Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: China's consumer prices declined at the fastest speed in 15 years in January.

CPI fell 0.8% in January on an annual basis, more than the median estimate for a 0.5% decline in a Reuters poll. This was its fourth straight decline and its biggest drop since 2009. Meanwhile, China’s PPI fell 2.5% in January from a year earlier, the National Bureau of Statistics reported Thursday, slightly better than expectations for a 2.6% decline.

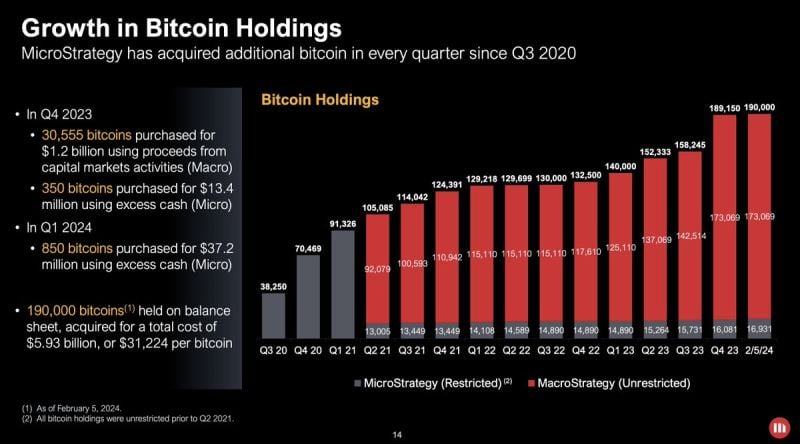

MicroStrategy holds almost 1% of all bitcoin that will ever exist.

Source: Altcoin Daily

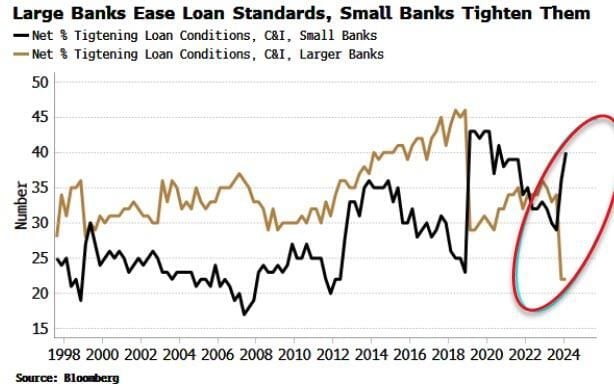

Large banks are easing lending standards while small banks tighten them Another sign of a K-shaped recovery, albeit in the financial sector

Source: Markets & Mayhem

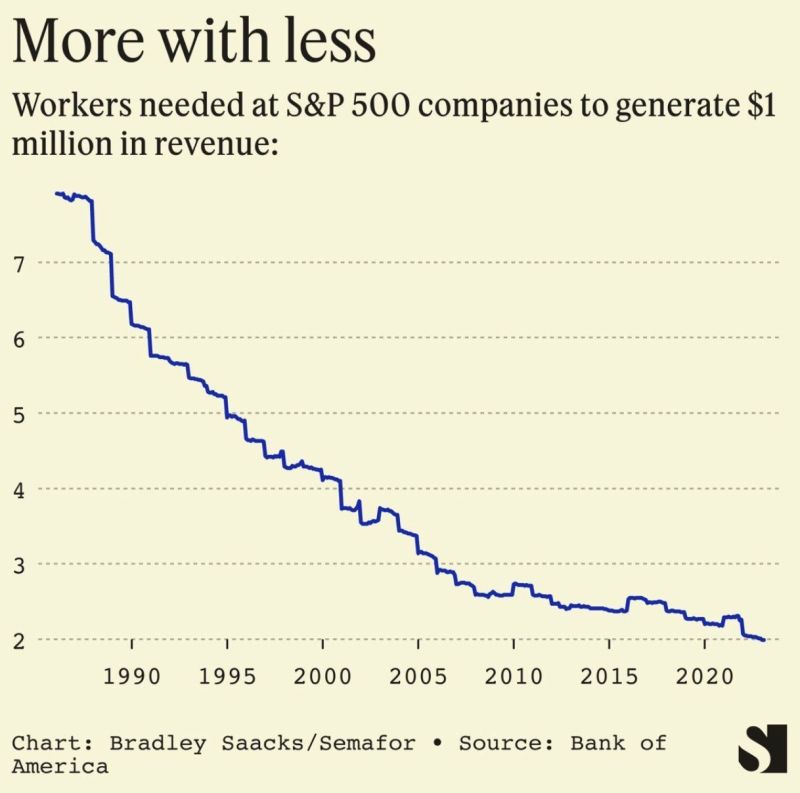

LESS IS MORE... or MORE WITH LESS.

This data is eye-opening. The number of workers needed at S&P 500 companies to generate $1 million in revenue has gone from: 7+ in pre-1990 period to only 2 in 2024 With AI developments, this metric is likely to continue declining Source: Game of Trades

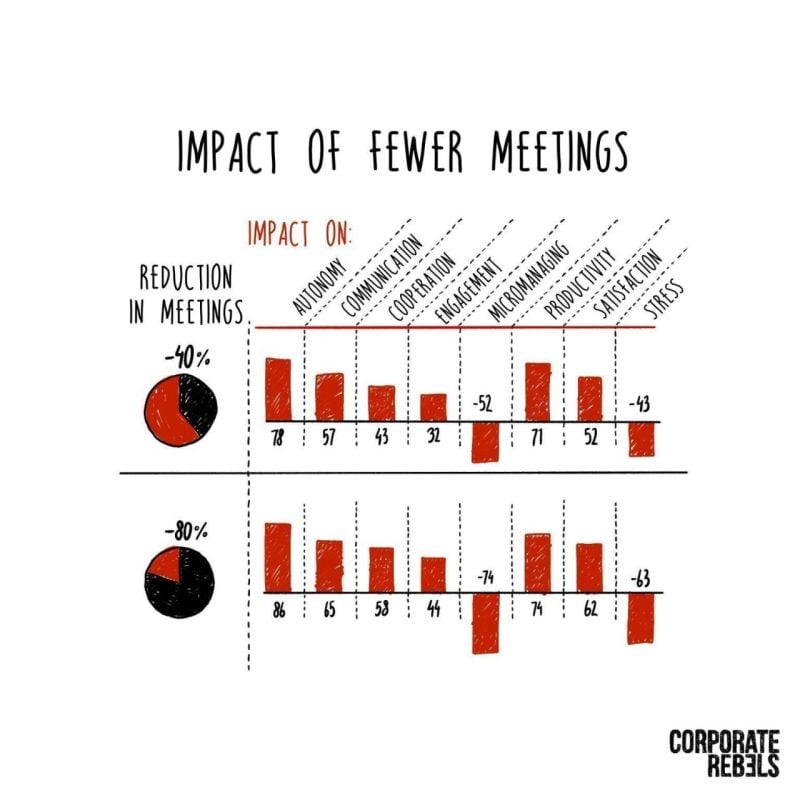

Uncover the sweet spot for meeting reduction.

Find out why ditching all meetings may not be the best solution: https://buff.ly/41U3U2b Source: corporate rebels

Investing with intelligence

Our latest research, commentary and market outlooks