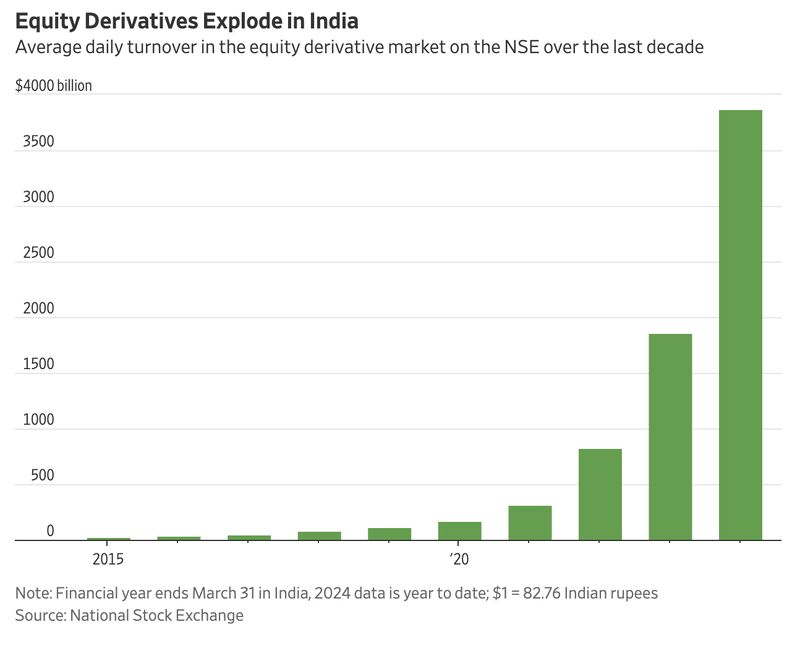

78% of equity options throughout the world were traded in India last year.

Look at this growth since the onset of Covid! Source: Barchart

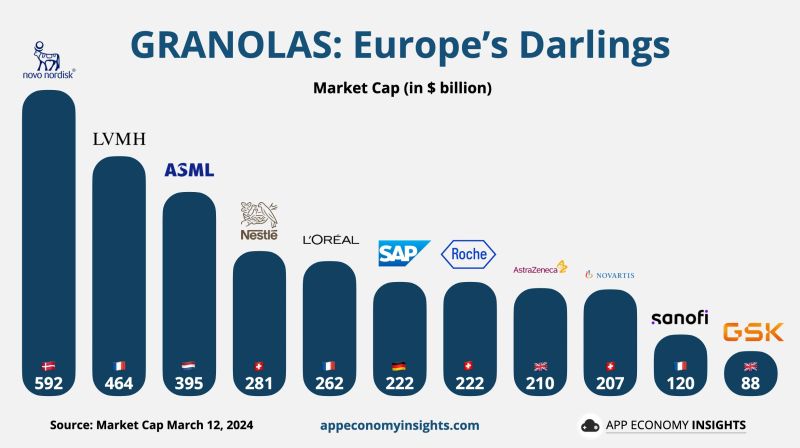

Who are Europe's GRANOLAS?

Novo Nordisk $NVO LVMH $LVMUY ASML $ASML Nestlé $NSRGY L'Oréal $LRLCY SAP $SAP Roche $RHHBY AstraZeneca $AZN Novartis $NVS Sanofi $SNY GSK $GSK Source: App Economy Insights

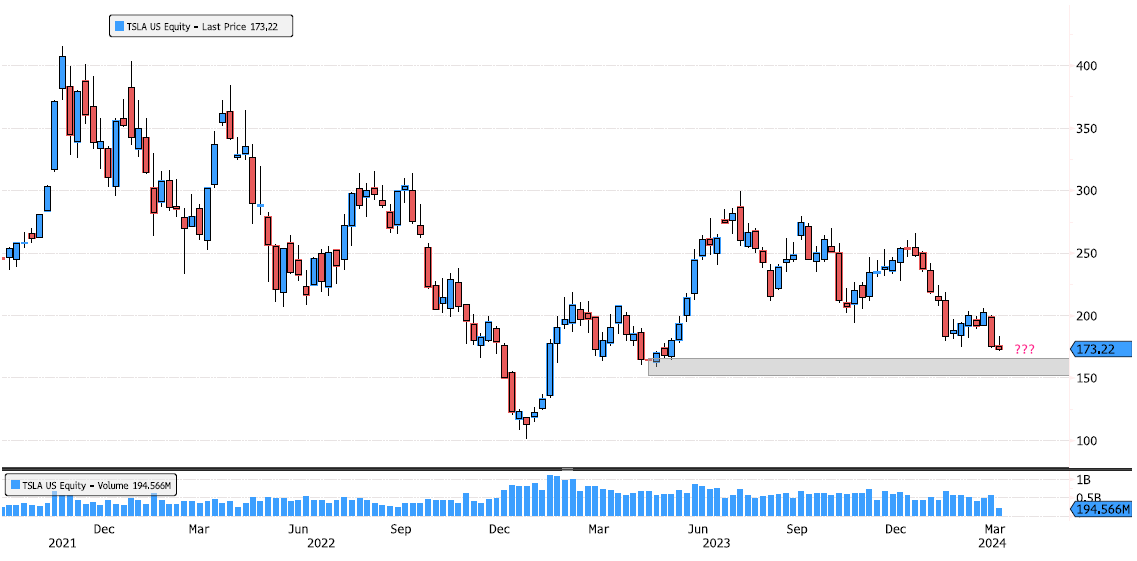

Tesla reaching strong support zone

Tesla (TSLA US) is approaching support zone 152.37 - 165.65. Keep an eye for any reaction over the next few days. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks