Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

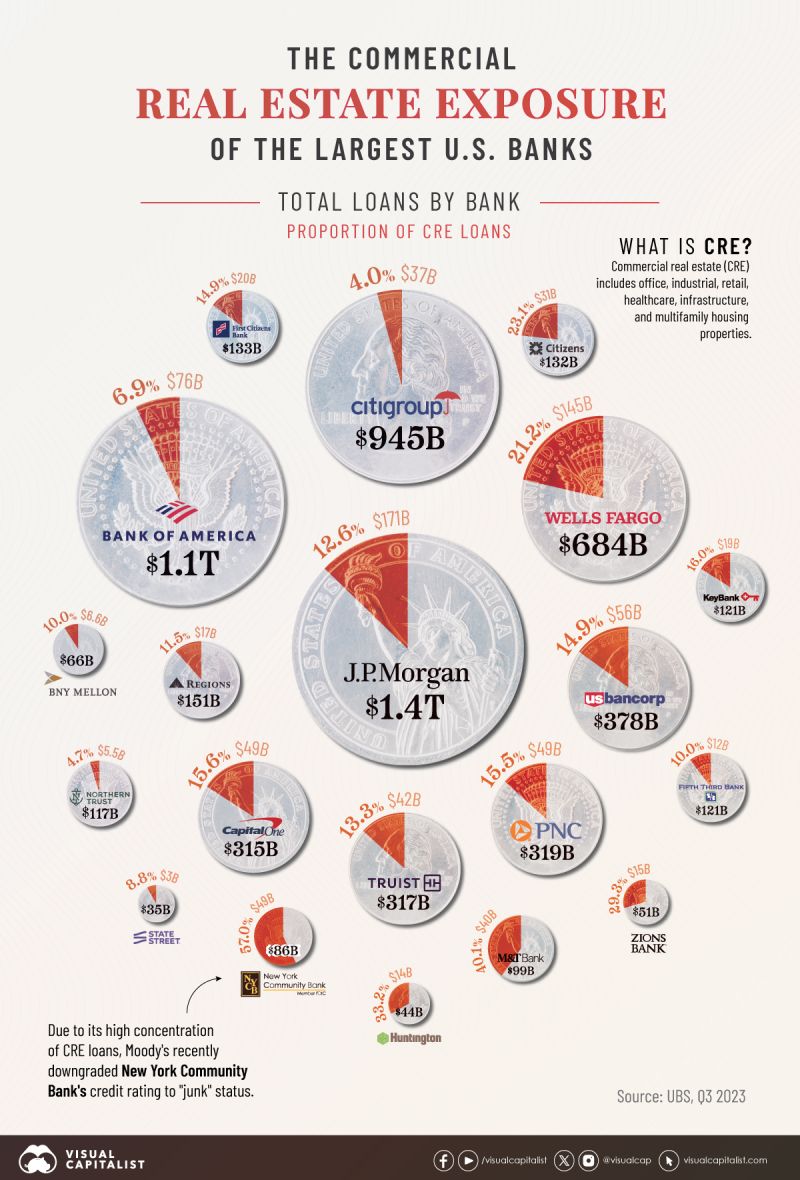

Major U.S. Banks, by Commercial Real Estate Exposure

This graphic shows the 20 largest U.S. banks by assets, and their exposure to commercial real estate as a percentage of total loans. source : visualcapitalist

