Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

High Perfomers

#passion #positiveattitude #focus #lifebalance #integrity #resultsdriven

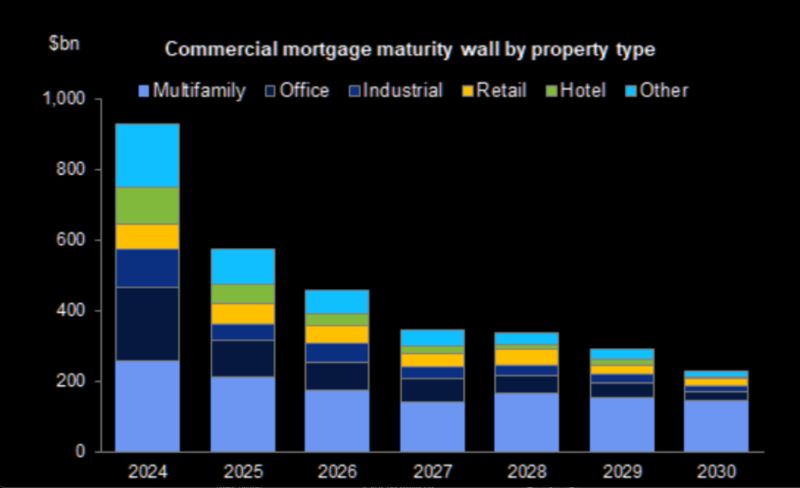

Maturity Wall

Roughly $930 billion in commercial mortgage loans are scheduled to mature in 2024. source : tme

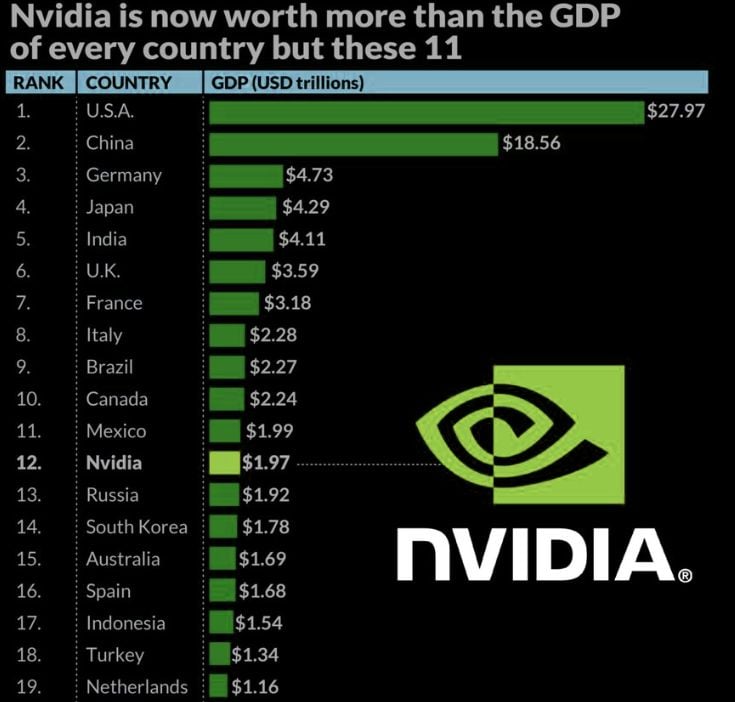

If NVDA Was a Country...

Nvidia is now worth more than the GDP of Russia, South Korea, Australia, Spain, Indonesia, Turkey, Netherlands and South Korea. source : forbes, tme

The Supreme Court is about to decide the future of online speech

Social media companies have long made their own rules about the content they allow on their sites. But a pair of cases set to be argued before the Supreme Court on Monday will test the limits of that freedom, examining whether they can be legally required to host users’ speech. But a pair of cases set to be argued before the Supreme Court on Monday will test the limits of that freedom, examining whether they can be legally required to host users’ speech.The cases, Moody v. NetChoice and NetChoice v. Paxton, deal with the constitutionality of laws created in Florida and Texas, respectively. Though there are some differences between the two laws, both essentially limit the ability of large online platforms to curate or ban content on their sites, seeking to fight what lawmakers claim are rules that suppress conservative speech. It’s not just big social media platforms that are concerned about the effects of the laws. The nonprofit that runs Wikipedia and individual Reddit moderators have worried that they might need to fundamentally change how they operate or face new legal threats. More traditional publishers have warned that a ruling in the states’ favor could undercut their First Amendment rights as well. source : theverge

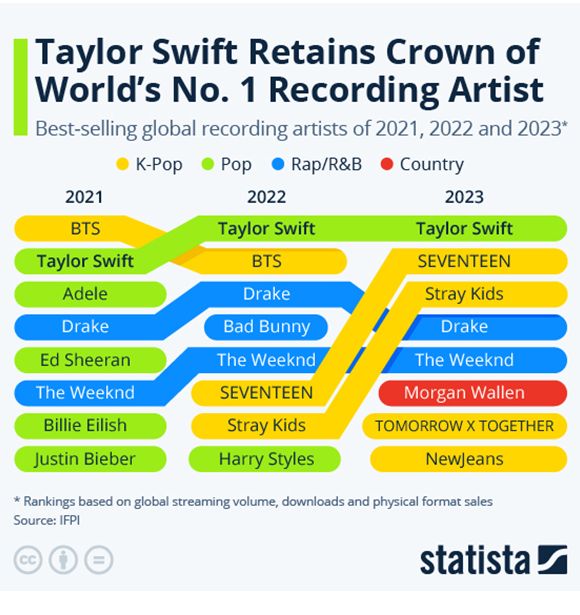

Taylor Swift: world-beater

2023 was a year of superlatives for Taylor Swift: she was the most-streamed artist in the world on Spotify and Apple Music, had the three best-selling albums in the United States, her “Eras Tour” became the first ever to gross more than $1 billion and the documentary shot during the tour turned out to be the highest-grossing concert movie of all time. To top it all off, IFPI, the governing body of the global music industry, announced on Wednesday that Swift was also the biggest-selling recording artist in the world last year, making her the first artist to win the award for a fourth time. source :statista

Warren Buffett says Berkshire may only do slightly better than the average company due to its sheer size

Berkshire Hathaway’s Warren Buffett said his sprawling conglomerate may only slightly outperform the average American company due to its sheer size and the lack of buying opportunities that could make an impact. “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” Buffett wrote. “Some we can value; some we can’t. And, if we can, they have to be attractively priced.” Berkshire held a record $167.6 billion in cash in the fourth quarter. Berkshire did build a 9% stake in five Japanese trading companies — Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo, which Buffett intends to own long term. ‘With our present mix of businesses, Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital,” Buffett said. “Anything beyond ‘slightly better,’ though, is wishful thinking.” Berkshire recently hit consecutive record highs, trading above $620,000 for Class A shares and boasting a market value above $900 billion. The conglomerate’s stock has gained about 16% in 2024, more than double the S&P 500′s return, after climbing 16% in all of 2023. Warren Buffett released Saturday his annual letter to shareholders. In it, he renders a tribute to his longtime friend and right hand man Charlie Munger, who died late in 2023. He also discusses his outlook for the company. link : https://lnkd.in/egEj-Pc6 source : cnbc

JPMorgan CEO Jamie Dimon sells $150M of stock in nation’s largest bank for the first time

JPMorgan Chase chief Jamie Dimon cashed in about $150 million of his stock in the bank — the first time the head of the largest US lender has sold shares since taking charge in 2005. Dimon, one of the longest-serving chief executives on Wall Street, unloaded 821,778 shares of JPMorgan, according to an SEC filing Thursday. The selloff is part of a larger plan the bank revealed in an SEC filing in October to sell 1 million of the 8.6 million shares . Dimon and his family own. source : nypost

Investing with intelligence

Our latest research, commentary and market outlooks