Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Coinbase suffered a glitch on Wednesday that left many users seeing a zero balance in their account.

The Coinbase crash just erased $100 BILLION of market cap in Bitcoin in 15 minutes. Between 12:15 PM ET and 12:30 PM ET, Bitcoin fell from $64,000 to $59,000. This was a near 9% swing in 15 minutes right as many Coinbase users began showing a $0 balance in their account. It also happened to occur just as Bitcoin was less than 10% away from a new all time high. Coinbase is reportedly still working on fixing the issue. Source: The Kobeissi Letter

BREAKING: Bitcoin prices rise above the key $60,000 resistance level for the first time since November 2021

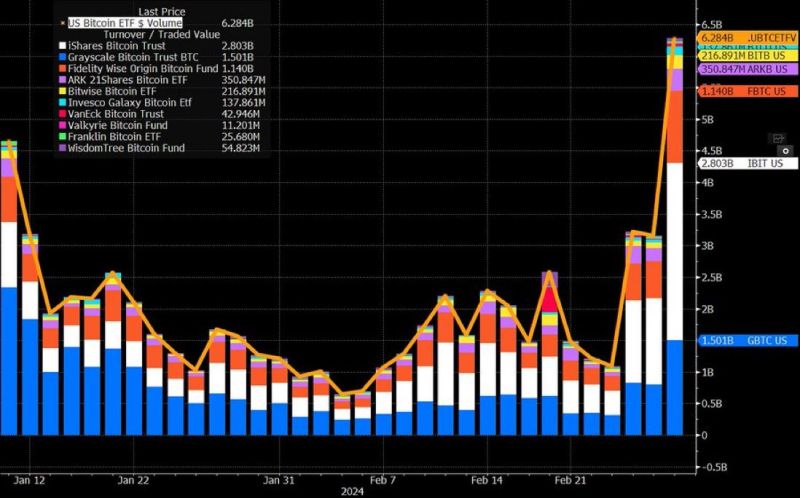

amid surging optimism that demand for the token is widening beyond committed digital-asset enthusiasts. iShares Bitcoin ETF manages >$8bn in assets after one and a half months. Over the past 24 hours, Bitcoin has surged by an impressive 7%, with a weekly gain of almost 20% and a staggering 160% increase over the last 12 months. So what's driving this remarkable rally? 1/ The recent spike in Bitcoin's price can be attributed to a significant increase in institutional interest, following the approval of 11 Bitcoin exchange-traded funds (ETFs) in the US earlier this year. This development has opened the floodgates for institutional investors, who are now entering into the crypto space. Bitcoin is obviously their choice number 1 2/ Adding fuel to the fire is the highly anticipated Bitcoin halving event, scheduled for April this year. Historically, halvings have triggered massive bull runs, as the mining rewards are cut in half, effectively reducing the inflation rate of new Bitcoin supply by 50%. 3/ Hedge funds are anticipating a massive demand-supply squeeze due to the combination of ETF-led demand and the halving. Some numbers to keep in mind (as of the end of last week): - 272,000 Bitcoin were bought in the last 28 days by ETFs. Meanwhile only 25,200 $BTC were mined! Yes, GBTC (Grayscale Bitcoin Trust) outflows are still a concern, but at some point that will have to end. - Assuming this number stays consistent (or possibly even increases) with roughly ~2 million BTC on exchanges (based on today's liquidity), that would mean that in about 8 months time there would literally be ZERO BTC available for sale!!! - And not mention the halving in 3 months will cut this amount to just 12,600 BTC mined in the same amount of time. 4/ Retail investors are now joining the party. They have been initially shy to follow the positive momentum but as the BTC keeps moving up they are starting to speculate on all-time-highs to be soon be revisited. From a technical analysis point of view, the all-time high of $67,757 is the next resistance. As a final note: Bitcoin is testing all-time highs before the halving. This has NEVER happened before in history Source chart: Rizzo

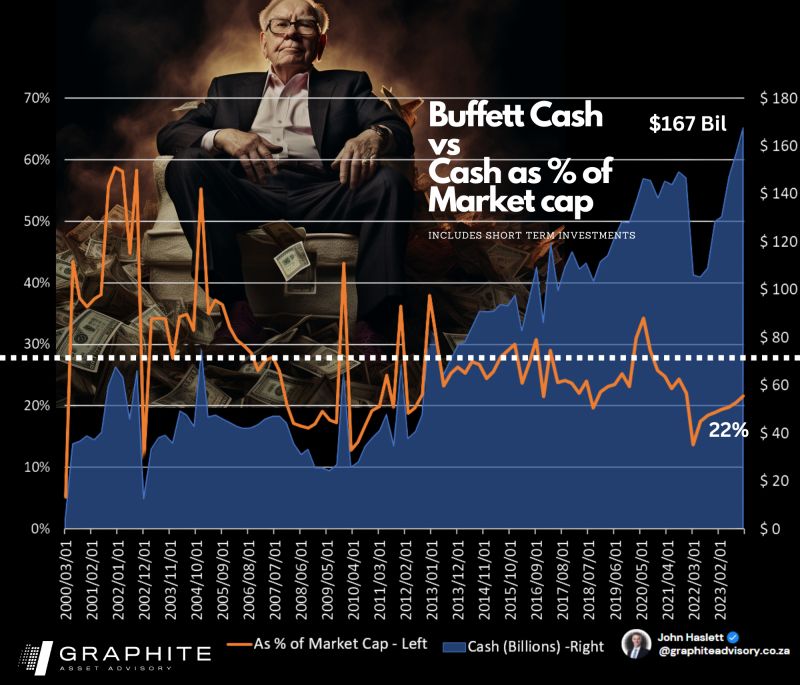

𝗕𝘂𝗳𝗳𝗲𝘁𝘁'𝘀 𝗖𝗮𝘀𝗵 𝗕𝗼𝗻𝗮𝗻𝘇𝗮 𝗡𝗼𝘁 𝗮𝘀 𝗕𝗶𝗴 𝗮𝘀 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸 💰

While Berkshire Hathaway is hoarding a record-breaking $167 billion cash pile, it accounts for just 22% of the market cap, trailing the 𝗵𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝟮𝟳% 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 the last 23 years. Source: John Haslett, CA(SA), FRM

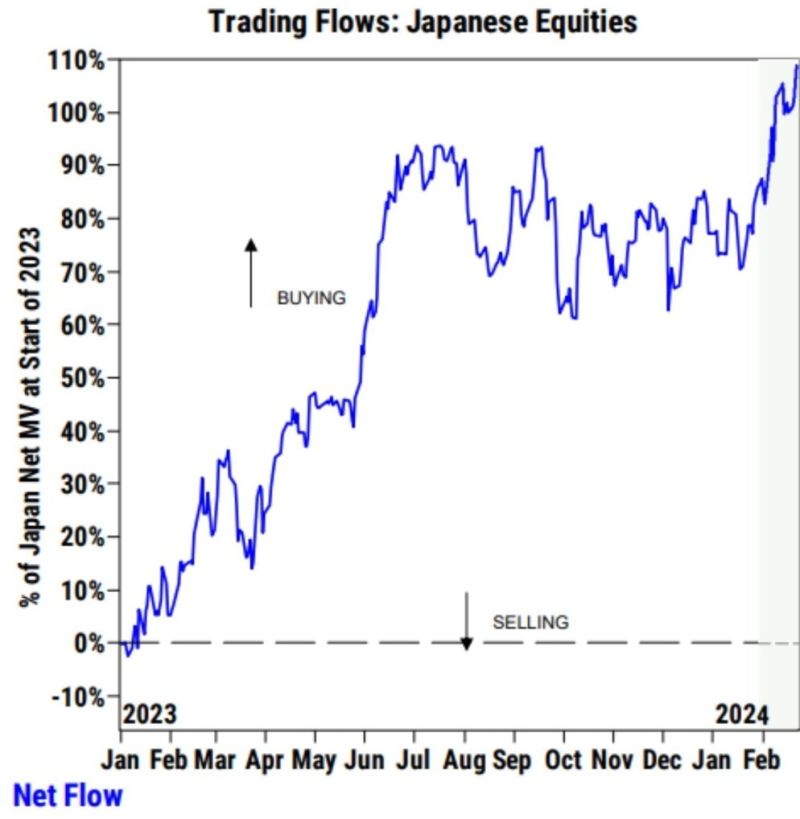

Hedge funds are loading up on japanese stocks with the Nikkei at all-time highs

Source: Win Smart, CFA

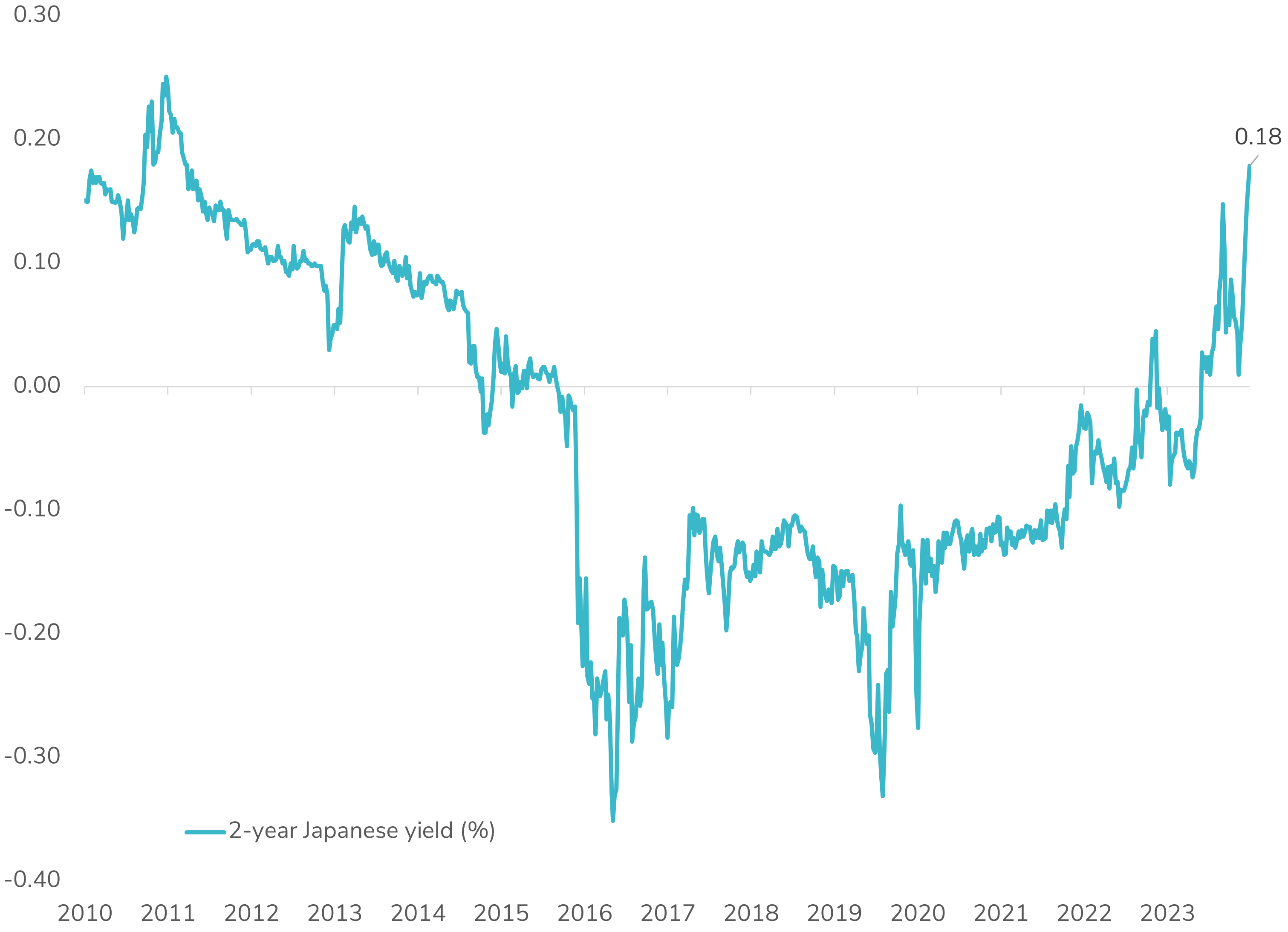

📈 Japanese 2-Year Yield Surges to 14-Year High!

Japanese government bond yields are on the rise across the curve, triggered by Bank of Japan Board Member Hajime Takata's comments hinting at a potential end to the negative interest rate policy. Takata cited progress towards achieving the price target, indicating a possible rate hike—the country's first since 2007—expected in March or April. The front end of the Japanese yield curve is particularly influenced by the BOJ's monetary policy and continues to reprice higher rates. The market anticipates a 0.25% rate hike for the full 2024 year. It appears that Japan will gradually transition away from the negative interest rate monetary policy. 🇯🇵💼 #JapanEconomy #BOJ #MonetaryPolicy #YieldCurve #FinanceNews

Investing with intelligence

Our latest research, commentary and market outlooks