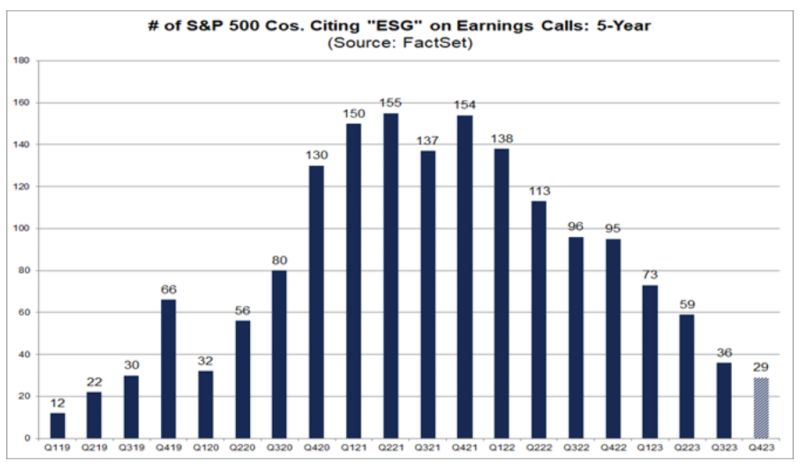

Lowest Number of S&P 500 Companies Citing “ESG” on Earnings Calls Since Q2 2019

Through Document Search, FactSet searched for the term “ESG” in the conference call transcripts of all the S&P 500 companies that conducted earnings conference calls from December 15 through March 7. Of these companies, 29 cited the term “ESG” during their earnings calls for the fourth quarter. This number is below the 5-year average of 82 and below the 10-year average of 43. In fact, this is the lowest number of S&P 500 companies citing “ESG” on earnings calls going back to Q2 2019 (22). Since peaking at 155 in Q4 2021, the number of S&P 500 companies citing “ESG” on quarterly earnings calls has declined (quarter-over-quarter) in nine of the past ten quarters. At the sector level, the Financials (6), Utilities (5), and Health Care (4) sectors have the highest number of S&P 500 companies citing “ESG” on earnings calls for Q4. On the other hand, the Utilities (17%) and Energy (15%) sectors have the highest percentages of S&P 500 companies citing “ESG” on earnings calls for Q4. source : factset

The US is pumping more oil than any country in history

US crude production has surpassed every record in history for six years in a row, the US Energy Information Administration wrote on Monday. Its latest peak reached in 2023 is unlikely to be broken by any near-term competitor, it said.Including condensate, last year's US crude production averaged 12.9 million barrels per day, eclipsing the 2019 global record of 12.3 million barrels per day.A monthly record also occurred in December, at over 13.3 million b/d. Source: business insider

Wall Street in Control?

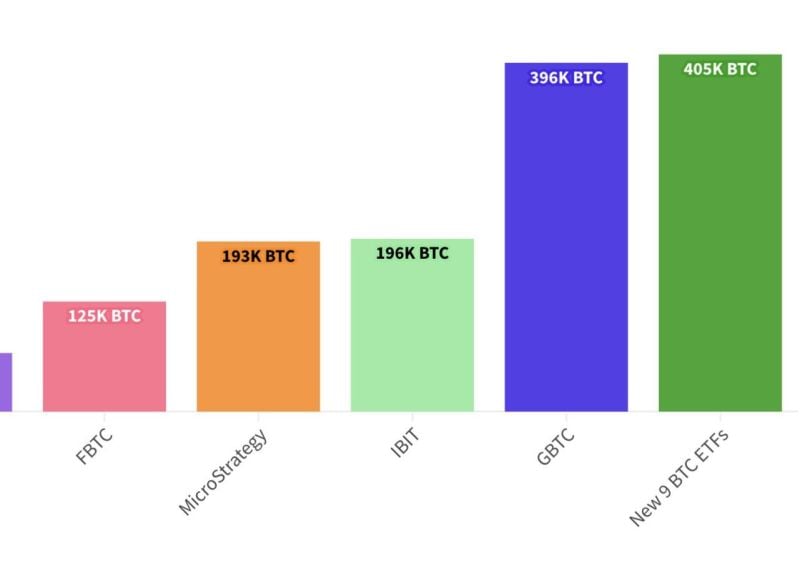

The New 9 have successfully overtaken the position previously held by GBTC, indicating a significant shift in market dynamics. Similarly, IBIT has surpassed MSTR, further emphasizing the evolving landscap... in 8 weeks' time. source : fred krueger

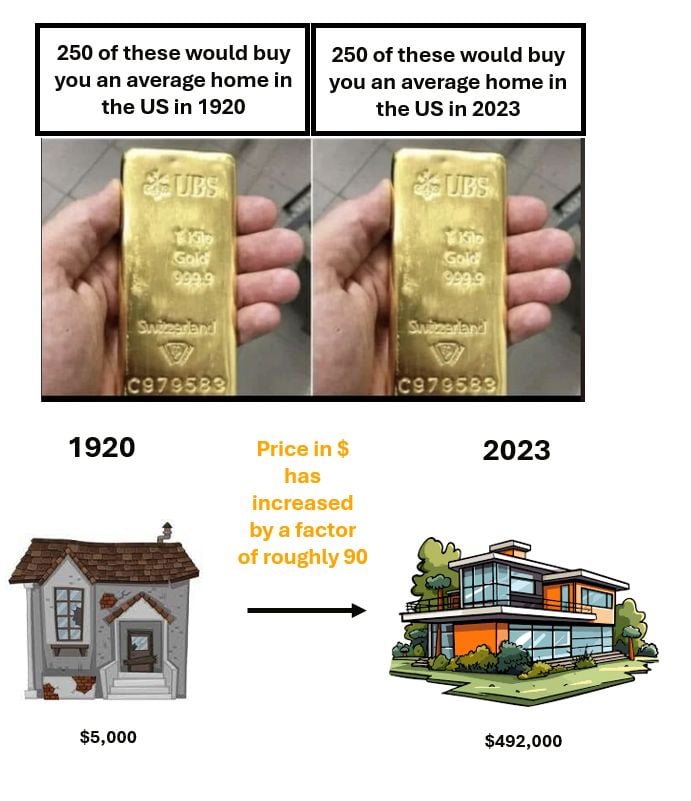

What is a store of value?

A good store of value preserve the amount of goods / services money can buy over time. Example (simplified): - The average gold price in 1920 was $20.68 per ounce. Today it is worth $2,100 per ounce. A 100 fold increase. - The average house price in the US in 1920 was between $5,000 and $6,000. The average sales price of a new home in 2023 was $492,000. A 90 to 100 fold increase.

The cocoa rally.

Cocoa prices hit a fresh record high, fast approaching the once unthinkable $7,000 per tonne level. At current levels, we will see soon widespread retail price increases for all kinds of chocolate. Source: Bloomberg, Javier Blas

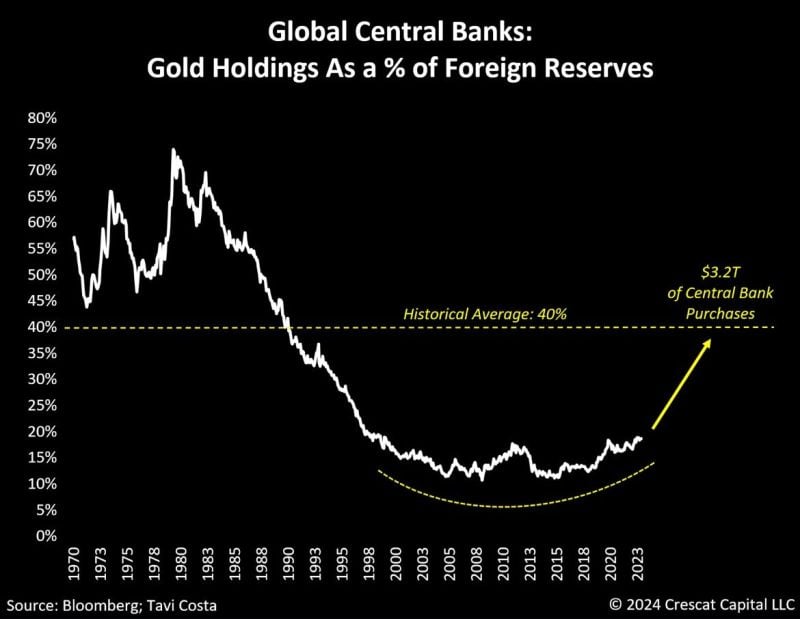

As highlighted by Tavi Costa:

The recent surge in gold prices, despite a lack of corresponding growth in assets managed by related ETFs, suggests that central banks' purchases have likely been the primary catalyst for the rally. Although there's been a record pace of metal accumulation, central banks currently hold a much smaller proportion of gold compared to historical levels. Back in the late 1970s and early 1980s, these institutions held around 80% of their balance sheet assets in gold, whereas today it's less than 20%. Will they continue to accumulate gold going forward? If we come back to the historical average (in terms of % of reserves), there is massive pent up demand ahead Source: Tavi Costa, Bloomberg

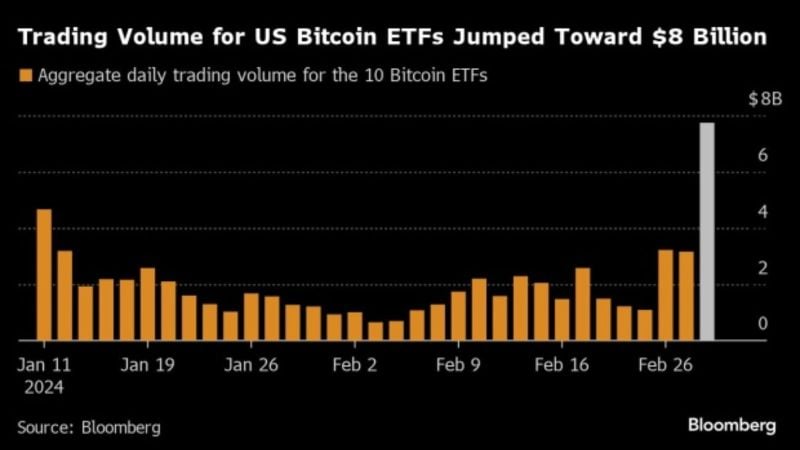

Trading volume in US Bitcoin ETFs hit YTD highs of $8B as Bitcoin prices are up 59% YTD, after reaching a new all-time high.

The surge follows regulatory approvals for spot-Bitcoin ETFs and comes ahead of the anticipated halving event, reflecting significant shifts in crypto accessibility and investor interest. Source: Bloomberg, Beth Kindling

Investing with intelligence

Our latest research, commentary and market outlooks