Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Valuations today:

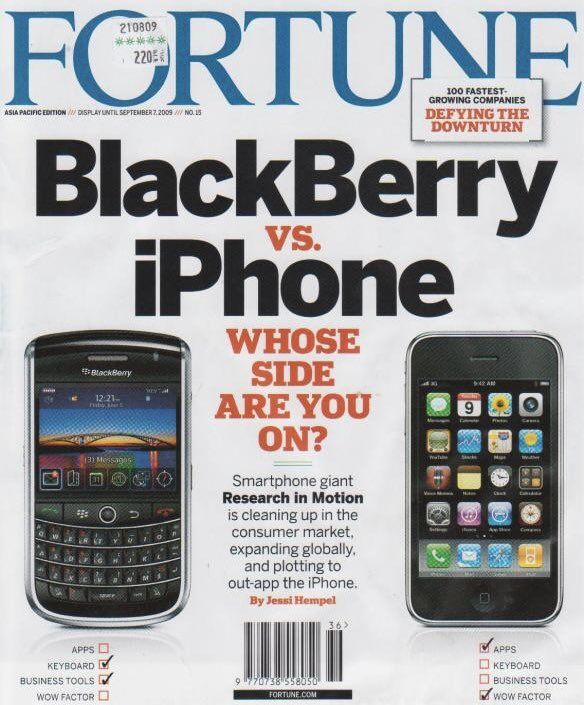

Apple: $2.8 trillion BlackBerry: $1.5 billion Valuations 15 years ago: Apple: $79 billion BlackBerry: $28 billion Source: Jon Erlichman

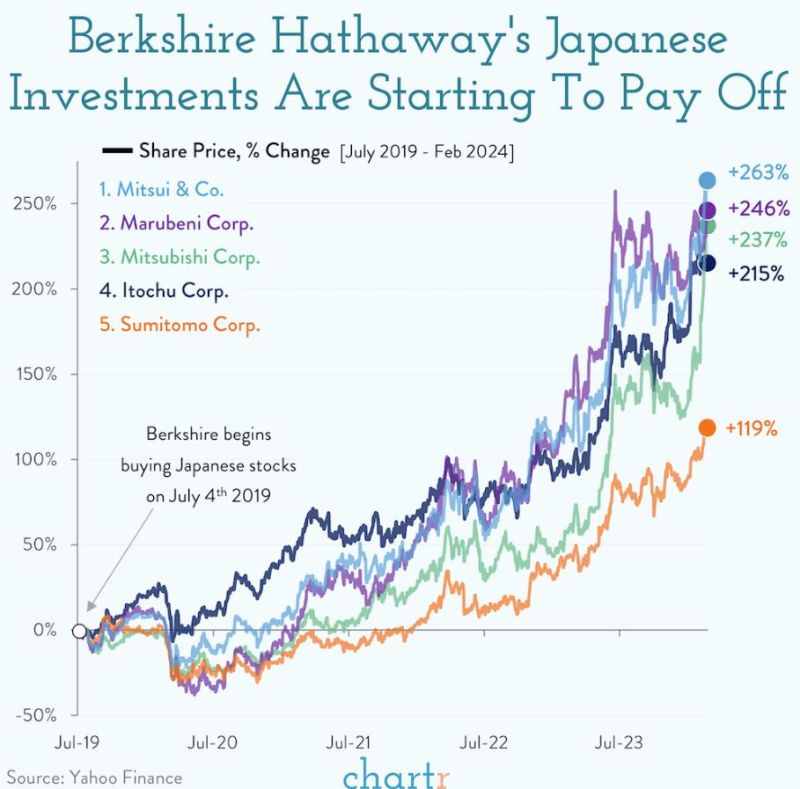

Berkshire Hathaway's Japanese Investment Are Starting To Pay Off

Source : chartr, yahoofinance

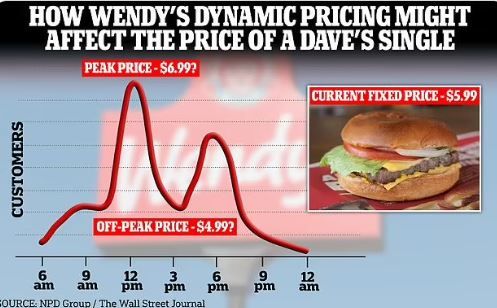

Wendy’s might try Uber-style surge pricing for burgers

Wendy's wants to use new digital menu boards to change prices based on overall demand. Wendy's will start experimenting with surge pricing, much like Uber and Lyft, as the company rolls out digital menus to all its United States restaurants by 2025. source : quartz

