Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

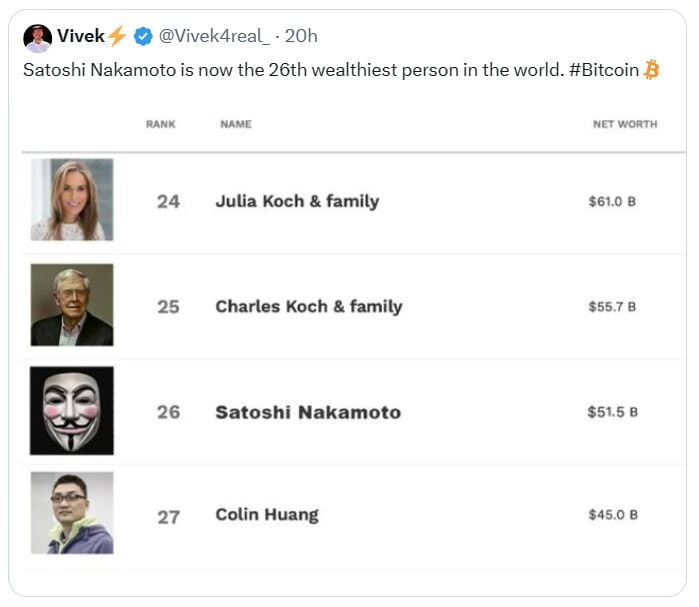

Satoshi Nakamoto is now the 26th wealthiest person in the world and we still don't who he/she/they is/are...

It'll be interesting if the wealthiest person in the world is unknown. At about $212k per Bitcoin, It happens...

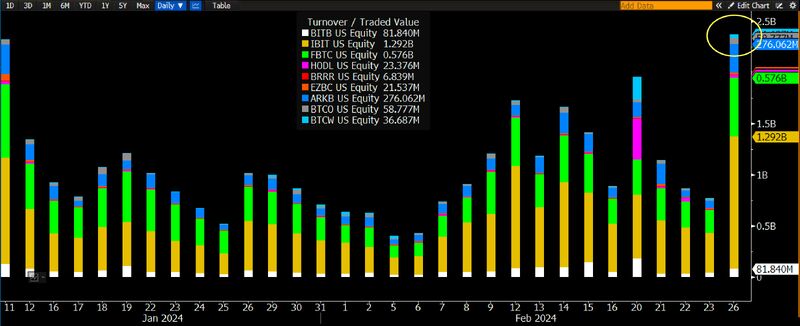

BREAKING: Bitcoin is now trading above $56,000 for the first time since November 2021.

Bitcoin is up over 250% from its 2022 low, adding $700 billion in value in less than 2 years. The total market cap of the crypto market is now at $2.25 trillion, more than double its recent low. In the first 2 months of 2024, Bitcoin has logged a near 30% gain. Just a few weeks ago, Bitcoin ETF approvals were called a "sell the news event." Are new all time highs ahead for Bitcoin? Source: The Kobeissi Letter

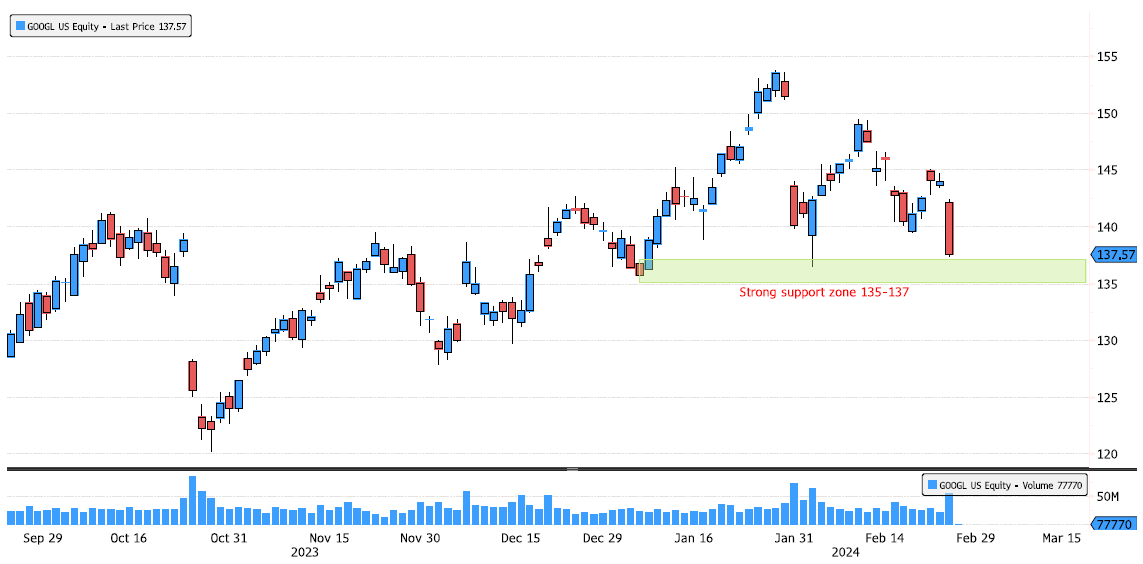

Google testing for a second time strong support

Google is still consolidating since January highs. It's approaching strong swing support level 135-137. Keep an eye on it. Source : Bloomberg

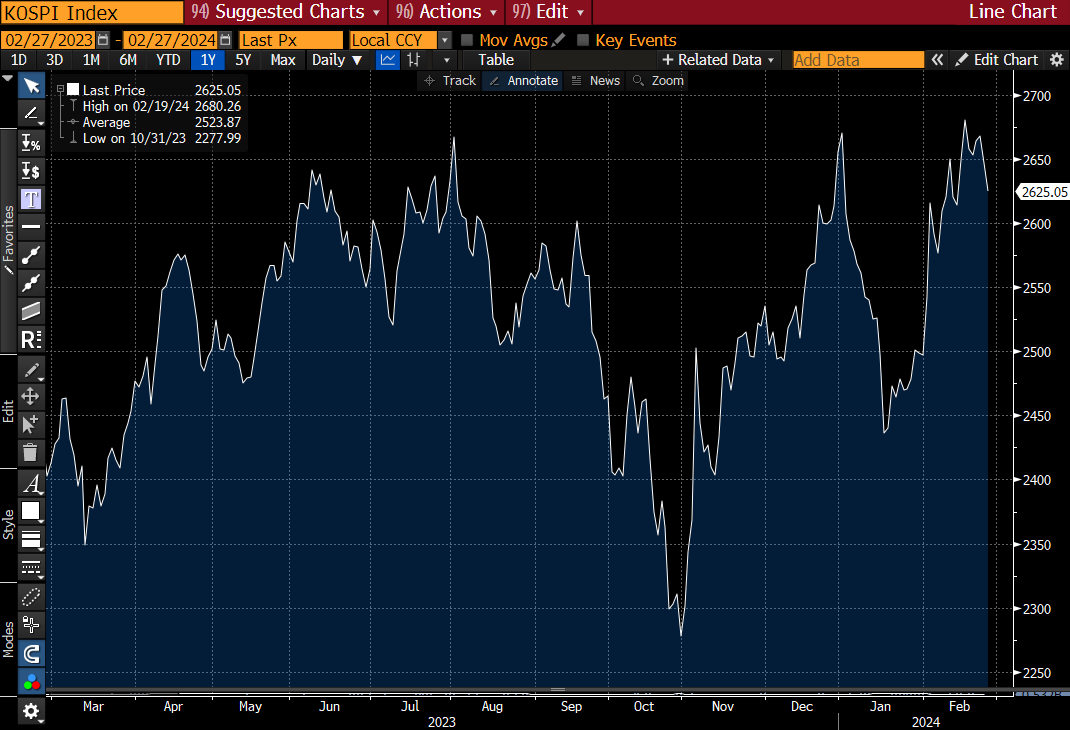

Just like Japan last year, yesterday, the Korean authorities have officially launched a corporate reform plan named the “Corporate Value-Up Program” in order to address the “Korean discount” issue.

Companies trading below book value have been asked to improve shareholders returns, albeit on a voluntary basis. Stricter measures could follow. For the time being, the country is benefiting from the semiconductor recovery cycle. Source : Bloomberg

Why Europeans are nervous about NATO without the US in one chart

Source: Michel A.Arouet

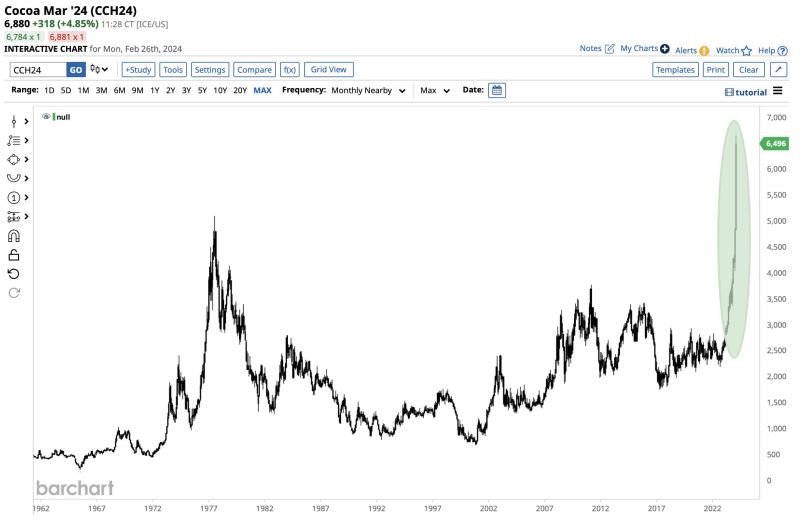

Cocoa Hits All-Time High 🚨

Cocoa competing against Nvidia $NVDA to see which one can set the most of new all-time highs this year... Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks