Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

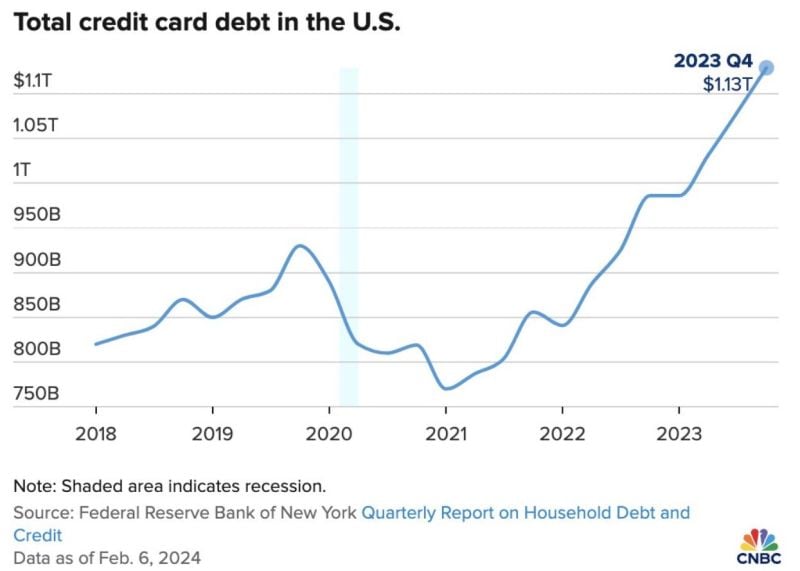

Americans now have a combined $1.13 Trillion of credit card debt, according to a new report from the Federal Reserve Bank of New York

source : cnbc

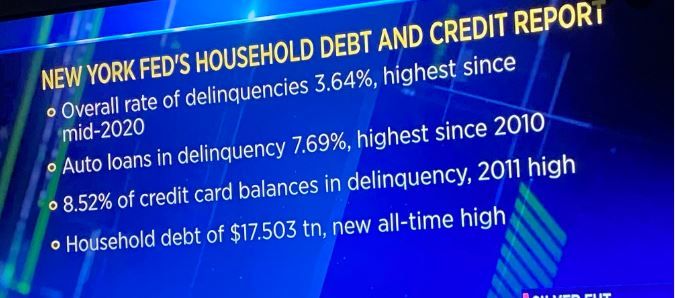

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

Who would have thought? Toyota Motor $TM is soaring (up another +7% on Tuesday) while Tesla TSLA is down -37% since July '23 high.

Source: Bloomberg

JUST IN: Michael Saylor’s MicroStrategy just bought another 850 Bitcoin worth $37.2m.

MicroStrategy now holds 190,000 Bitcoin worth $8.2 BILLION (vs. Market cap of $6.8 BILLION). Source: Bitcoin Archive

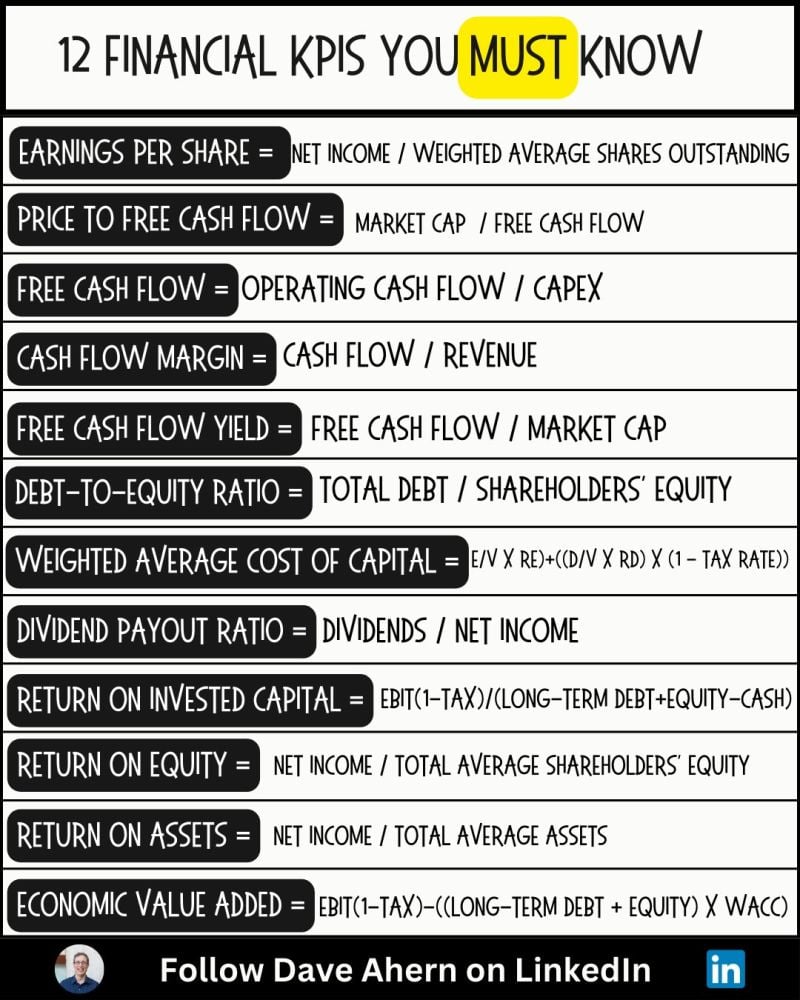

12 Financial KPIs every investor should know.

Source: The Investing for Beginners Podcast

Investing with intelligence

Our latest research, commentary and market outlooks