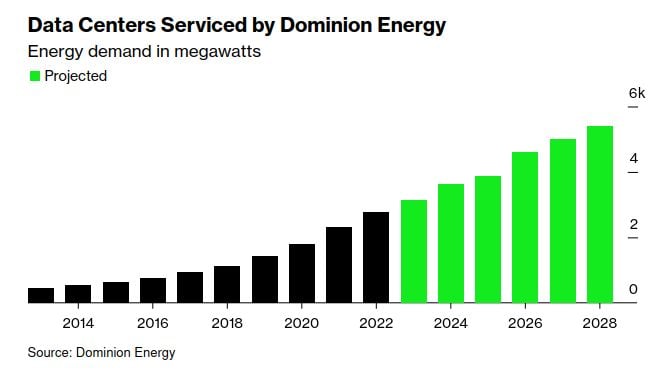

Data center energy demand is expected to continue to grow at a brisk pace due to increased usage of AI 🤖

We'll continue to need as much energy as we can get from almost anywhere we can get it... Source: Bloomberg, Markets & Mayhem

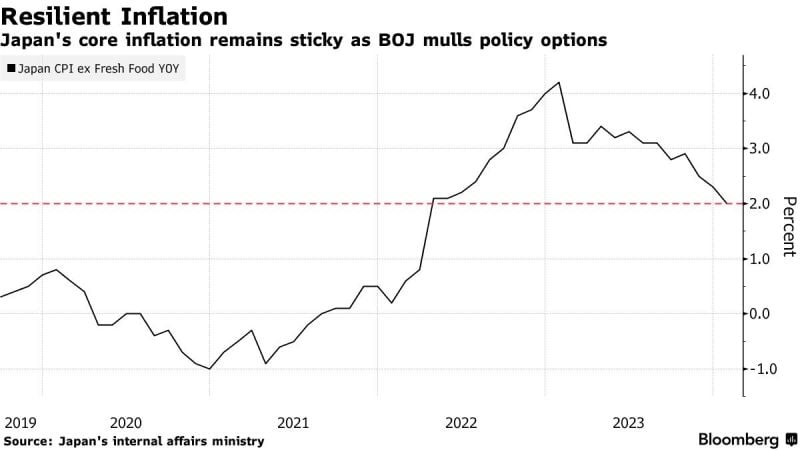

In case you missed it: Japan’s Jan CPI overshoots expectations, w/headline coming in at +2.2% (vs. +1.9% expected and vs. +2.6% in Dec) while core rises 3.5% (vs. Street +3.3% and vs. +3.7% in Dec).

While these numbers pèrove that inflation remains sticky, inflation continues to come down and hit a 22-month low! Source: Bloomberg

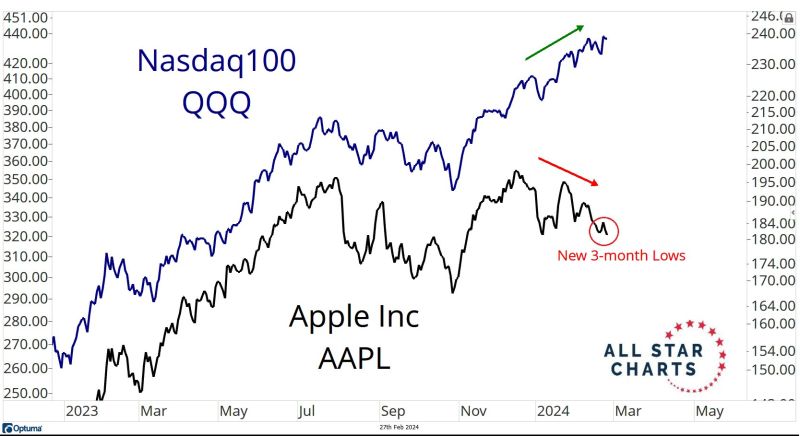

Remember when Apple was the most important company in the world?

That was like just a few months ago. Source: J-C Parets

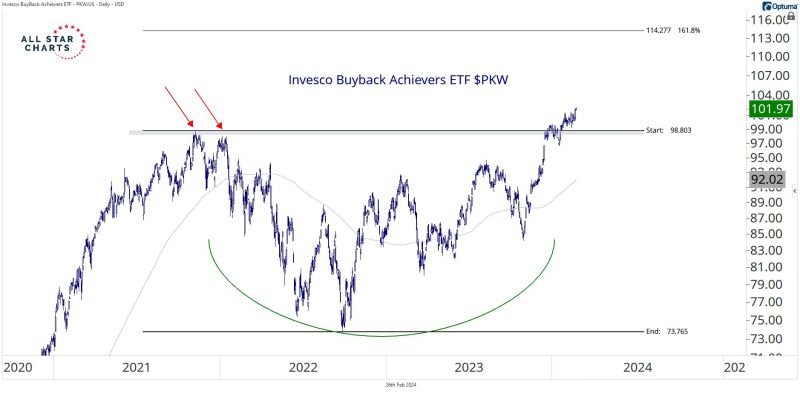

Buybacks win again! New all-time highs for the Buyback Achievers ETF

$PKW as it resolves higher from a multi-year base. Source: Alfondo de Pablos, J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks